#457: Vertical Integration In AI: X And xAI Join Forces, & More

1. Vertical Integration In AI: X And xAI Join Forces

On Friday, Elon Musk announced that X and xAI will merge in an all-stock transaction,1 the combined entity valued at $125 billion.2 The two entities were already linked commercially, X premium users enjoying privileged access to xAI’s Grok model, and Grok offering answers and analysis on X’s platform. Strategically, the merger gives xAI more direct control over its distribution and its exclusive data while allowing X to integrate AI into its platform more seamlessly.

Source: ARK Investment Management LLC, based on query of Grok.com on March 28, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

As in other industries undergoing technological transformations, vertical integration could prove the winning strategy in AI. Ford achieved dominance in the automotive industry by vertically integrating mass production all the way through rubber manufacturing in the early 20th century. Standard Oil leveraged control of extraction, refining, and distribution to dominate the oil boom of the late 19th century. More recently, Apple outperformed competitors by integrating chips, hardware, software, and services to lead the smartphone revolution.

With the help of Grok, ARK details historical examples of vertical integration as a dominant strategy in technological transitions below.

.png)

New technologies require optimized inputs that are not available in quantities sufficient to support exponential growth. A new technology platform relying on external suppliers will be tripped up by the weakest link in its supply chain. Tesla vertically integrated through power electronics because it couldn’t maximize the performance of electric vehicles with the specs available from off-the-shelf components. Subsequently, it integrated vertically by manufacturing batteries to avoid cell-supply constraints and then built its own supercharger network, as customers would not have paid premium prices for vehicles unable to take long intercity trips.

