Global Digital Advertising Appears Poised for Significant Growth

Everything “digital” stepped up to solve problems during the COVID-19 pandemic. In our view, the acceleration to digital will continue in most sectors as the pandemic wanes.

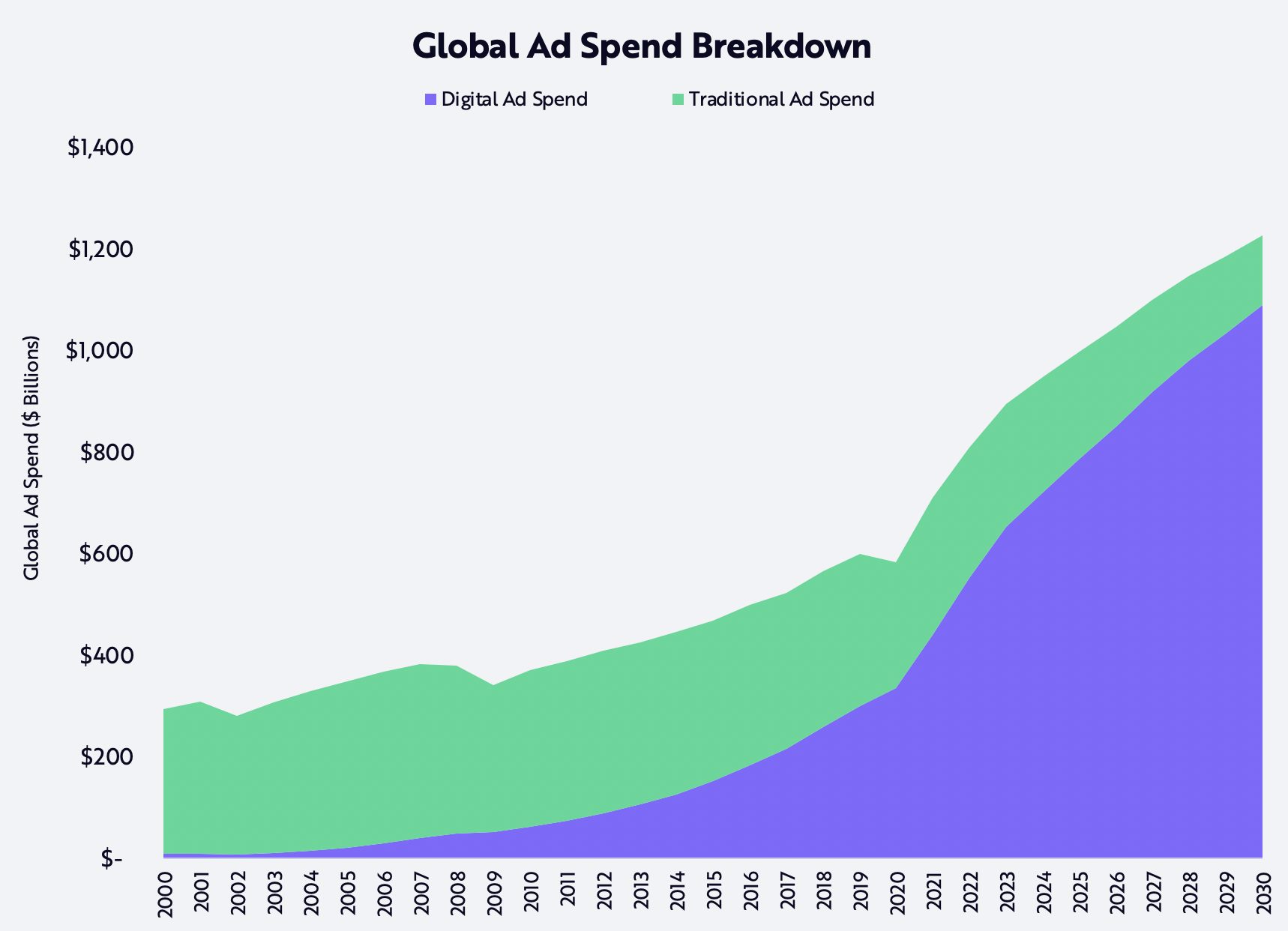

Digital advertising is a case in point. During the pandemic, digital advertising gained share as traditional advertising declined. At the end of 2021, global digital advertising was roughly $440 billion, 62% of the market. According to our research, it will continue to grow at a 11% compound annual rate during the next eight years, surpassing $1 trillion by the end of 2029, as shown below.

Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2021

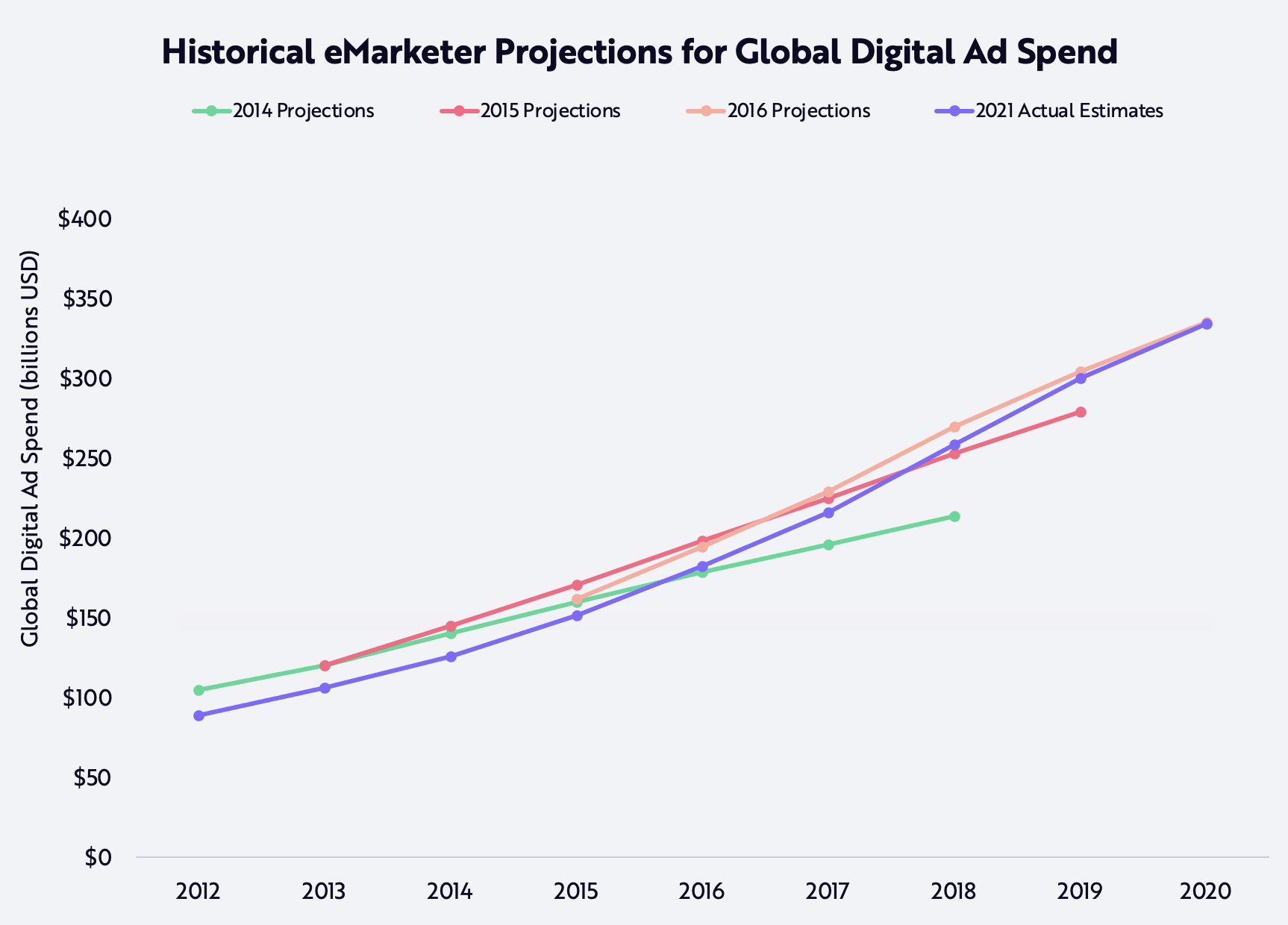

According to our research, previous forecasts underestimated the potential of digital advertising significantly. eMarketer, for example, projected in 2014 that the market would grow to $214 billion by 2018, then in 2015 to $279 billion by 2019, and finally in 2016 to $335 billion by 2020. In other words, eMarketer underestimated growth in all three instances, as shown below.

