#456: Waymo’s Safety Improves While Tesla Has The Data Advantage Ahead Of Its Robotaxi Launch In June, & More

1. Waymo’s Safety Improves While Tesla Has The Data Advantage Ahead Of Its Robotaxi Launch In June

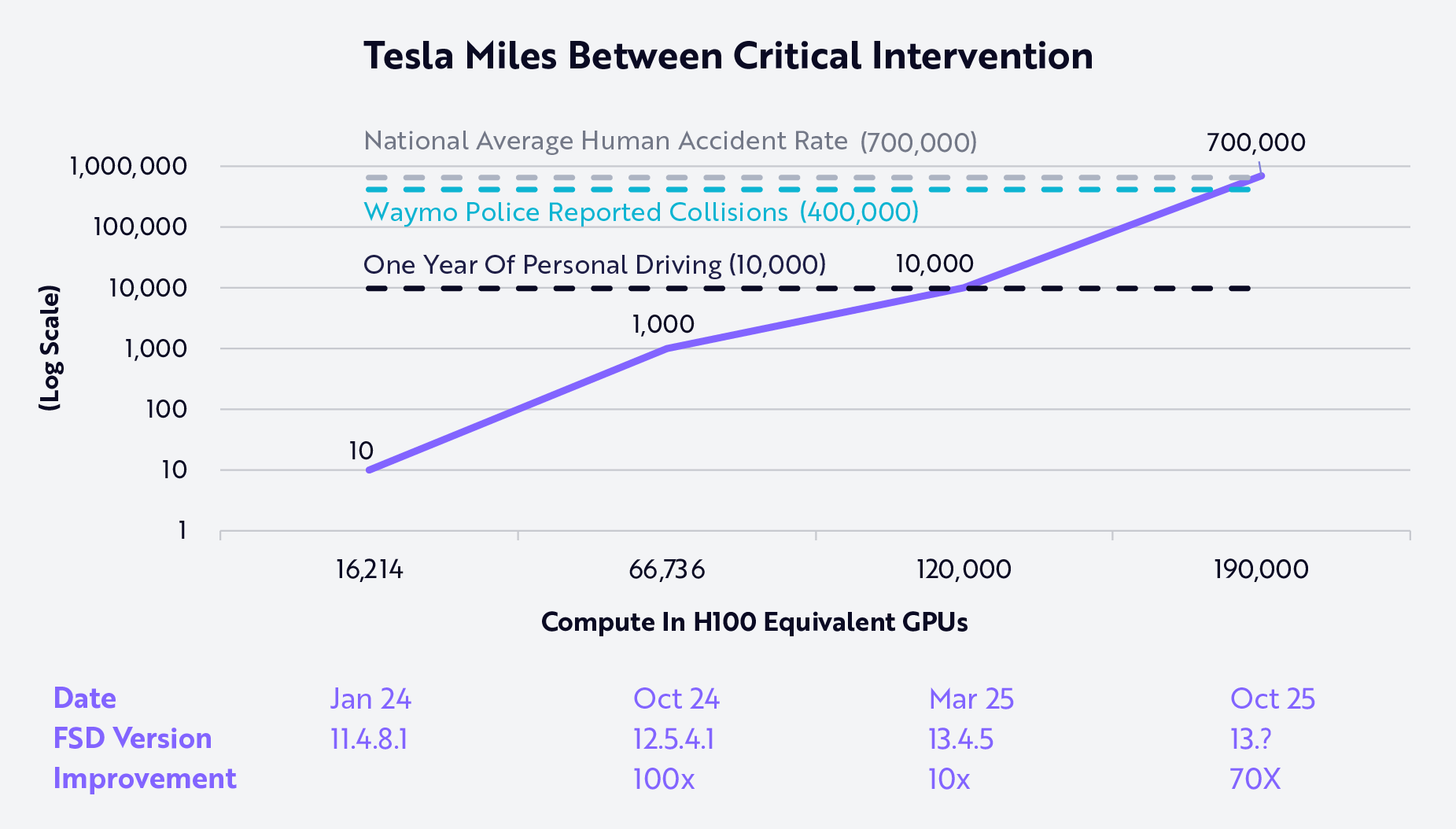

Last week, Waymo released its latest Safety Report, from which we estimate that its commercial robotaxi service averaged ~500,000 miles between police-reported collisions in the fourth quarter.1 Based on this metric, in just one quarter Waymo’s performance improved 25%, from ~400,000 miles during the third quarter, as presented in ARK Big Ideas 20252 and shown below, to 500,000.