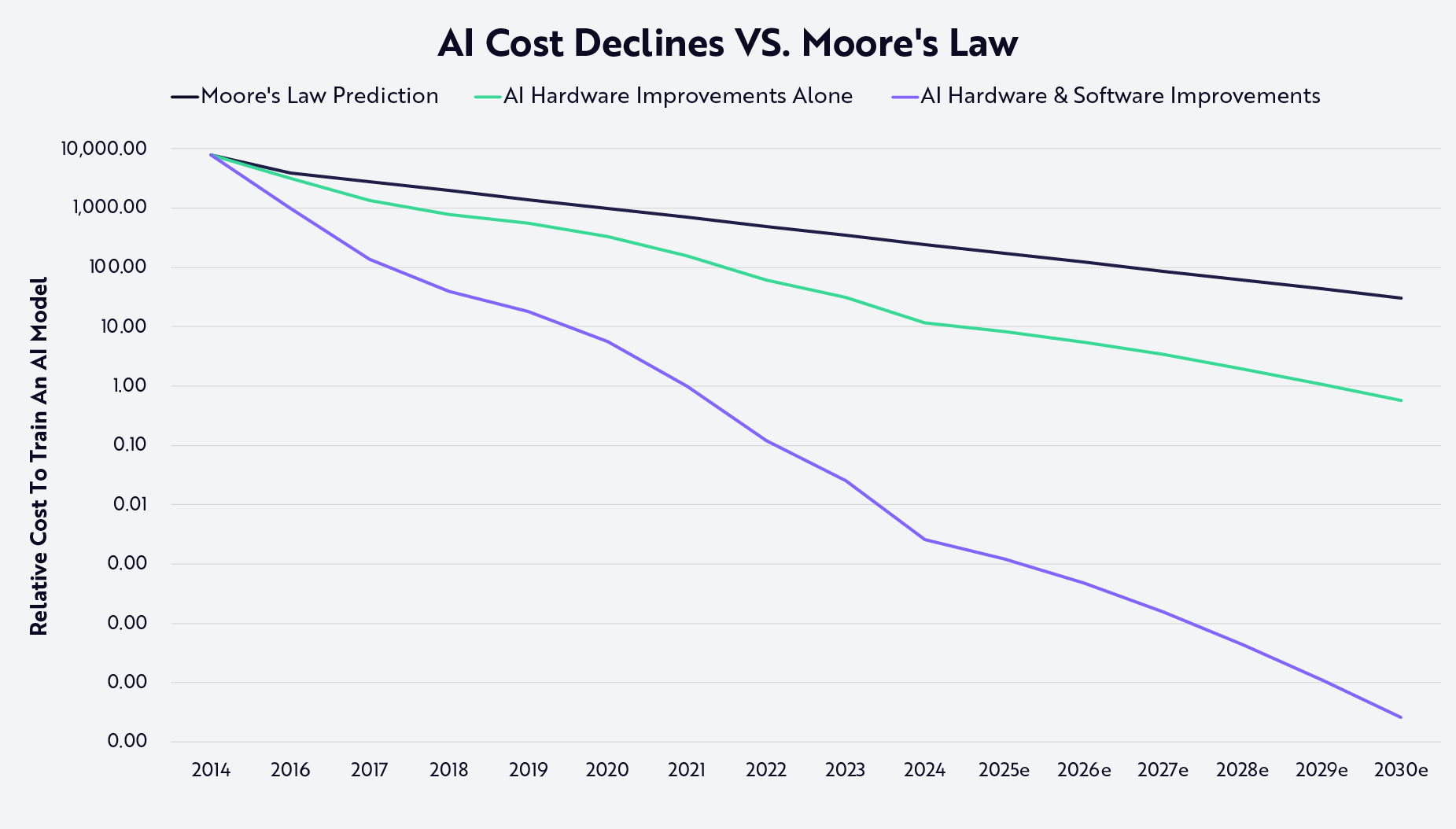

AI has amplified the urgency to integrate vertically. According to ARK’s research, as performance doubles every six months, AI capability per dollar could increase ~1000-fold by 2030. While awaiting power availability to spin up a data center, traditional tech solutions--in which performance doubles relative to cost every 18 months to two years--could face a two-and-a-half-year delay in getting to market, which in the AI age would be equivalent to a decade delay, as shown below. Winning companies will destroy the friction preventing AI from reaching end-customers.

Note: Wright’s Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. See Winton 2019.14 Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of March 28, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

