Digital wallets are emerging and could upend traditional branch-based banking networks globally during the next five to ten years. Already in China and Kenya, Alipay and M-Pesa have on-boarded hard-to-reach customers with digital wallets, offering access to payment platforms, investments, loans, insurance and asset management. Such wallet ecosystems are revolutionizing the delivery of banking products at scale, particularly in emerging markets. In the US, where traditional bank networks are well-established, digital wallets have been slower to take hold…until now.

Thanks to peer-to-peer applications like Venmo and Square’s Cash App, 2017 was a milestone year for digital wallets. According to our estimates, these two digital wallets had attracted 21 million users in the US by the end of 2017 and have scaled another 60-80% to 40-45 million this past year, swamping the number of depositors added at traditional banks.[1] Venmo, the popular social-network and peer-to-peer wallet, has attracted nearly 30 million users, trailing the number of depositors only at Bank of America, J.P. Morgan Chase, and Wells Fargo. Introduced in 2013, Square’s Cash App inflected in 2017, jumping from 2 million to 7 million active customers, on its way to nearly 15 million this year and bordering on the top ten “deposit” bases.

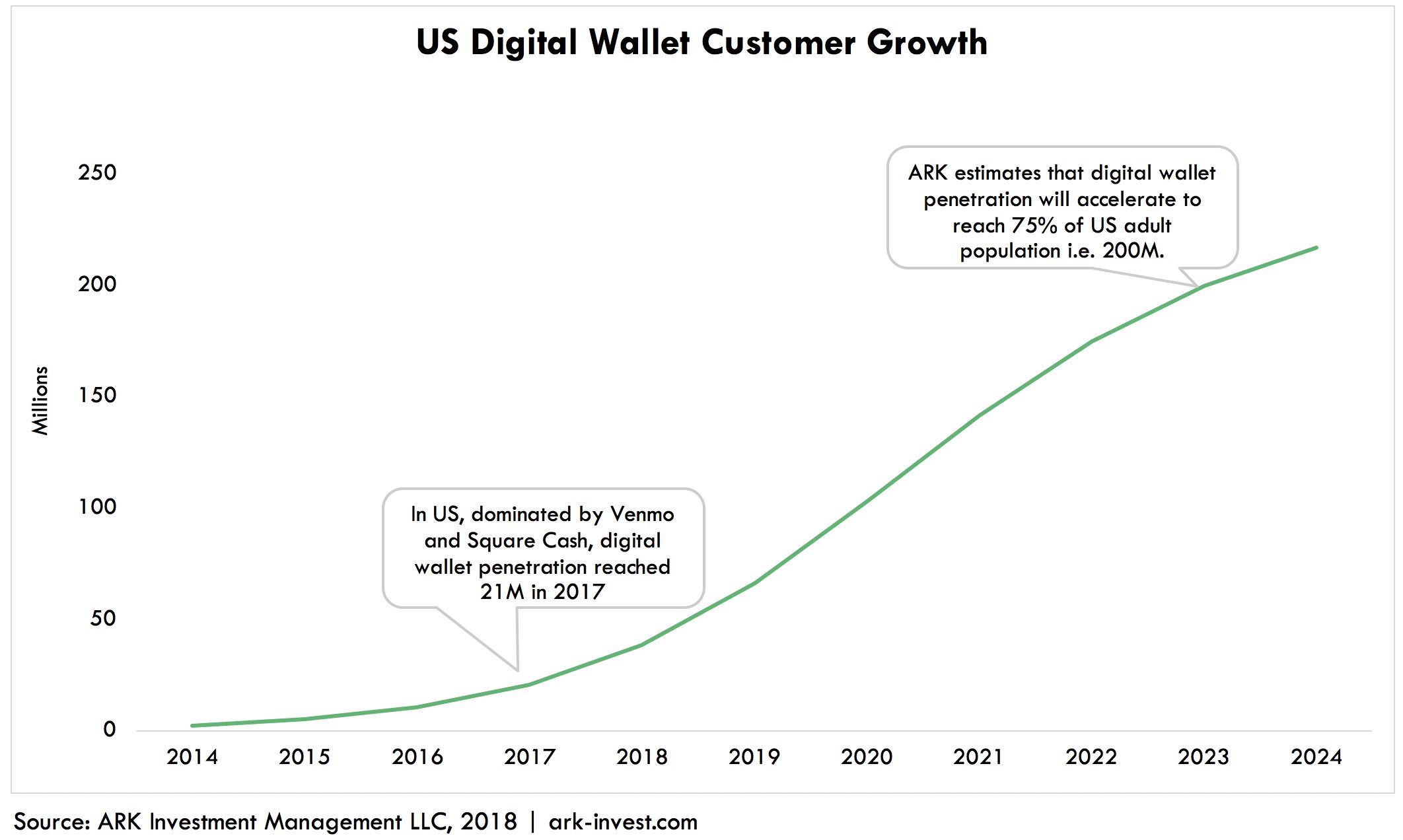

According to ARK’s estimates, dominated by Venmo and Square, the number of digital wallets in the US will approach 200 million by 2023. In other words, in five years they will penetrate 75% of the US adult population, as shown below.