Source: ARK Investment Management LLC, 2021 based on data sourced from eMarketer

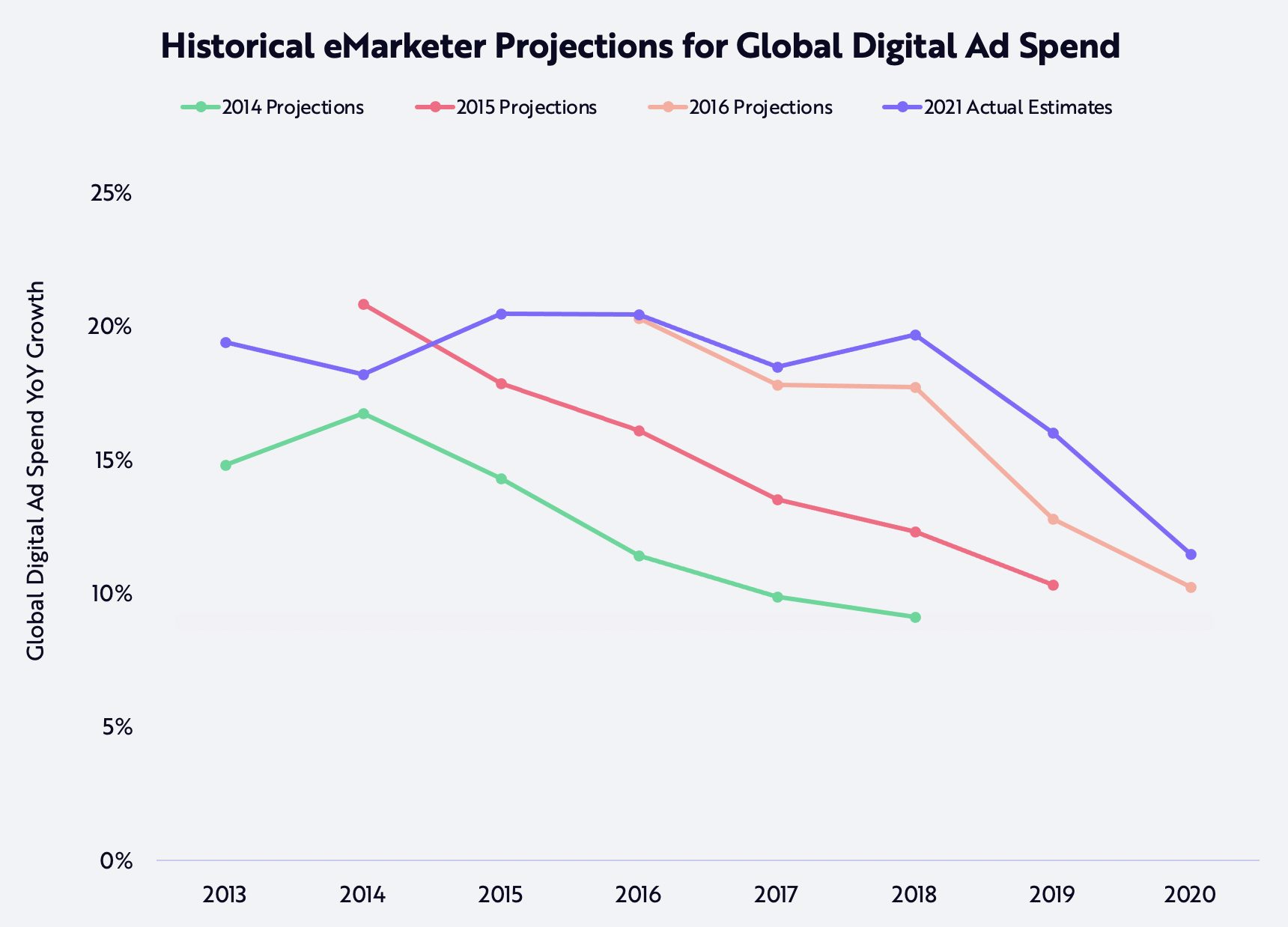

Actual numbers surpassed projections apparently because eMarketer assumed that digital advertising was more mature than most observers expected. In fact, eMarketer’s projections have missed the mark on the low side of expectations consistently and significantly during the past few years, as shown below: the market outpaced its forecasts by roughly 3% on average each year, with a most impressive showing last year in the face of the coronavirus crisis.