Note: “Miles Between Critical Intervention” measures the distance traveled before a human driver must take control to avoid an accident. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

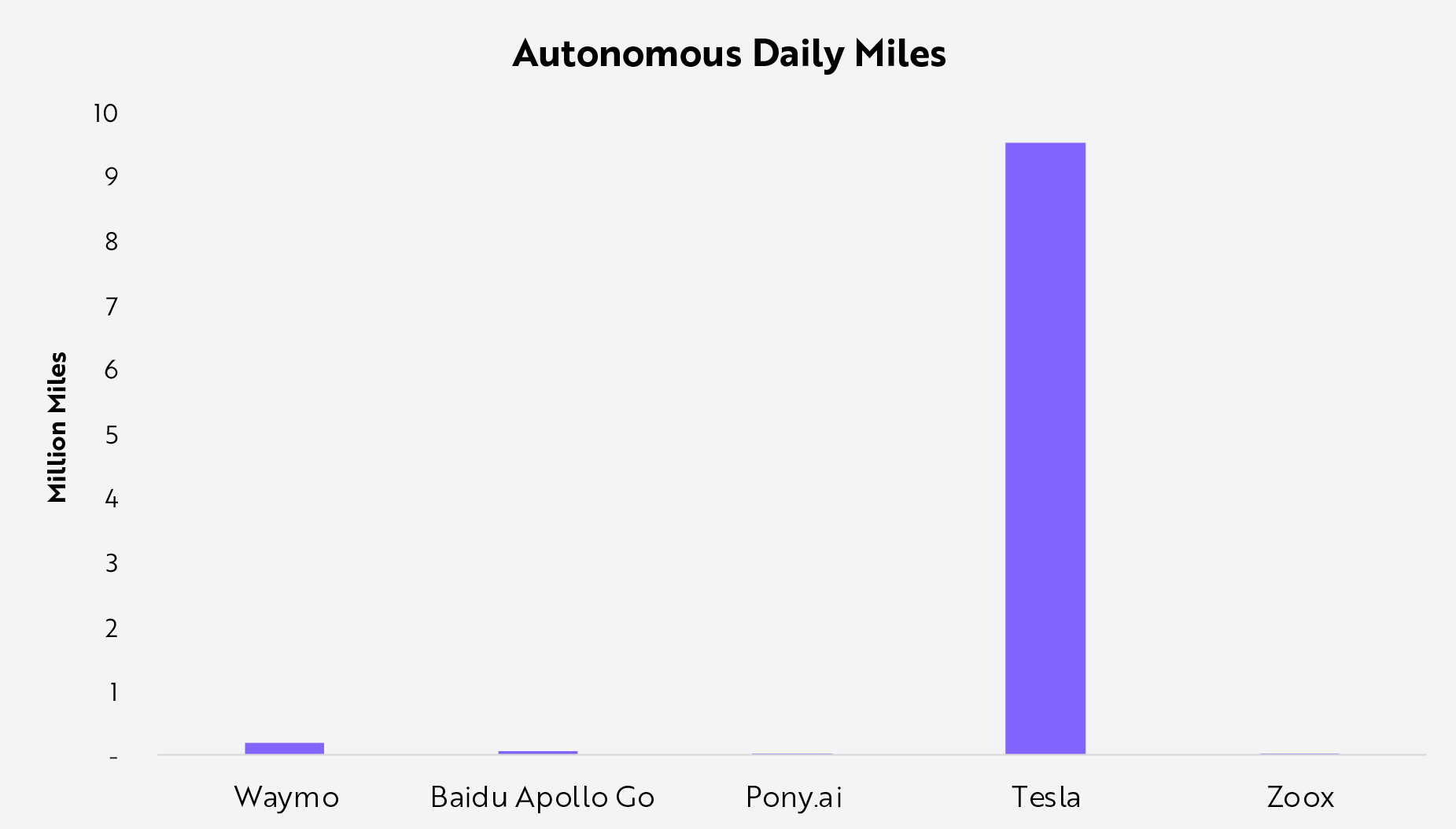

According to our research, Waymo’s commercial robotaxi service is logging ~200,000 miles per day—an impressive metric given its small fleet size. That said, as noted in ARK’s previous research,3 Waymo’s autonomous service is geofenced, an approach that we believe will prove inferior to Tesla’s Full Self-Driving (FSD) service which, even before the planned launch of its robotaxi service in June, is logging ~10 million miles per day across myriad real-world conditions, as shown below. Tesla’s ~50X advantage in real world driving data should help it scale rapidly once it launches robotaxis in Austin this June.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 29, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

ARK is eager to track the progress of Waymo and Tesla as the year of the robotaxi plays out. Read our full take in ARK Big Ideas 2025.4

2. Nvidia Showcased Its AI Hardware And Software Roadmap During GTC 2025

During his keynote at GTC 2025 last week,5 CEO Jensen Huang outlined Nvidia’s large strides in AI hardware and software, focusing on four main areas: the increased demand for AI inference, new software solutions, an ambitious hardware roadmap, and progress in physical AI applications like autonomous vehicles and humanoid robots.

