#454: Spaceflight Is High-Risk, High-Reward, & More

1. Spaceflight Is High-Risk, High-Reward

Last week, several attempts at spaceflight highlighted the challenges. Backed by NASA, Firefly Aerospace began 14 days of lunar surface operations during which its Blue Ghost began to capture stunning, sci-fi-like images, as shown below.1 As part of the same NASA program, Intuitive Machines launched Athena, its second attempt at a lunar lander, that missed its target, tipped over, and shut down within 24 hours.2 Meanwhile, although SpaceX’s Mechazilla chopsticks caught Flight Test 8’s Super Heavy Booster for a third time, its next-gen Starship exploded upon separation.3

Source: Firefly Aerospace 2025.4 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

These setbacks remind us not only of spaceflight’s challenges but also of its successes. During 2024, SpaceX launched 134 Falcons,5 99% of which were successful, highlighting the payback after years of explosions, iterations, and persistence.6

Spaceflight is difficult, its success based on execution and rapid iteration, with each failure helping to refine the technology and transforming lessons into future success. We look forward to witnessing how Intuitive Machines and SpaceX apply recent lessons to their next missions.

For our detailed thoughts on spaceflight, please read ARK Big Ideas 2025, available here.7

2. The White House Has Established A Strategic Bitcoin Reserve

Last Thursday, President Trump issued an executive order—“Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile” —formally recognizing bitcoin as a strategic asset to be managed with federal oversight.8 The order states first that the government will not sell the bitcoin confiscated in response to criminal activity during the last ~12 years, currently estimated at ~187,000 units, or roughly $15 billion.9

The order also calls for a separate stockpile of digital assets other than bitcoin, signaling not only the government’s broad interest in digital innovation but also the distinction between bitcoin as a strategic asset and the role of other cryptoassets.

The US government also made clear that it will not use taxpayer funds to purchase bitcoin or altcoins, stating that future purchases will be “budget neutral.” The order stipulated that future purchases would involve congressional deliberation, as prescribed by the U.S. Constitution, Article I, Sections 8 and 10.10

Digital asset experts like Nic Carter say11 that this announcement “couldn’t have gone better.” Trump kept his campaign promise with a formal endorsement of bitcoin but a reserved stance on future purchases. In our view, alongside a similar approach by Texas,12 President Trump’s thoughtful follow-through on his campaign promise will encourage the US government to adopt bitcoin in a healthy way.

