#455: Apple Is Delaying Apple Intelligence, & More

1. Apple Is Delaying Apple Intelligence

Apple has delayed the release of some of its most widely touted Apple Intelligence features until 2026 or later.1 Though the delay may be a surprise to seasoned Apple observers,2 disruptive technologies are challenging for incumbents—now including Apple—to incorporate.3 The characteristics that make AI interesting may not be consistent with Apple’s buttoned-up, optimized ecosystem.

Though a one-year delay might sound insignificant, such a time-gap is dramatic and potentially deadly in the AI age. Just two years ago, in March 2023, OpenAI’s GPT-4 did not exist and ChatGPT's subscription service—now netting billions in revenue annually4—had yet to launch. Historically, for traditional technologies, performance has doubled every two years, thanks to their learning curves and cost declines. As a result, a company one year behind would have lagged by only half a generation. In the AI age, however, performance is doubling every 4 to 5 months,5 suggesting that a year‘s delay would be the equivalent of launching Apple‘s first smartphone not in 2007 but in 2012. Despite an additional year to work on the project, there is no guarantee that Apple will deliver its widely advertised personalized AI features, even on the newly revised timeline.6 Last year, users responded positively to the Apple promo videos7 promising a truly smart Siri that would incorporate the raw context collected on iPhones to answer questions and take intelligent actions. Yet, Apple has yet to demonstrate these capabilities in any live forum. In AI, prototypes are easy, and concept videos—as Apple presented—are even easier. Delivering a product that works consistently, however, is hard. Indeed, some of the Intelligence features that Apple has rolled out already have been recalled.8

AI could create a new class of operating system allowing users to manage wildly performant AI agents.9 As users seek a new operating system to manage their agents, AI agents could reduce the consumer need for apps and traditional web interfaces, putting Apple’s entire app store franchise at risk. Just as the iPhone relegated cellular companies to providers of dumb pipes,10 AI could render smartphone manufacturers into providers of dumb hardware. No wonder leaks from internal meetings suggest that Apple is in an “AI crisis.”11