Huang noted that advanced reasoning models from companies like OpenAI and DeepSeek are boosting demand for compute power. According to Nvidia’s estimates, compared to traditional large language models (LLMs), reasoning models generate 20x more tokens and use 150x more compute per query.6 The significant increase in compute is necessary to increase the efficiency and performance of existing AI models as they adapt to breakthrough innovations like reasoning. Huang introduced Dynamo, a software platform that optimizes LLM inference by improving resource allocation between the primary stages of inference, Prefill and Decode. On existing Hopper GPUs, Dynamo’s dynamic compute management has doubled efficiency and cut inference costs by 40%.7

On the hardware front, Huang detailed Nvidia’s roadmap through 2027. Next year, compared to this year’s Blackwell Ultra system, Vera Rubin will deliver 3.3x more FLOPS and 1.6x more memory per rack. In 2027, Rubin Ultra will boost the number of GPUs 4x to 576 in single rack, delivering 14x the FLOPS of Blackwell Ultra.8 The Rubin Ultra system will draw an unprecedented 600 kilowatts of power per rack, 60x more than a standard density rack which consumes only ~10 kilowatts in traditional data centers9 and 5X more than Blackwell’s 120 kilowatts per rack.10 Huang estimates that Rubin’s performance relative to total cost of ownership will be 4x higher than Blackwell and 33x higher than Hopper, Nvidia’s last generation GPU.

Finally, Huang showcased Nvidia’s new physical AI-focused software and partnerships. GM will integrate Nvidia AI into its vehicles and factories, seemingly to reboot its autonomous vehicle efforts after exiting Cruise in December 2024.11 Focused on humanoid robots, Nvidia’s new open-source model, GR00T N1, uses a dual-system design for both reflexive and deliberate actions, an approach similar that of Helix, which supports Figure AI’s humanoid robot.12