3. AI Agents Are Operating Systems

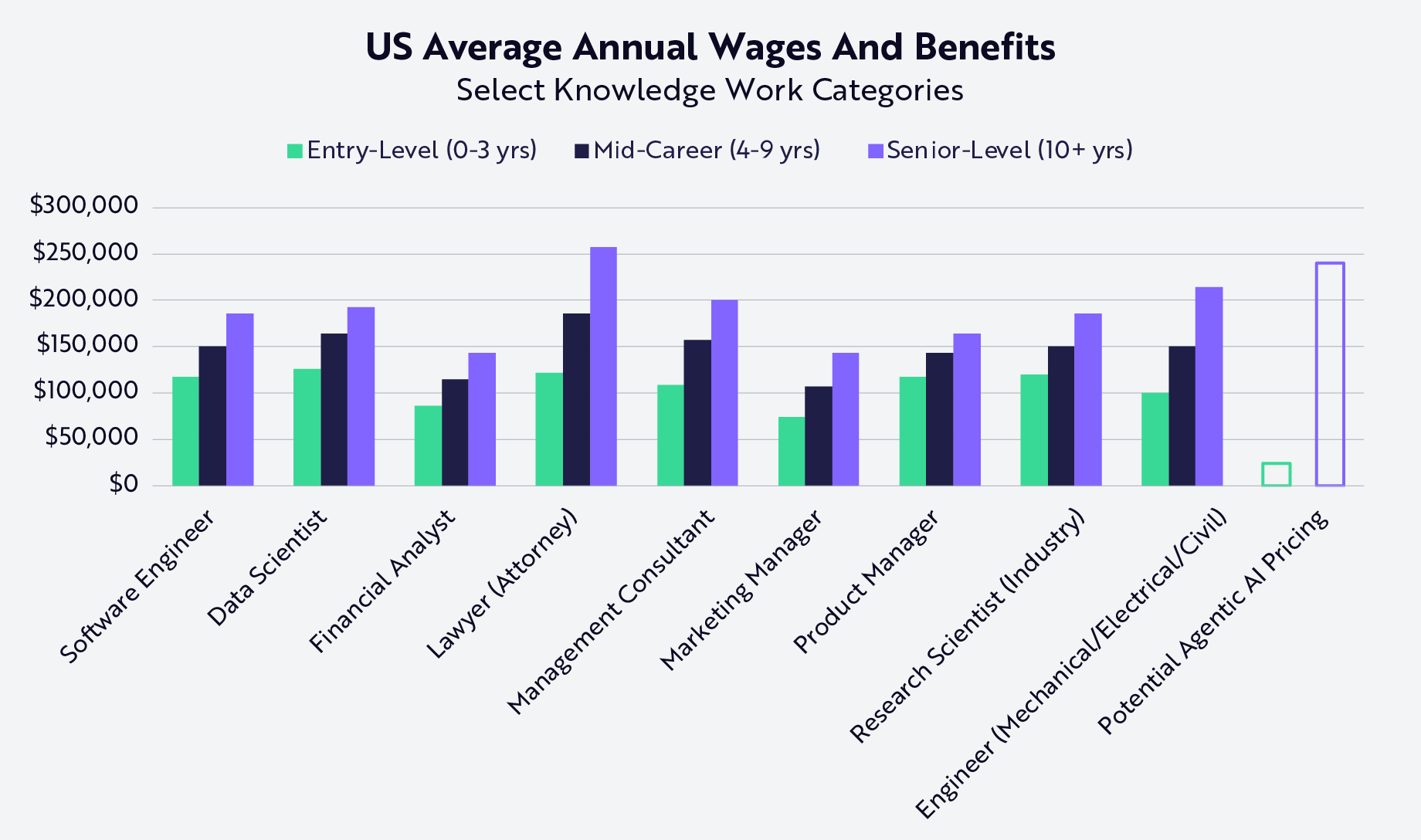

Amid rumors that it is raising money at a $300 billion valuation, OpenAI seems to be entertaining a new pricing strategy for its AI applications.13 In addition to paying a $20-200 monthly fee for access to advanced versions of ChatGPT, users might be asked to pay $2,000 - $20,000 per month for access to high-end AI agents that can produce PhD-caliber work.14 Though seemingly hefty, $2,000 per month would be a bargain compared to the cost including benefits of a typical knowledge worker in developed markets, as shown below. As a bonus, AI agents can operate around the clock, can be “hired” or “fired” instantaneously, and don’t require additional office space or equipment to operate.15

Source: ARK Investment Management LLC, 2025, based on data from Payscale as of March 7, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