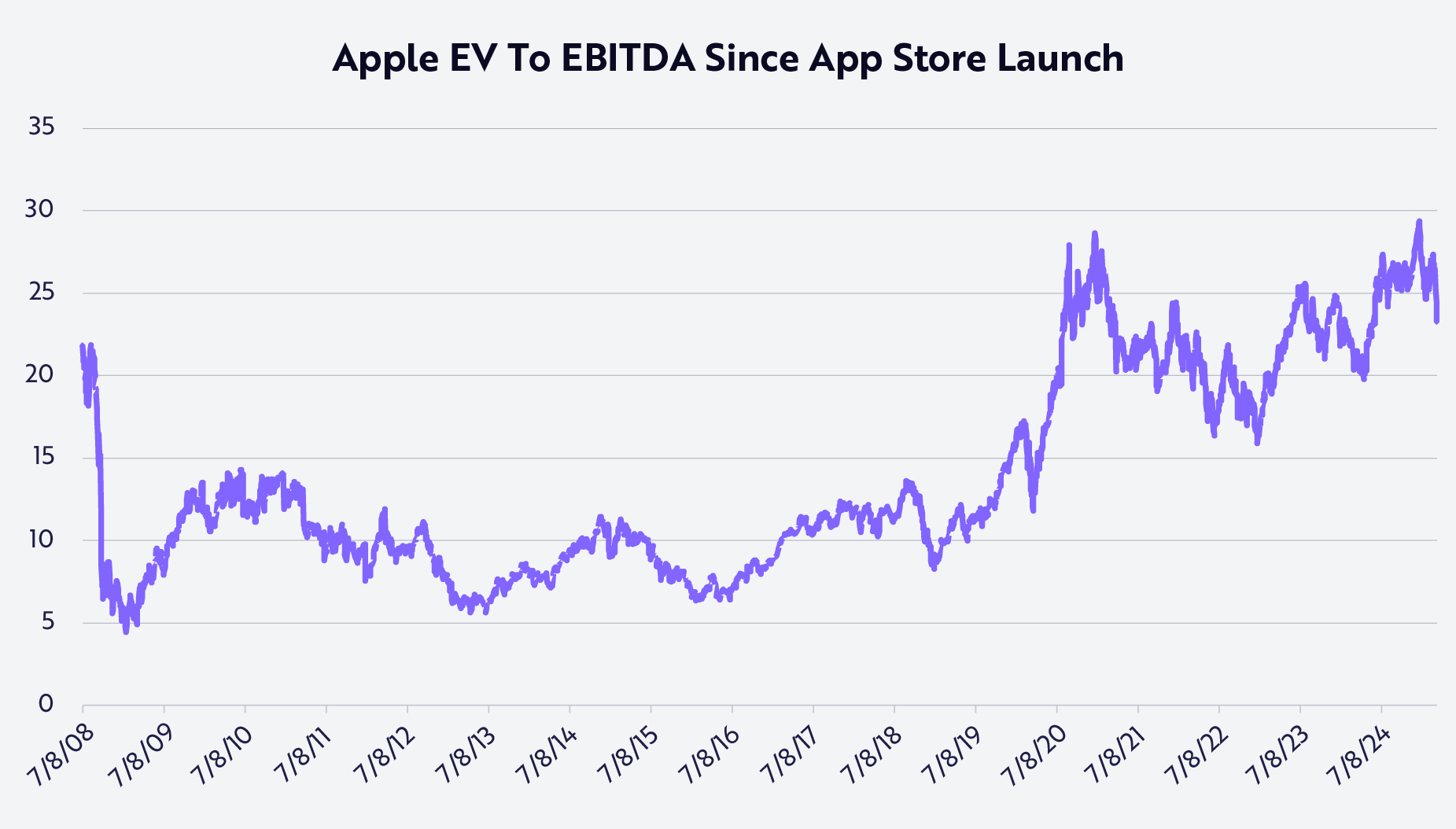

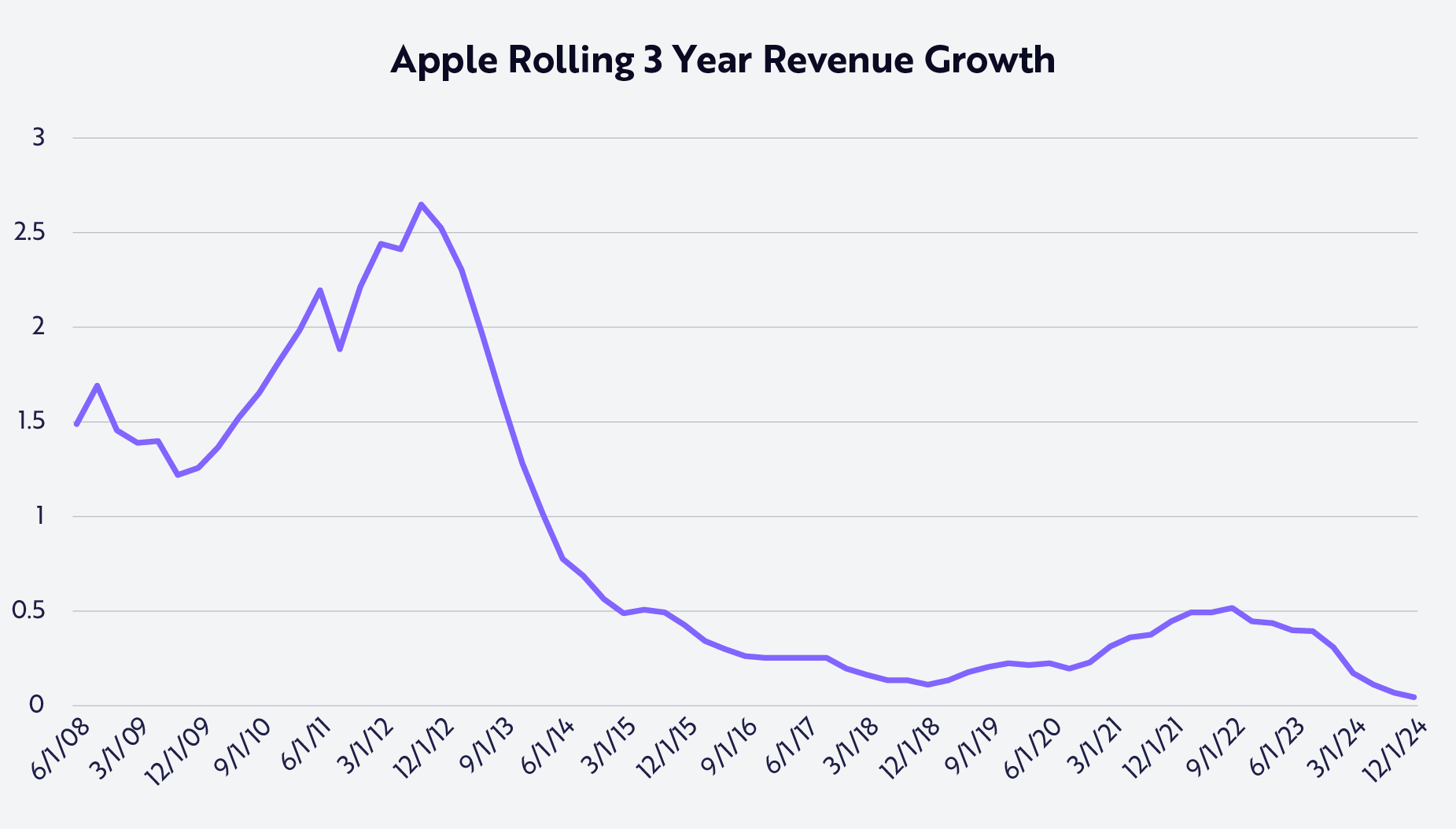

Apple’s stock price performance during the past few years belies this unfolding dislocation. Measured by EV to EBITDA (enterprise value relative to earnings before interest, taxes, depreciation, and amortization),12 AAPL has rarely been more expensive,13 even though its revenue growth has decelerated to nil during the past three years, as shown in the two charts below.14

Source: ARK Investment Management LLC, 2025, based on data from yCharts as of March 13, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Source: ARK Investment Management LLC, 2025, based on data from yCharts as of March 13, 25. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Strategic uncertainty, execution stumbles, and near-zero growth typically undermine equity valuations, but is this time different for Apple? The company’s constellation of devices supports one of most lucrative global distribution channels in history. Now the question is whether Apple can capitalize on its channel to deliver on the AI promise. The burden of proof is on Apple.

2. Lila Is Leading The Charge Into Autonomous Science

Last week, bioplatform innovation company Flagship Pioneering unveiled15 Lila Sciences, an autonomous science company aiming to introduce Autonomous Science to the physical world. Combining AI, robotics, and automated laboratories, Lila has developed an autonomous science platform that redefines16 scientific discovery. At its core are AI Science Factories (AISFs)—self-learning systems that generate hypotheses autonomously, design and execute experiments, and refine results continuously to spur scientific progress at unprecedented scale and speed across life sciences, materials, and energy.

Distinguishing Lila is its “self-reinforcing data flywheel”: instead of relying on static datasets, its AI generates proprietary scientific data continuously, compounding its advantage with every experiment. Addressing a multi-trillion-dollar market spanning life sciences, energy, and materials, we believe Lila could become the NVIDIA of physical innovation.

Backed by top investors, including General Catalyst, March Capital, Altitude Life Science Ventures, Blue Horizon Advisors, State of Michigan Retirement System, Modi Ventures, a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA), and ARK Venture Fund, Lila seems poised to drive a step-change in research and development (R&D) productivity, compressing decades of progress into years. At the dawn of Autonomous Science, Lila appears poised to lead charge.