Source: ARK Investment Management LLC, 2021 based on data sourced from eMarketer

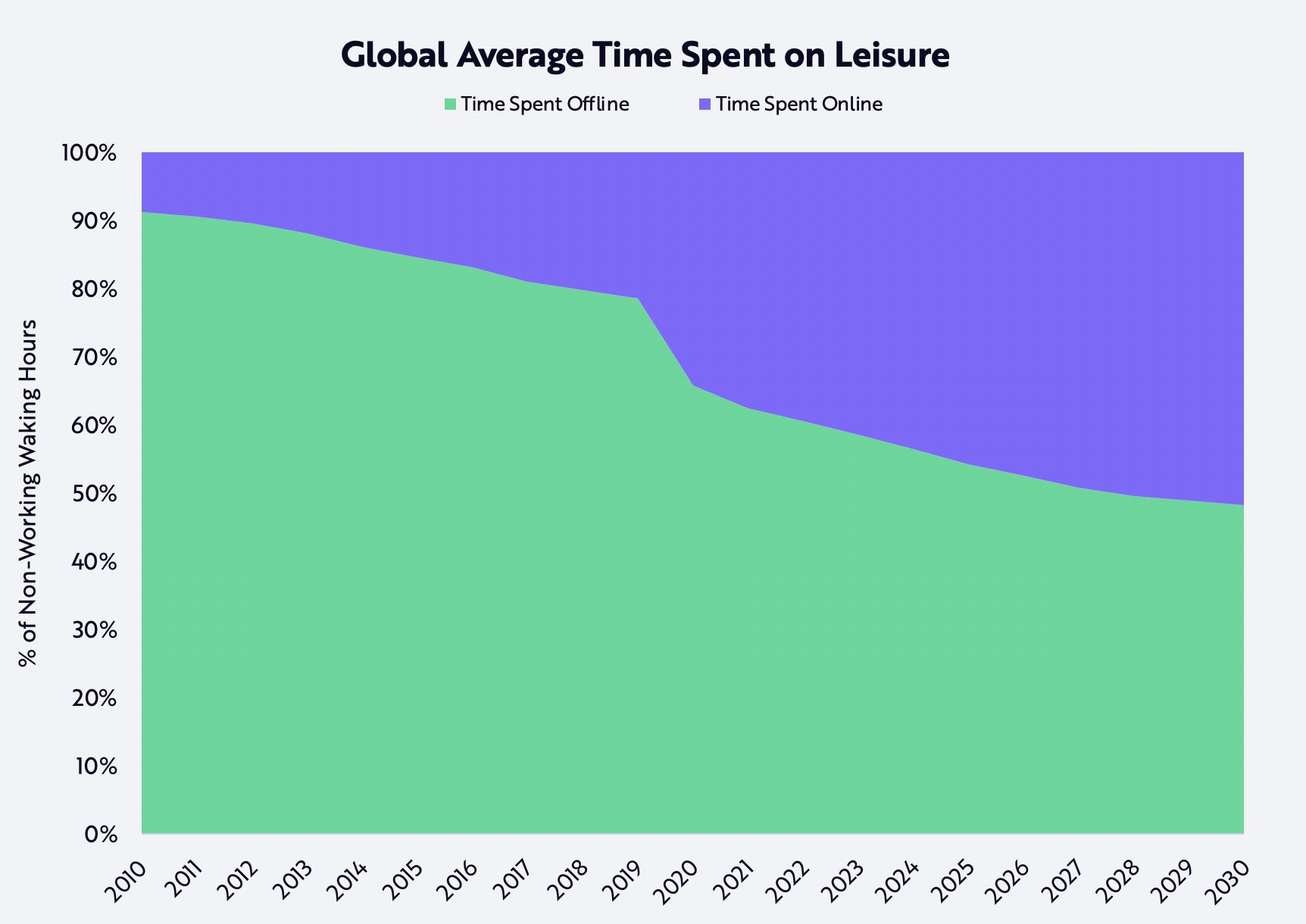

In our view, most forecasts still are underestimating the growth potential in digital advertising, particularly because the pandemic seems to have introduced important tailwinds. Digital everything accelerated during the pandemic. From 2.85 hours per day[1] in 2019, average discretionary screen time jumped significantly in 2020. According to Nielsen, the pandemic boosted total adult media consumption by 60%, most of it online. What if that bump has become permanent?

If online consumption rates are accelerating, digital ad spend could follow. We believe that this shift will be analogous to that from traditional print media to digital media during the global financial crisis. Despite the increase in internet adoption, advertisers were reluctant to spend online aggressively until 2008-09. During and after the crisis, however, as traditional media sources faltered at an accelerated rate, ad budgets began the shift to more efficient digital media formats. In our view, the pandemic created the same dynamic.