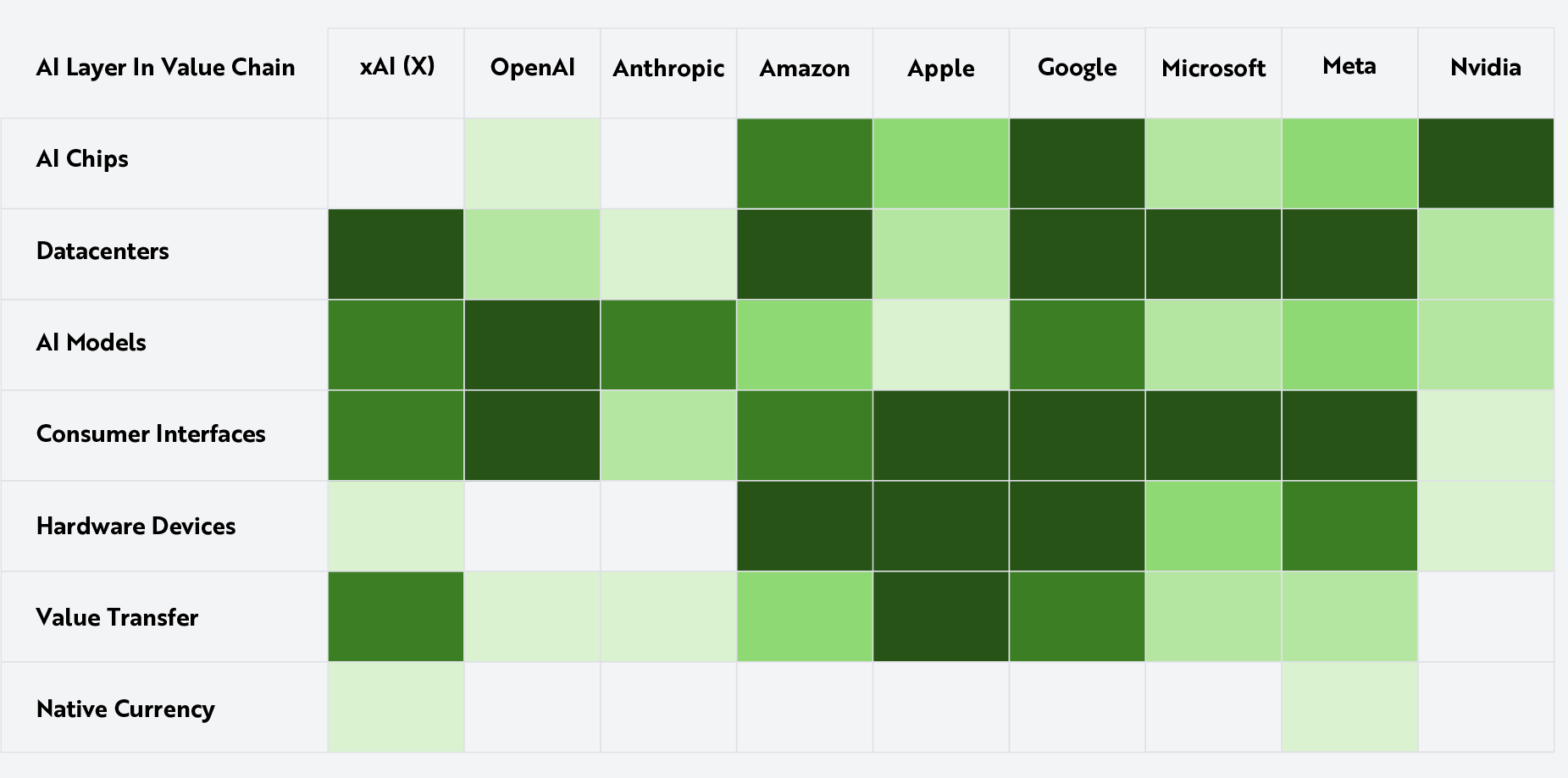

What is a winning vertical integration strategy in AI? Beginning at the model layer, AI companies are moving both up- and down-stack. OpenAI built amazing consumer distribution with ChatGPT and is moving down stack into datacenters and, potentially, chips. xAI, already vertically integrated across datacenters and AI models, now is merging with X which benefits from customer distribution and differentiated data. ARK has assessed the vertical integration of the major AI players in the table below.

Note: The darker the green, the more complete the vertical integration. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of March 28, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