Seemingly aggressive, this forecast stems from the network effects that are spurring digital wallet proliferation. The ability to split restaurant bills and rent with friends or to make small purchases in local retail establishments without any friction enables every user to “acquire customers” for the network. Enhancing engagement are product extensions like merchant point-of-sale integration, loyalty and reward programs, and personal financial management applications.

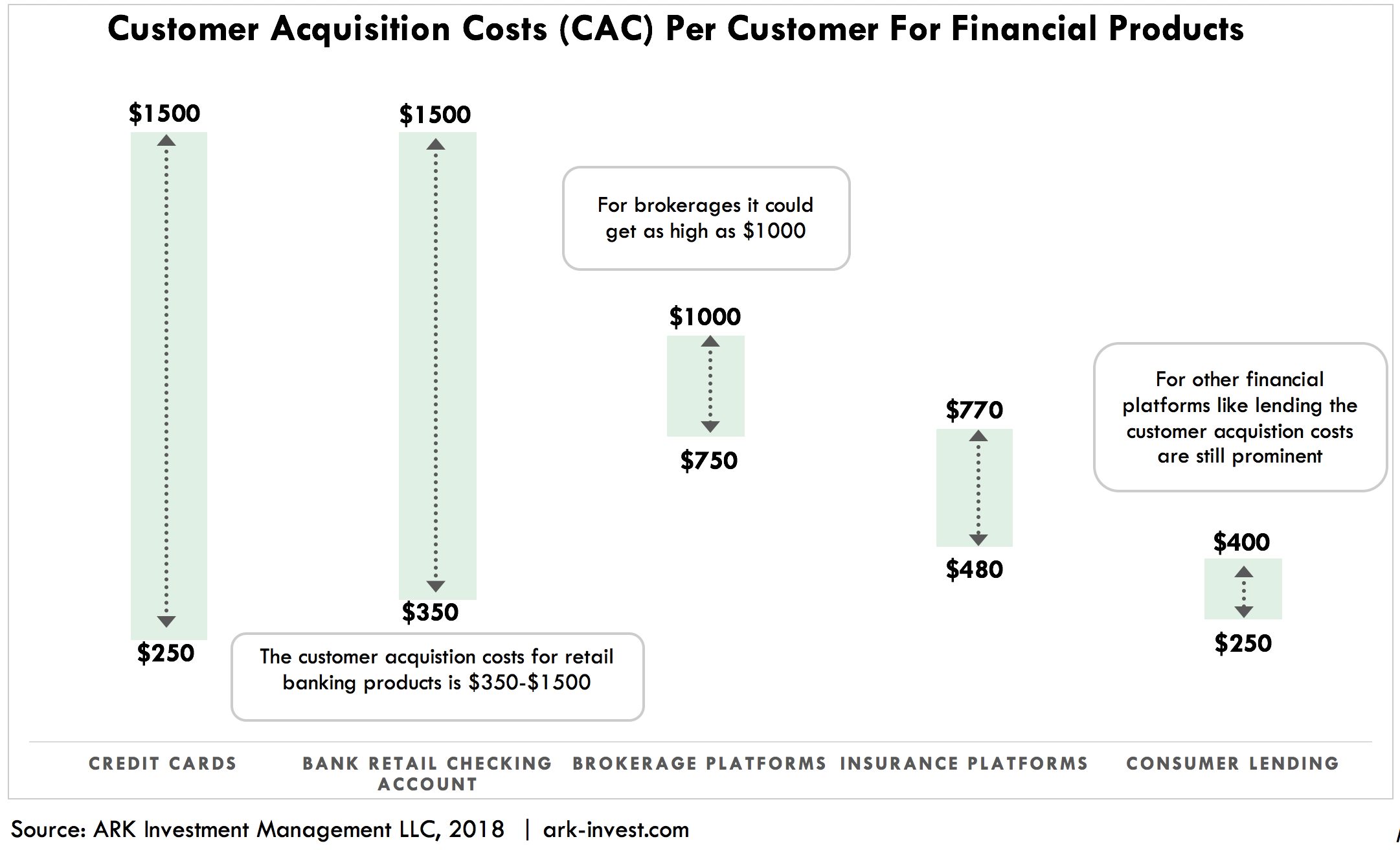

Perhaps more important, these digital wallets have the potential to usurp the role of bank branches. Large retail banks rely on real estate, both branches and ATMs, to acquire customers. Physical infrastructure is costly to staff and maintain, pushing the cost of customer acquisition to $350-1500 per person, as shown below. Curiously, while digital wallets are taking off and taking share, their offline bank competitors are doubling down on investments in physical infrastructure and high customer acquisition costs. JP Morgan Chase, for example, has announced plans for 400 new bank branches, 50 in Philadelphia alone.

By contrast, digital wallet providers can acquire customers for as little as $20 each, thanks to real time data on income and spending. While they may not have in place all of the operational and regulatory infrastructure necessary to offer traditional bank branch services, digital wallet providers should be able to white-label or acquire those capabilities and attract new users for a fraction of the cost banks are paying.