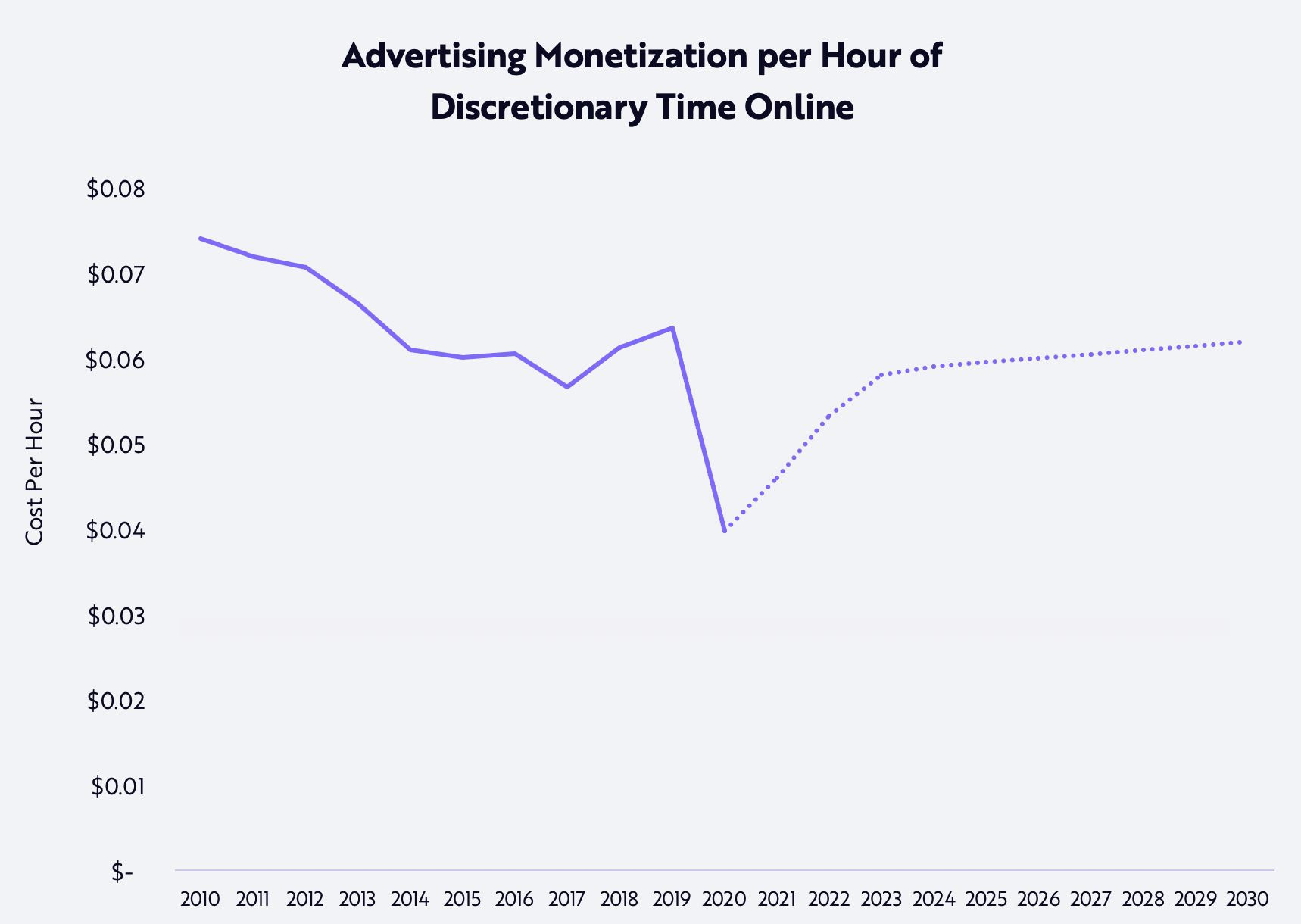

To understand the relationship between time spent online and advertising spend, we have analyzed costs per hour online. From 2014 to 2019, the monetization of discretionary time spent online was range-bound between $0.06 and $0.07 per hour, as shown below.

Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2021

Although time spent online increased by roughly 60% during the pandemic in 2020, digital advertising grew only 11%, resulting in a sharp drop in its monetization per hour to roughly $0.04, as shown above. Now that the impact of the crisis is diminishing, however, we are confident that the migration of advertising dollars online will accelerate, catching up with the increased time spent online shown below. Increases in digital advertising are likely to push the monetization per hour back to roughly $0.06.

Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2021

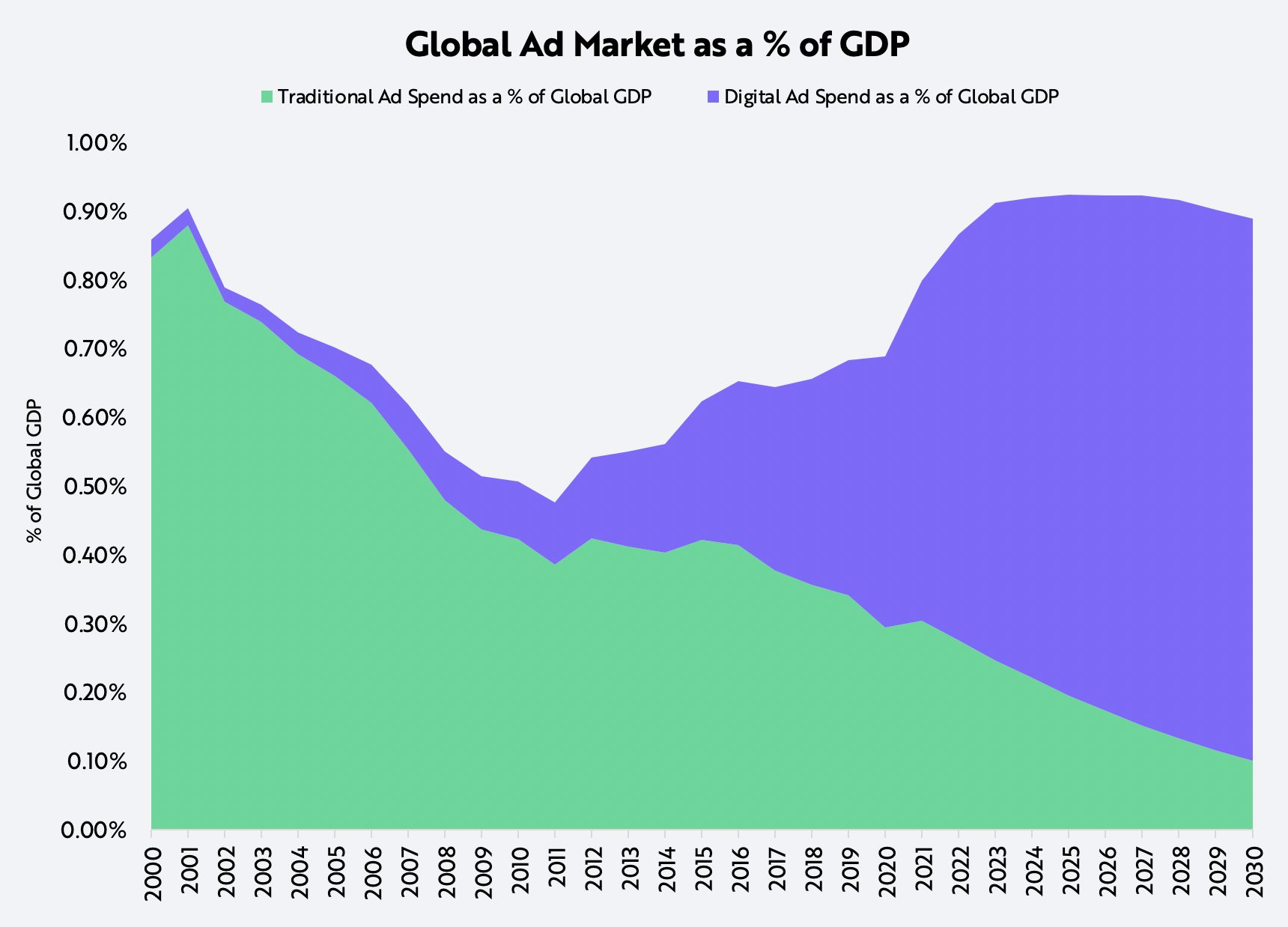

As a sanity check, we mapped our expectations for advertising relative to global GDP, assuming nominal GDP growth of 5% per year. As shown below, our projection does not require unprecedented spending on advertising as a percent of GDP but instead a return to levels last seen in the early 2000s.

Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2021

Based on this analysis, we believe digital advertising will continue to take share from traditional advertising and expand the total addressable market thanks to new advertising formats such as short-form video, augmented reality, and virtual reality. These innovations––and ones we cannot imagine––are likely to generate 11% annualized growth in digital advertising, pushing it up from $440 billion in 2021 to $1 trillion in 2029.