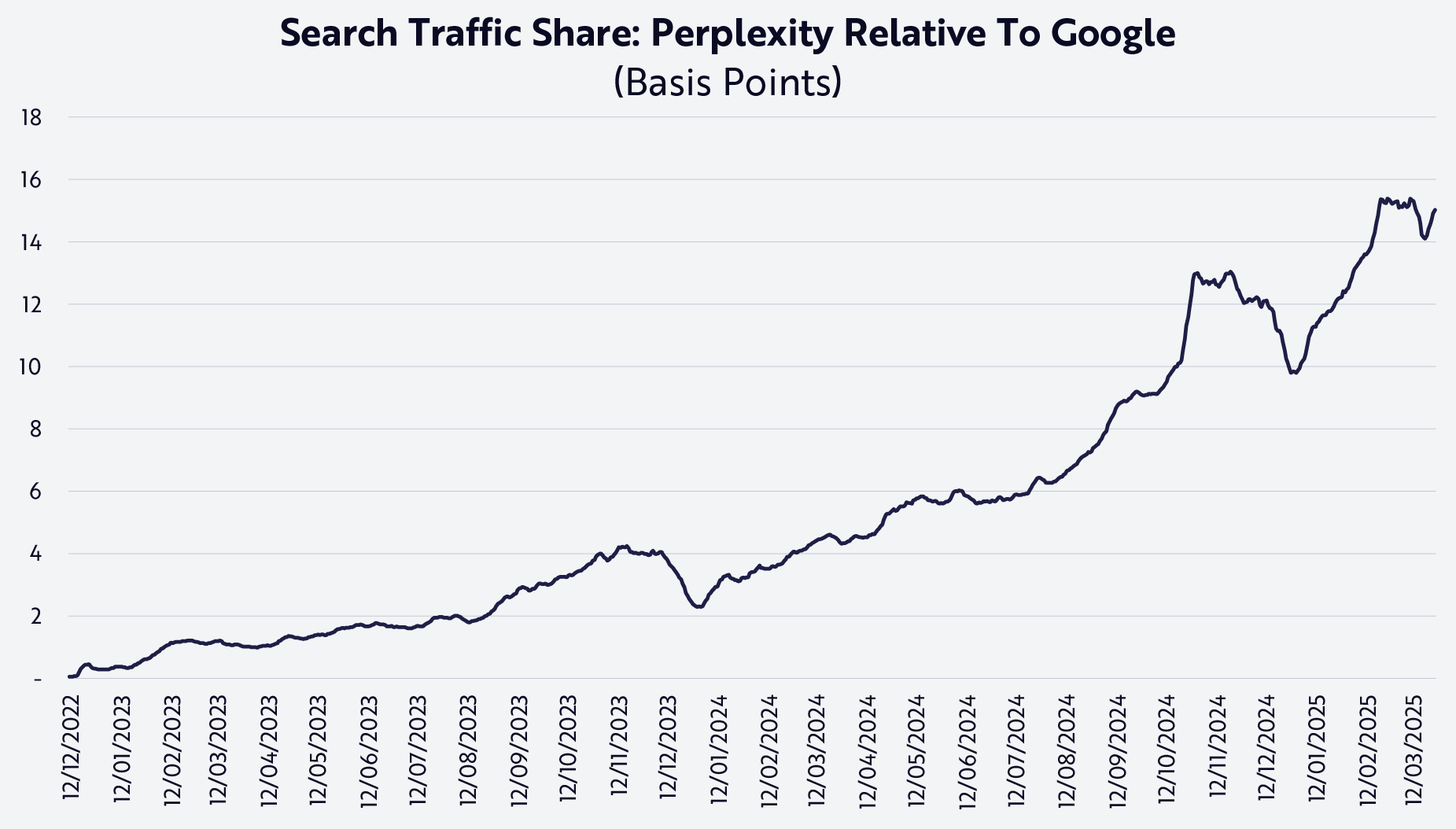

Other large-cap tech players could benefit from deeper vertical integration than the AI startups, but large incumbents often suffer from a lack of coordination among its divisions. Fully vertically integrated, Google is a prime example. Google owns its own chips, datacenters, AI models, distribution, data from Search and YouTube, endpoint devices, and Google Wallet, its payment layer. Nonetheless, Gemini, its AI user-interface, has had trouble attracting and retaining users and, as measured by active users, ranks below Grok and DeepSeek as well as ChatGPT, the market leader. Google also has integrated AI model results into search but is losing share on that front to Perplexity AI, as shown below.

Note: A basis point is equal to 1/100th of a percentage point (1 basis point = .01%)Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of March 28, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

According to ARK’s research, the winning AI platform could command trillions of dollars in revenue and 10s of trillions in market value. The competition will be fierce. As a result, we are not surprised that xAI is marshalling all available weapons. With X, xAI is better equipped for the battle.

2. Are Digital Wallets Becoming Financial SuperApps?

Last week, Robinhood announced a significant expansion of its premium offering, Robinhood Gold.15 For $5 per month, members can gain access to an actively managed robo-advisory service offering personalized investment portfolios at a competitive annual management fee of 25 basis points,16 capped at $250. Robinhood also is offering a 2% automated customer account transfer service (ACATS) transfer bonus for clients who move qualifying assets from an external brokerage.17 Additionally, Robinhood revealed plans to evolve its credit card app into a full-featured banking product, integrating checking and savings to consolidate its financial services stack even further.