3. Has Google Ignited An M&A Megacycle?

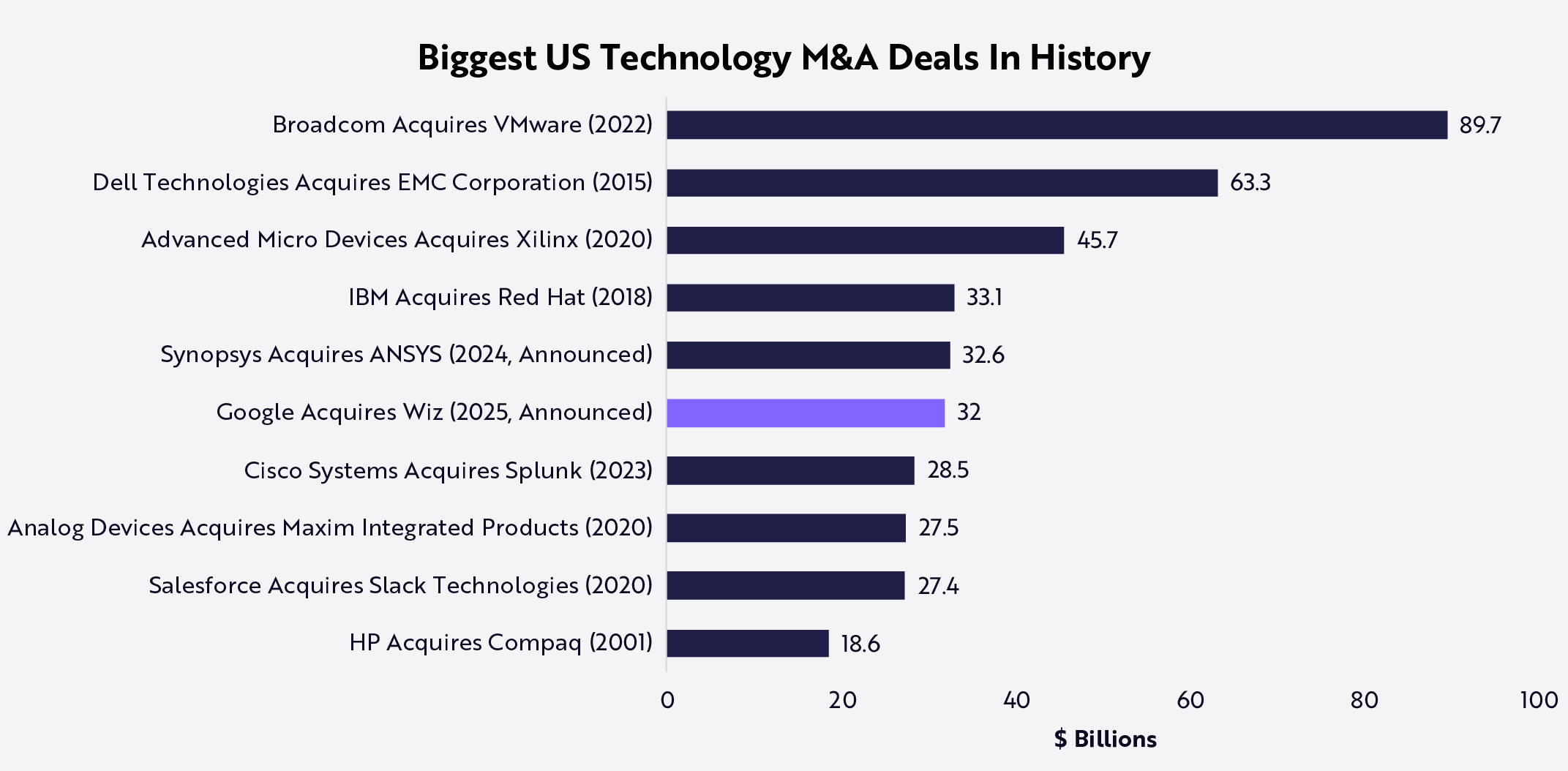

Last week, Google announced the sixth-largest US tech merger and acquisition (M&A) transaction in history—and the largest in its own corporate history—when it acquired Wiz, a private cybersecurity company, for $32 billion in cash.13 The transaction follows a severely restrained M&A environment driven largely by restrictions imposed by the Federal Trade Commission (FTC). While small relative to Google's $2 trillion market capitalization,14 the Wiz transaction sends a signal that could propagate across the innovation space.

Source: ARK Investment Management LLC 2025, based on data from CapitalIQ, as of March 23, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

