The IPO of Lending Club (LC) has drawn a lot of attention to Peer-to-Peer (P2P) lending, also known as marketplace lending. P2P lending directly connects borrowers and lenders on a secure platform. The resulting loans are better for borrowers, better for lenders, but may leave credit card companies and their banking partners in a lurch.

To date, roughly 84% of Lending Club borrowers have used their loans to refinance existing loans or pay off credit cards. The economics are compelling.

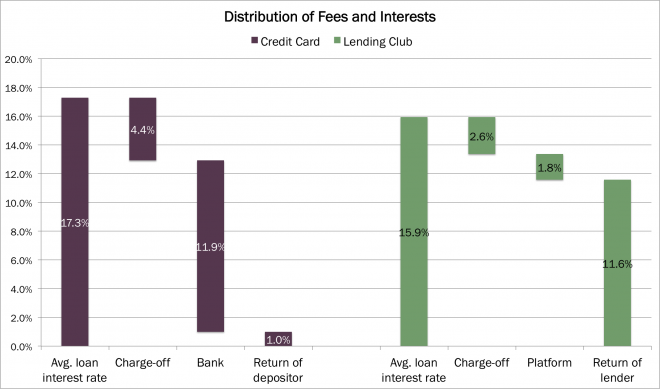

The average annual percentage rate (APR) for a credit card in the US is about 18%, but can hit 30% if borrowers fall behind on their payments. Banks are able to fund these loans with deposits that cost them less than 1%. As can be seen in the left bar below, net of losses, banks [1][2]. earn an average of 12% on their revolving credit card balances, 12 times more than depositors earn. Does something seem wrong with this picture?

Lending Club, on the other hand, charges fees that annualize to less than 2% of loans outstanding, passing most of the savings along to investors that fund the loans.[3] As can be seen in the right bar above, investors enjoy returns net of losses approaching 12% on Lending Club’s platform, while the average borrower’s interest rate is almost 1.5 percentage points less than that on a Chase credit card.

An average saving of 1.5 percentage points on a loan payment may not seem like much, but for individual borrowers looking to refinance who miss payments and face up to 30% credit card interest rates, the savings become quite meaningful. Borrowers also value the transparency of the platform and the simple structure of its loan terms.

The 12% annualized return that investors have enjoyed on the Lending Club platform to date could come under pressure as the model becomes more widely understood and emulated. That said, this fin-tech model should enjoy platform and network effects that drive unit demand much higher.

The risk in a pool of Lending Club borrowers is equivalent to that of a high yield corporate bond issuer. Consequently, investors should be willing to accept a similar return in the 4-6% range. As marketplace lenders pass savings on to borrowers, the price elasticity of demand should kick in, spurring further demand, and putting existing credit card franchises under greater pressure, if not at risk.

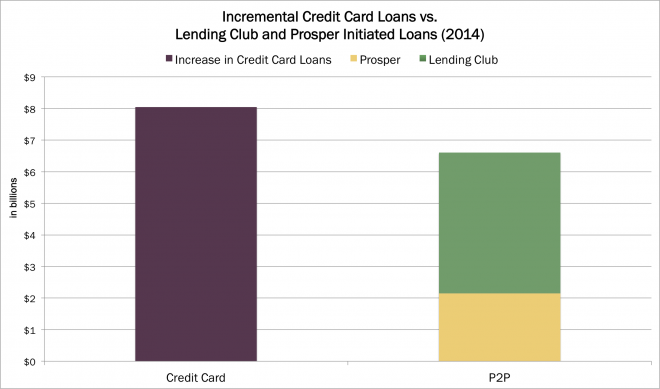

The two largest P2P lending platforms, Lending Club [LC]and Prosper, have issued roughly $7.7 billion in loans cumulatively through September 2014, with annual growth rates between 200% and 300% over the last few years. Compared to the $880 billion in total consumer credit outstanding,[4] P2P lending looks inconsequential. As shown below, however, in 2014 the platforms will provide $6.6 billion in unsecured funding to consumers, nearing the $8 billion in incremental credit card loans that banks will extend during the same time. Simple math would suggest that this competitive source of unsecured credit is already depriving banks like Citigroup [C], JP Morgan Chase, Bank of America [BAC], and Discover Financial [DFS] of revenue. Given the marketplace platforms’ growth rates, and the added visibility associated with successful stock offerings like that of Lending Club and On Deck Capital [ONDK], the competitive threat could become dire within the next few years.

P2P lending platforms are not destined for unqualified success. As with all financial innovations, too much capital chasing the opportunity could cause a degradation in lending standards. Combined with a large-scale credit shock, too much borrowing could result in the failure of the platforms themselves.

In the meantime, money-center banks will be vulnerable to the dramatic share shift towards this new credit channel. The weakness of previously robust franchises may come into stark relief during the next few years.