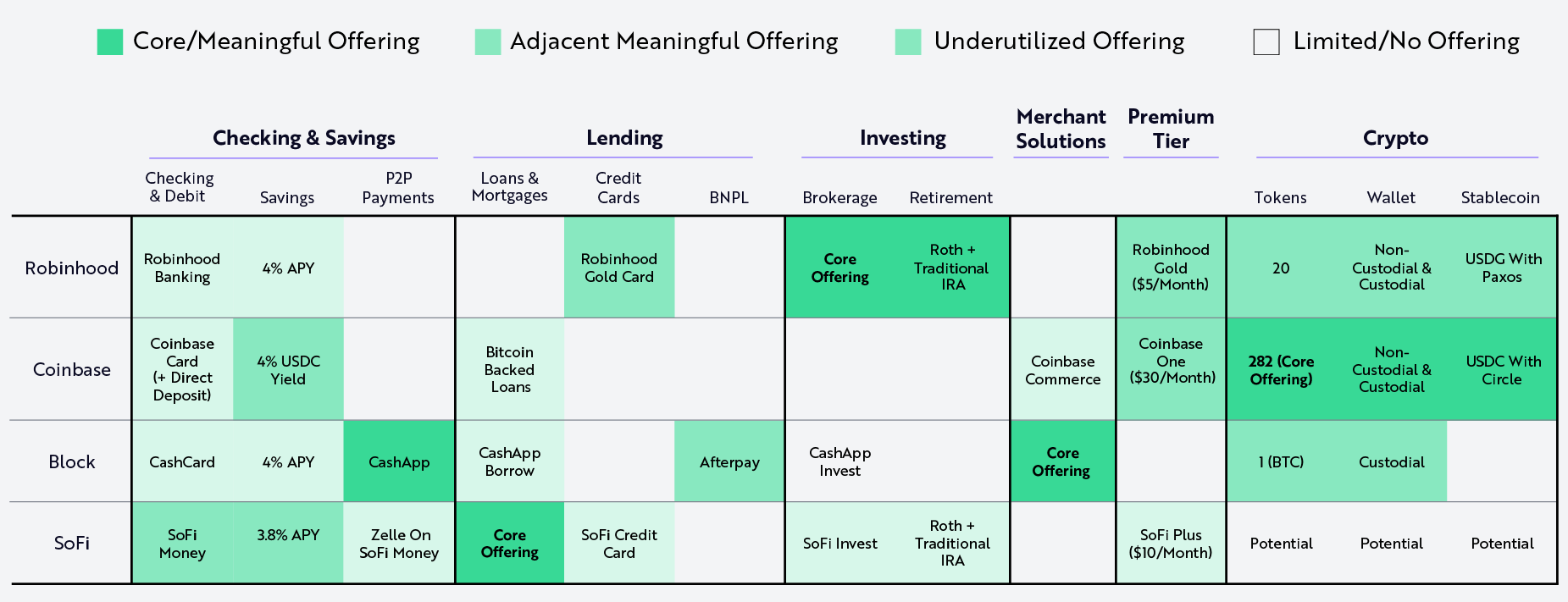

In our view, this move suggests that digital wallets are transforming into financial superapps. Importantly, platforms like Coinbase, SoFi, and Block are collapsing services that have been siloed traditionally—checking, credit, investing, and crypto—into unified, software-native ecosystems, as shown below. Financial products that once were standalone become features in a single, vertically integrated experience. In our view, digital wallets are well-positioned to disrupt incumbent institutions by driving higher engagement, lowering acquisition costs, and redefining consumer money. management As the category matures, digital wallets could become the new super apps for personal finance.

Source: ARK Investment Management LLC, 2025. This ARK comparison draws on a range of external data sources, as of March 28, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

3. Traditional Financial Institutions Are Entering The Digital Asset Space

Thanks to regulatory clarity during the first two months of the Trump administration, many financial institutions are shifting their stance on the digital asset space. With the repeal of SAB 12118— now allowing banks to custody crypto without counting it as a liability on their balance sheets—and the Office of the Comptroller of the Currency’s (OCC’s) new guidance19 permitting banks both to custody and to stake crypto assets, regulators have introduced much-needed clarity into the digital asset space. Additionally, progressing through the US House and Senate, are the GENIUS and STABLE Acts which should reduce regulatory uncertainty around stablecoins.