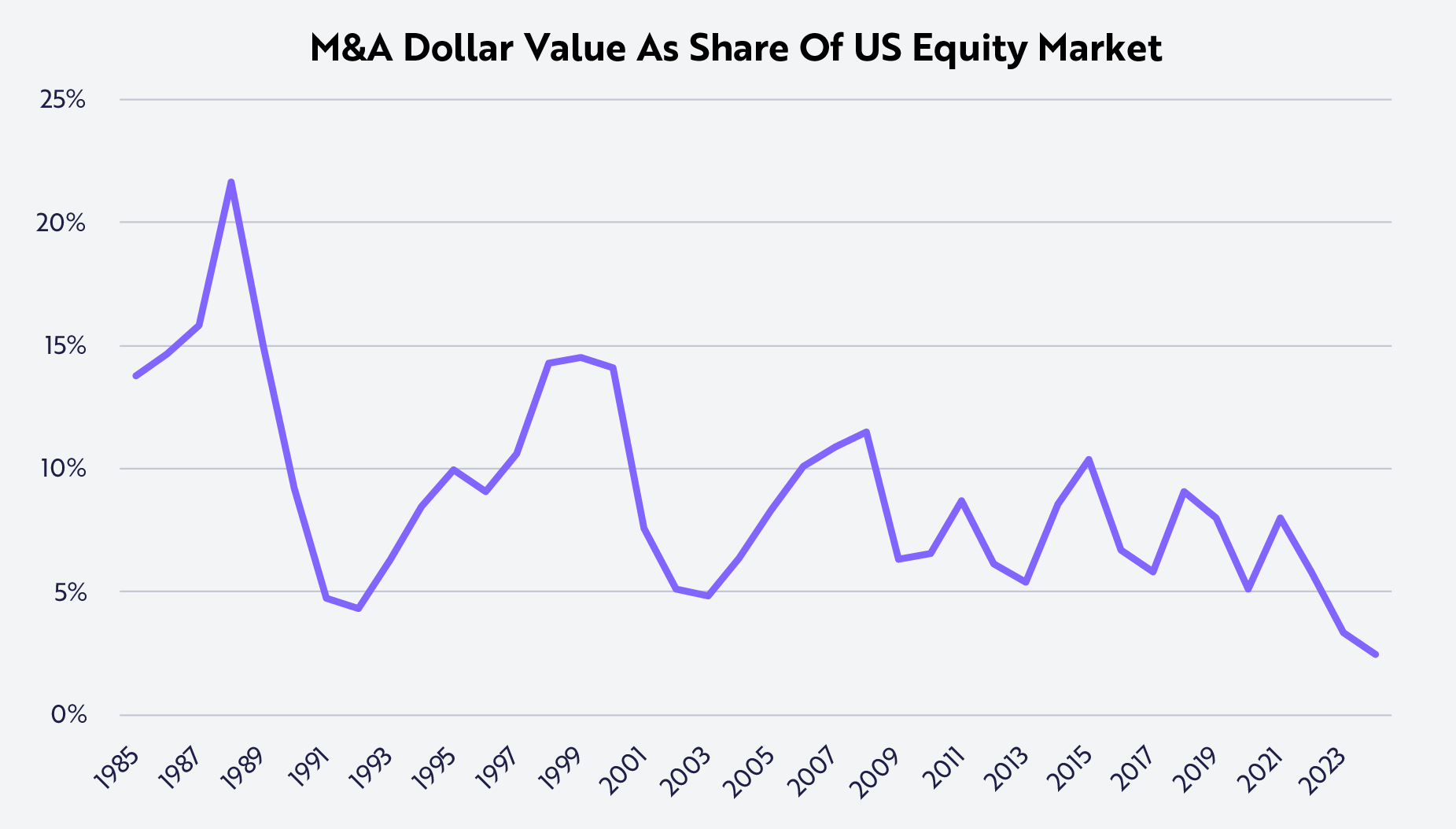

History puts into perspective the recent drought in tech M&A activity. Relative to the US equity market, transaction activity hit consecutive record lows in 2023 and 2024. In 2024, M&A transactions were less than 2.5% of the US equity market cap, or roughly half the 4.3% and 5% respective troughs in the early 90s recession and the tech and telecom bust in the early 2000s, as shown below. The recent dearth of activity was set in motion after newly elected President Joe Biden ordered the FTC publicly to scrutinize both proposed deals and past transactions.15

Source: ARK Investment Management LLC 2025, based on data from CapitalIQ, as of March 23, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Ironically, while attempting to curb the power of tech monopolies by restricting acquisitions, the FTC may have strengthened their monopoly power inadvertently. Why? Most M&A transactions destroy value for the acquiring company while benefiting the acquired. Large-cap tech firms typically harm themselves—and the companies they acquire—yet pursue these deals anyway to prevent competitors from seizing strategic opportunities. This dynamic resembles the “prisoner's dilemma,” a classic game theory scenario illustrating how individually rational decisions can lead to collectively suboptimal outcomes unless parties can coordinate. Although large tech companies would collectively benefit by abstaining from M&A activity, individually they feel compelled to acquire competitors defensively. By broadly restricting acquisitions, the FTC inadvertently has facilitated implicit coordination, effectively aligning individual incentives with collective interests by making M&A impossible for all.