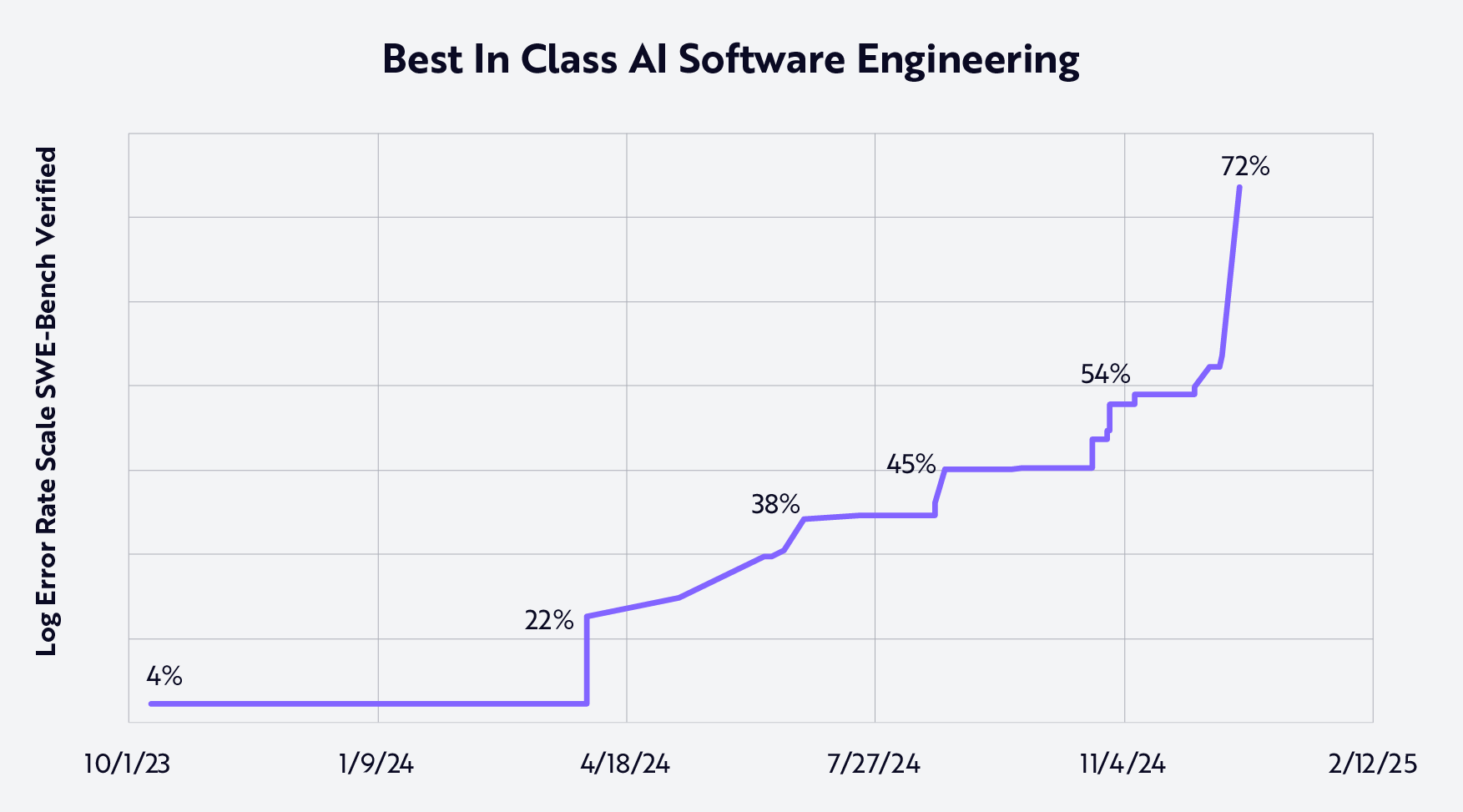

Recently, many companies have added new agentic AI capabilities to their repertoire. Replit’s coding agent, for example, is productizing the capability.16 The agentic focus coincides with a proliferation of agentic benchmarks and emerging evidence of radically capable agents. SWE-bench,17 for example, highlights that the software-engineering capability of state-of-the-art AI models has soared from a success rate of 4% to 70% in the past year, as shown below.

Source: ARK Investment Management LLC, 2025, based on data from SWE-Bench as of March 7, 2025. [KV1] For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

As a result, our personal and business lives are likely to revolve around managing teams of AI agents acting on our behalf. To do so effectively, we will need to communicate via a user interface—an “operating system”—that will manage these agents. In the new paradigm, agents could become equivalent of smartphone apps and the interface that controls them, the equivalent of iOS. Whereas users currently control their apps via the smartphone touchscreen, we will probably operate our agents using natural language. Built into the front end of large language models, AI chatbots could become the operating systems of the AI age.