3. Tesla’s Robotaxi Edge Should Drive Its Long-Term Value

As analysts debate the fate of its near-term electric vehicle (EV) sales, Tesla’s robotaxi ambitions are now impossible to ignore. According to our research, its robotaxi platform will account for 90% of Tesla’s enterprise value in 2029. Importantly, Tesla will operate primarily on a fleet sales model, though individuals who own Tesla cars will be welcome to join as well.17

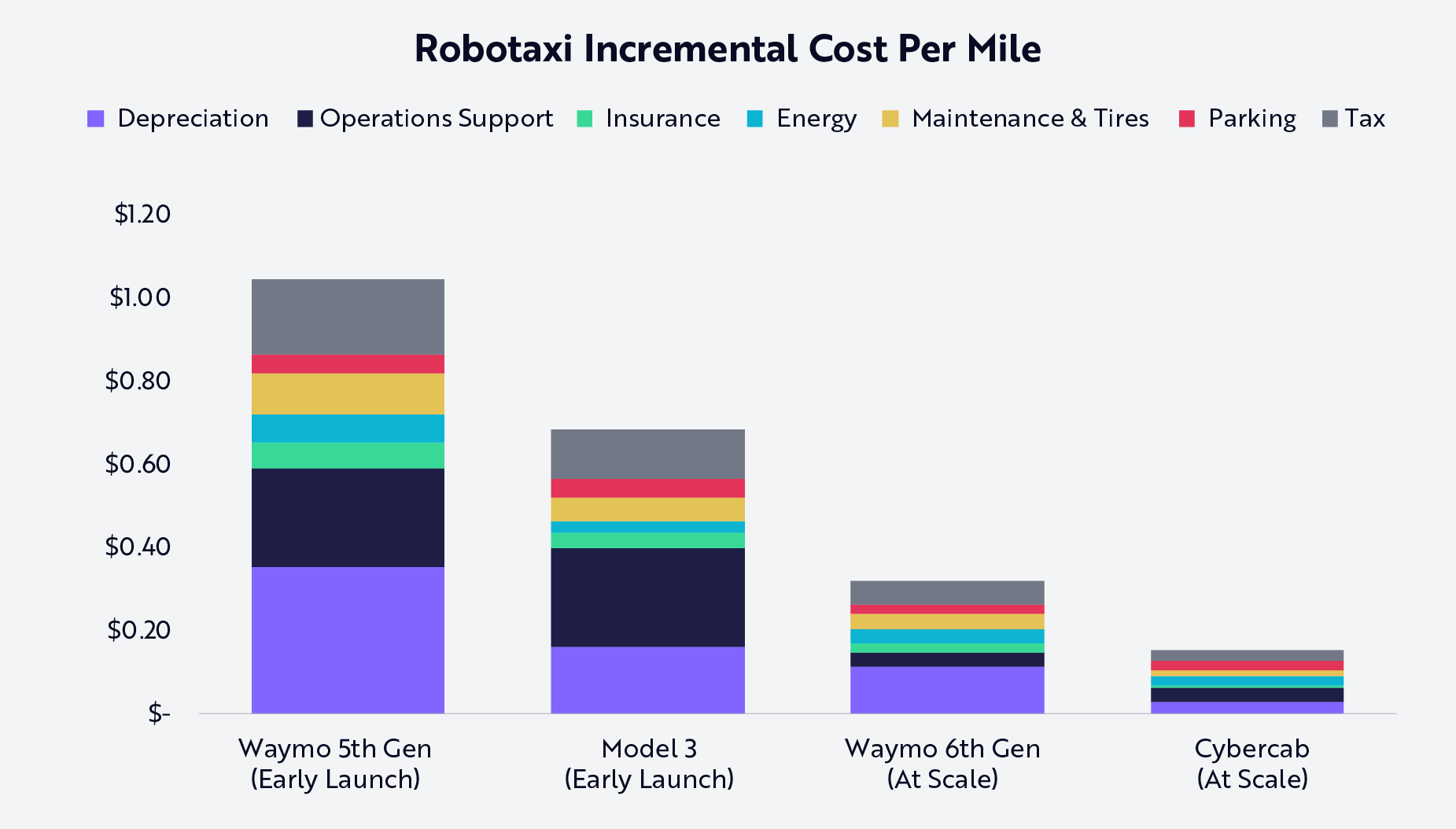

In June, Tesla plans to launch its first robotaxi service in Austin,18 which could serve as a pivotal “seeing is believing” moment for the industry. ARK’s research suggests that Tesla has an edge in both data and cost relative to Waymo and other competitors. It has access to ~10M miles of Full Self-Driving (FSD) data per day from a diverse set of real-world driving conditions,19 compared to Waymo’s ~100K miles per day from more limited geofenced environments.20 Moreover, Tesla’s cost per mile could be 30-40% lower than Waymo’s, thanks in large part to vertically integrated manufacturing unencumbered by LiDAR and other unnecessary hardware, as shown below.

“Early launch” assumes ten cars per remote operator with utilization rates roughly equivalent to ride-hail today. “At scale” assumes 100 cars per remote operator with an improved autonomous operation utilization rate. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Tesla’s data and cost advantages should enable it to scale much faster and more efficiently than competitors. If successful, its robotaxi rollout could redefine how investors value the company, shifting their focus from EV sales with low gross margins to autonomous mobility with more SaaS (Software-as-a-Service)-like economics. Its June launch in Austin could be the moment Tesla proves that its autonomous taxi network is substance, not hype.

-

1

Nellis, S. 2025. “Apple says some AI improvements to Siri delayed to 2026.” Reuters.

-

2

Gruber, J. 2025. “Something Is Rotten in the State of Cupertino.” Daring Fireball.

-

3

Winton, B. 2024. “Is AI Truly Disruptive?” ARK Investment Management LLC.

-

4