The acquisition drought has harmed disruptive technology up-and-comers, particularly those traded publicly and relying on public capital markets for funding. Without the threat of M&A, short sellers have targeted and depressed the stock prices of companies coming to market for additional cash, effectively starving them of capital. In functioning M&A environments, buyers provide “strategic price discovery” and valuation floors for innovative companies. In the last four years, many innovative companies have suffered, some unwinding altogether in bankruptcy.

Though somewhat disadvantageous for large-cap tech companies, an M&A revival should benefit disruptive innovation broadly and disproportionately. Large cap core tech and pharma/biotech companies will have to respond to looming strategic vulnerabilities, triggering a re-rating of the technologies associated with disruptive innovation.

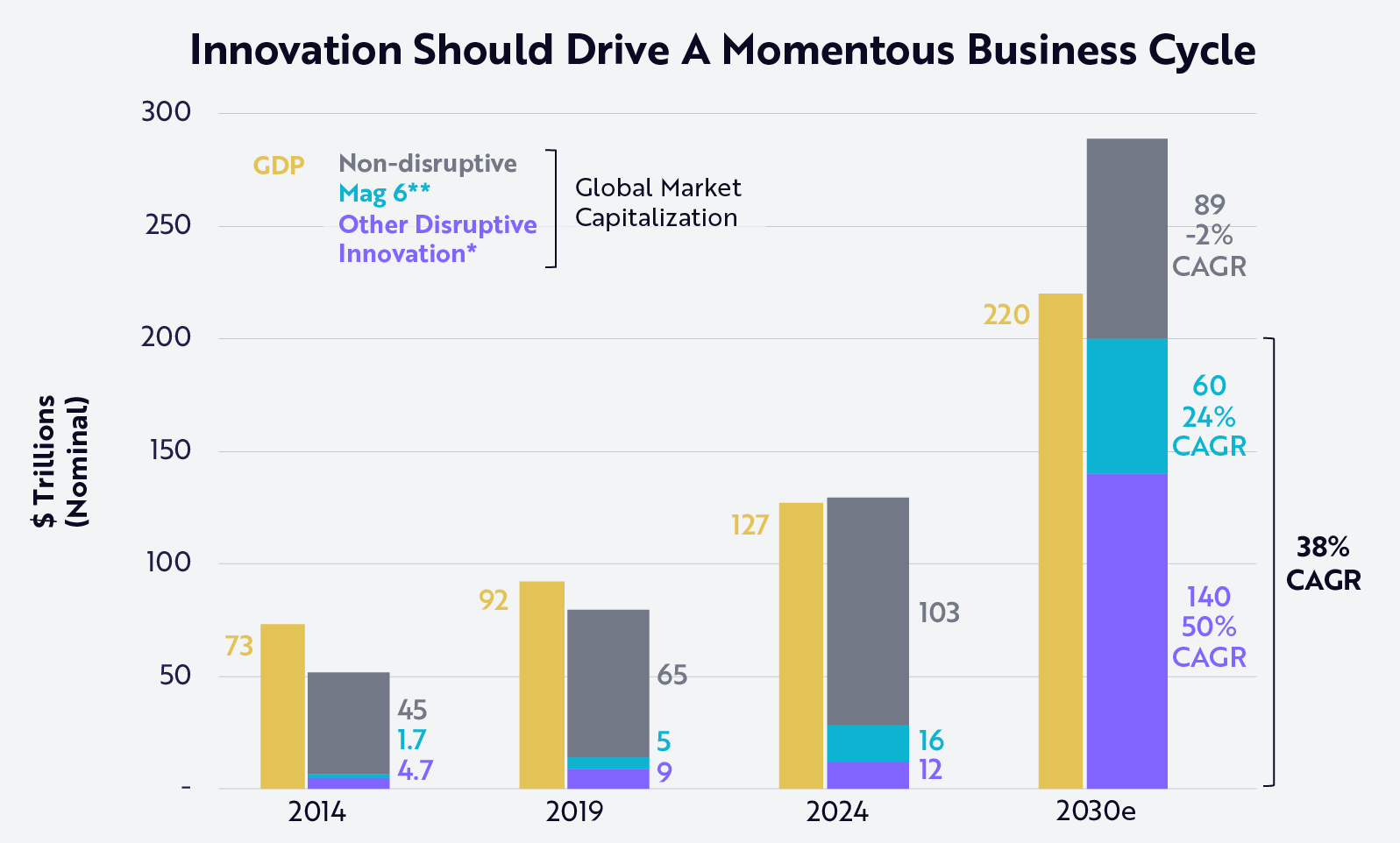

The return of M&A could catalyze the reversal of a trend that has dominated technology investing increasingly since the COVID pandemic: the concentration of enterprise value into a handful of companies—the so-called Mag 6. Before 2020, Microsoft, Apple, Alphabet, Meta, Amazon, and Nvidia accounted for roughly one third of disruptive tech enterprise value. During the past five years, their share has ballooned to nearly 60% as, in the absence of M&A, they have been building cash war chests or buying back shares while watching smaller companies skate across thin balance sheets, as shown below. As the Trump Administration encourages the FTC to deregulate and get out of the way of M&A, the balance sheet fortresses of large cap tech and pharma/biotech companies could pour into innovative companies that have created and evolved strategic technologies against the odds during the last five years—depriving large cap shareholders of cash returns.