The GENIUS Act focuses on creating a dual regulatory framework for stablecoins, with larger issuers subject both to state and to federal oversight, and mandates a study of algorithmic stablecoins and sets strict reserve requirements.

The STABLE Act seeks to establish a uniform federal framework for all stablecoin issuers, requiring consistent regulation across states. It also imposes a two-year moratorium on algorithmic stablecoins to evaluate their risks.

Today, traditional asset management giants like BlackRock, Fidelity, and Franklin Templeton are surfacing as determined competitors in the digital asset space:

- Last year, BlackRock launched the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), a tokenized money market fund that already has scaled to ~$2 billion in AUM (assets under management).20 Additionally, its strategic investment in Securitize has positioned Blackrock to tokenize more assets.

- Fidelity recently announced the launch of its own tokenized money market fund and is developing its own stablecoin,21 another major step toward blockchain-based financial products.

- Franklin Templeton has made strides with BENJI, its on-chain money market fund, which has scaled to ~$700 million in AUM.22

By actively building and scaling blockchain-based products, these financial institutions are highlighting the convergence between traditional finance (TradFi) and digital assets. Now that these industry titans are focused strategically with abundant resources and a long-term perspective on the digital asset space, many crypto-native companies will face an uncertain future. Some will benefit by catering with essential infrastructure and services to the needs of these large asset managers. Others could become acquisition targets, while less fortunate pure-play digital asset companies will struggle to compete.

-

1

Musk, E. 2025. “@xAI has acquired AX in an all-stock transaction….” X.

-

2

Measured by enterprise value.

-

3

Gordon, J.S. 2025. “Andrew Carnegie and the Creation of U.S. Steel.” Bill of Rights Institute.

-

4

Wikipedia. 2025. “Vertical Integration.”

-

5

Digital Data Design Institute. 2025. “Future Proof with AI.”

-

6

Wikipedia. 2025. “Vertical Integration.”

-

7

Automotive American. 2025. “Henry Ford and Vertical Integration.”

-

8

Ibid.

-

9

Wikipedia. 2025. “History of IBM.”

-

10

Wikipedia. 2025. “United States v. Microsoft Corp.”

-

11

Eightception. 2025. “Eightception: INJECTION IN ACTION.”

-

12

Ibid.

-

13

Ibid.

-

14

Winton, B. 2019. “Moore’s Law Isn’t Dead: It’s Wrong—Long Live Wright’s Law.” ARK Investment Management LLC.

-

15

Robinhood. 2025. “Introducing Robinhood Strategies, Robinhood Banking, and Robinhood Cortex.”

-

16

A basis point is equal to 1/100th of a percentage point (1 basis point = .01%).

-

17

Robinhood. 2025. “Robinhood ACATS 2% Bonus Offer Terms & Conditions.”

-

18

Lindrea, B. 2025. “SEC cancels controversial crypto accounting rule SAB 121.” Cointelegraph.

-

19

U.S. Office of the Comptroller of the Currency. 2025. “OCC Clarifies Bank Authority to Engage in Certain Cryptocurrency Activities.”

-

20

Rwa.xyz. 2025. “Tokenized Treasuries.”

-

21

Aziz, A. 2025. “Fidelity Develops Stablecoin and Tokenized Fund as U.S. Weighs New Crypto Regulations.” CoinMarketCap (via Yahoo Finance).

-

22

Per Franklin Templeton, “…users on the Benji Investments platform can convert USDC stablecoin to U.S. dollars (“USD”) to fund their investment in shares of the Franklin OnChain U.S. Government Money Fund (FOBXX) (the “Fund”). One share of the Fund is represented by one “BENJI token.” See Franklin Templeton. 2024. “Franklin Templeton Enables USDC Conversions on Benji Investments Platform.” AUM data sourced from rwa.xyz. 2025. “Tokenized Treasuries.”