Efrati, A. and S. Palazzolo. 2025. “OpenAI Revenue Surged From $200-a-Month ChatGPT Subscriptions.” The Information.

-

5

ARK Investment Management LLC. 2024. “Big Ideas 2024.”

-

6

According to Bloomberg, Apple’s Siri chief raised doubts about “meeting the current release expectations.” See Gurman, M. 2025. “Apple’s Siri Chief Calls AI Delays Ugly and Embarrassing, Promises Fixes.” Bloomberg.

-

7

Gruber, J. 2024. “WWDC 2024: Apple Intelligence.” Daring Fireball.

-

8

Mickle, T. 2025. “Apple Plans to Disable A.I. Features Summarizing News Notifications.” The New York Times.

-

9

See Winton, B. 2025. “AI Agents Are Operating Systems.” ARK Disrupt Newsletter. ARK Investment Management LLC.

-

10

Macleod, E. 2008. “U.S. Carriers Become Dumb Pipes.” Mobile Industry Review.

-

11

Gurman, M. 2025. “Apple’s Siri Chief Calls AI Delays Ugly and Embarrassing, Promises Fixes.” Bloomberg.

-

12

EV to EBITDA is calculated by dividing a company’s enterprise value by its earnings before interest, taxes, depreciation, and amortization (EBITDA), with the resulting ratio used to determine the value of the company. Higher enterprise multiples are expected in high-growth industries and lower multiples in industries with slow growth.

-

13

As of March 13, 2025, Apple has been less expensive 89% of the time as measured by its EV to EBITDA going back to the July 2008 launch of the app store.

-

14

The most recent two quarters are the only quarters since the app store launch in which 3-year annual revenue growth has fallen into the single digits.

-

15

Flagship Pioneering. 2025. “Flagship Pioneering Unveils Lila Sciences to Build Superintelligence in Science.”

-

16

Lohr, S. 2025. “The Quest for A.I. ‘Scientific Superintelligence.’” The New York Times.

-

17

Stafford, e. 2025. “Tesla's Paid Robotaxi Service Slated to Start in Austin in June.” Car and Driver.

-

18

Ibid.

-

19

This is an ARK estimate based on data from Tesla as of December 31, 2024. See Tesla. 2024. “Q4 and FY 2024 Update.”

-

20

This is an ARK estimate based on data from Waymo as of February 27, 2025. See Waymo 2025. “200,000+ weekly Waymo rides and counting!...” X.