At the top of the banking stack, digital wallets should thrive as they gain a portion of the lifetime value of every customer they on-board. Today, investors are willing to pay a median market cap of $3400 per demand deposit for traditional banks. Each of those demand deposit relationships is at risk of disintermediation by in-pocket banking. If investors would value a digital wallet user similar to such demand deposit relationships, with 200 million users in 2023, the digital wallet opportunity could be valued at up to $700 billion, perhaps with winner-takes-most. By our estimates, Venmo may account for roughly $15 billion of PayPal’s market cap today, and Square’s market cap is roughly $25 billion, putting into perspective this opportunity.

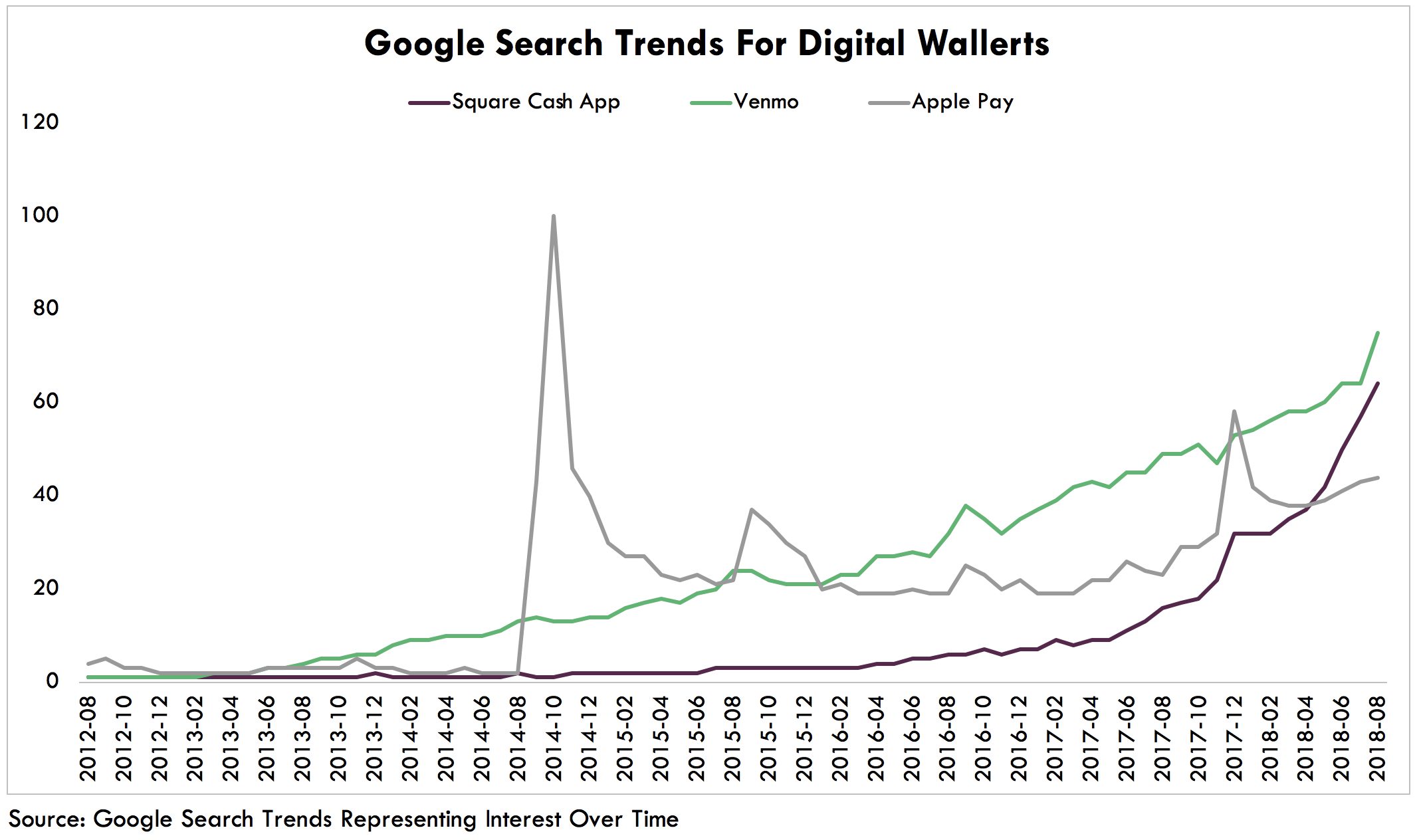

Square’s Cash App, Venmo and, perhaps, Apple Pay are well positioned to benefit from strong network effects. According to Google Search Trends, while all three services are attracting similar levels of interest, Square’s Cash App has entered an accelerated growth phase relative to Venmo and Apple Pay, as shown below.

As a footnote, digital wallets could become a gateway for access to cryptoassets. Though still in early days, digital services should become cryptoasset native, giving companies that provide access to those services substantial economic leverage. With Cash App, Square is the first digital wallet at scale to build out this capability.