While several of the Mag 6 could capitalize on disruptive strategic technologies, the broader innovation space should benefit more. By 2030, our research suggests that the Mag 6 will drop from roughly 60% share of the overall innovation market cap to historical norms closer to 30%, ceding disruptive innovation market cap share to innovative companies enjoying much stronger tailwinds.

Note: “CAGR”: Compounded Annual Growth Rate. *We include cryptocurrencies and crypto assets in disruptive innovation capitalization. **Microsoft, Nvidia, Meta, Apple, Amazon, and Alphabet. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

If M&A activity were to return just to the average of the last 20 years, this transaction cycle would be unprecedented, surpassing the high-water mark set during COVID by hundreds of billion dollars. Typically, M&A cycles are contagious. The acquisition of strategic assets can cause buyer frenzies benefiting those that remain. Well, Google just sneezed!

-

1

Waymo. 2025. “Fresh safety data is in!...” X.

-

2

ARK Investment Management LLC. 2025. “Big Ideas 2025.”

-

3

Keeney, T. 2024. “Countdown To Cybercab, Tesla’s Multi-Trillion Dollar Robotaxi Opportunity.” ARK Investment Management LLC.

-

4

ARK Investment Management LLC. 2025. “Big Ideas 2025.”

-

5

Nvidia. 2025. “GTC March 2025 Keynote with NVIDIA CEO Jensen Huang. YouTube.

-

6

Ibid.

-

7

Ibid.

-

8

Ibid.

-

9

Pacheco, M. 2024. “Navigating Data Center Power Density in the Age of HPC and AI.” Tierpoint.

-

10

Mann, T. 2024. “One rack. 120kW of compute. Taking a closer look at Nvidia's DGX GB200 NVL72 beast.” The Register.

-

11

Shepardson, D. and N. Eckert. 2024. “GM to Exit Loss-Making Cruise Robotaxi Business.” Reuters.

-

12

FigureAI. 2025. “HELIX: A VISION-LANGUAGE-ACTION MODEL FOR GENERALIST HUMANOID CONTROL.”

-

13

An ARK Invest analysis based on transactions data from CapitalIQ as of March 23, 2025.

-

14

Alphabet’s market capitalization is 2.011 trillion according to CapitalIQ as of March 23, 2025.

-

15

Adams, S. et al. 2021. “President Biden’s Executive Order on Promoting Competition.” Harvard Law School Forum of Corporate Governance.