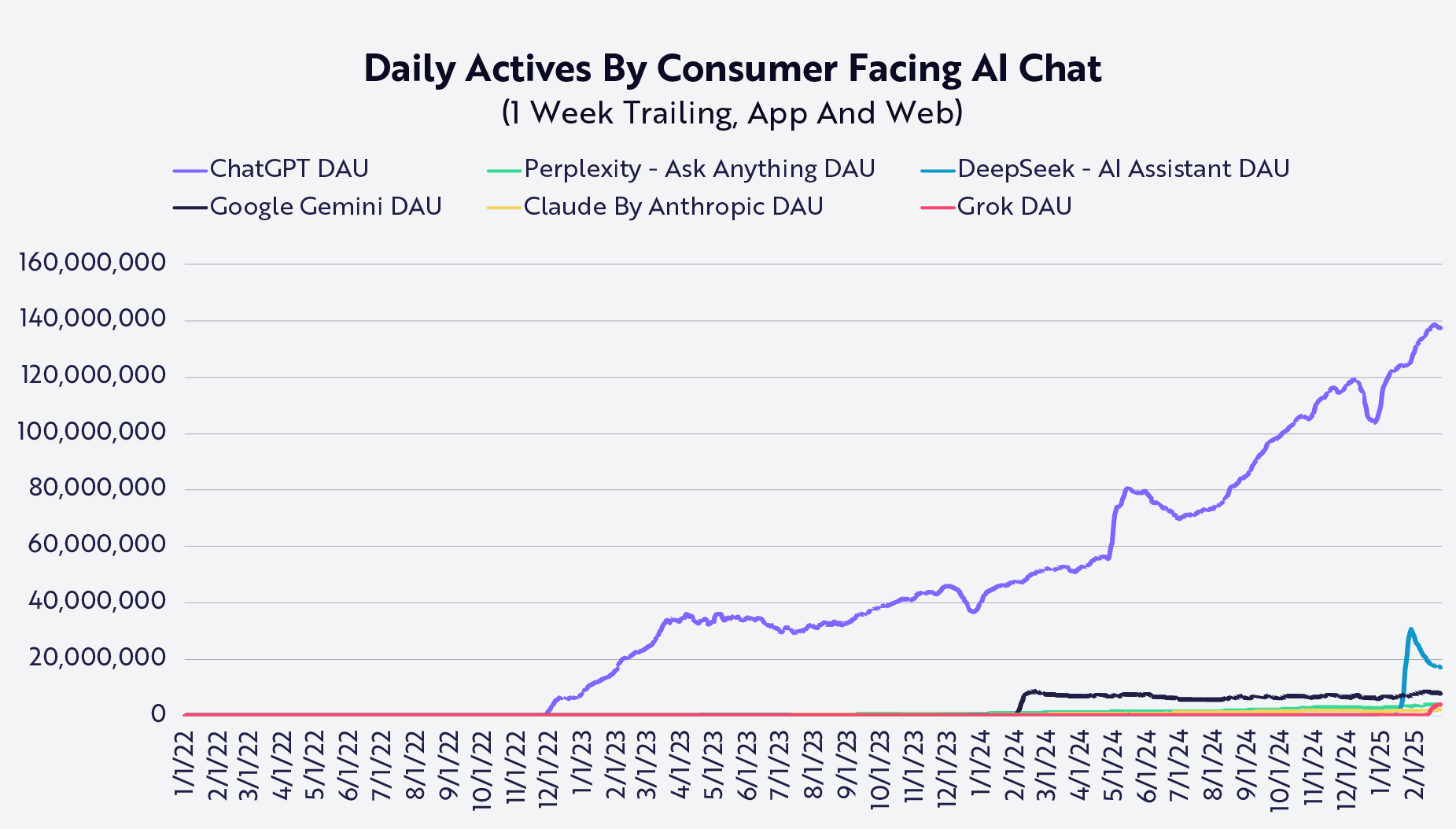

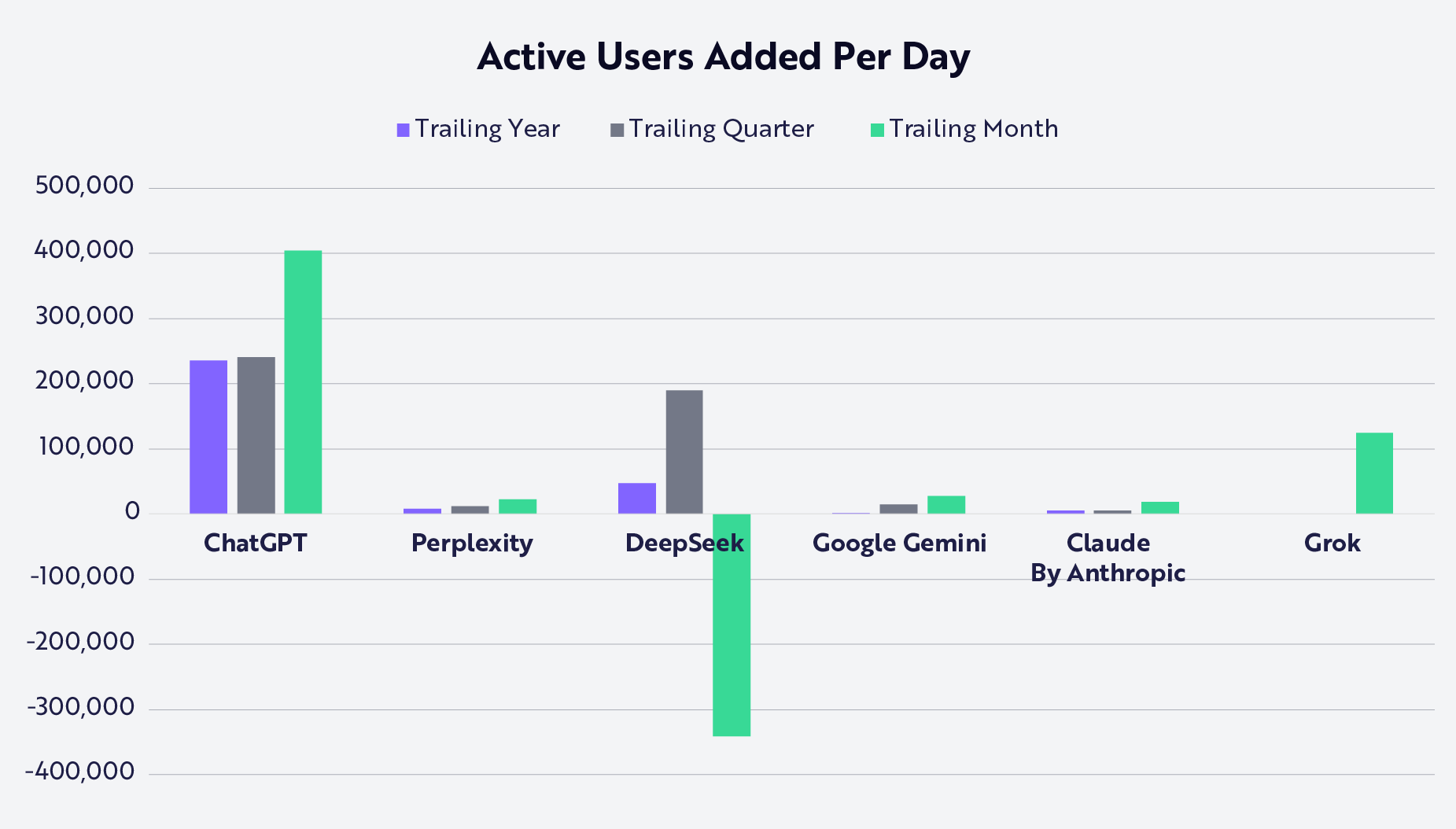

In that context, OpenAI seems to be in the pole position to deliver a host of agents to end-users. Indeed, among proto-operating-system providers, OpenAI dominates market share at this time, as shown below.

Source: ARK Investment Management LLC, 2025, based on data from Similarweb and SensorTower as of March 7, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Just as Microsoft exploited its position as the dominant computer OS provider to cement Office as the productivity suite, OpenAI could use ChatGPT to become the dominant distribution channel for AI agents. OpenAI has disclosed weekly active users of more than 400 million users, of which we estimate daily active users at ~140 million.18

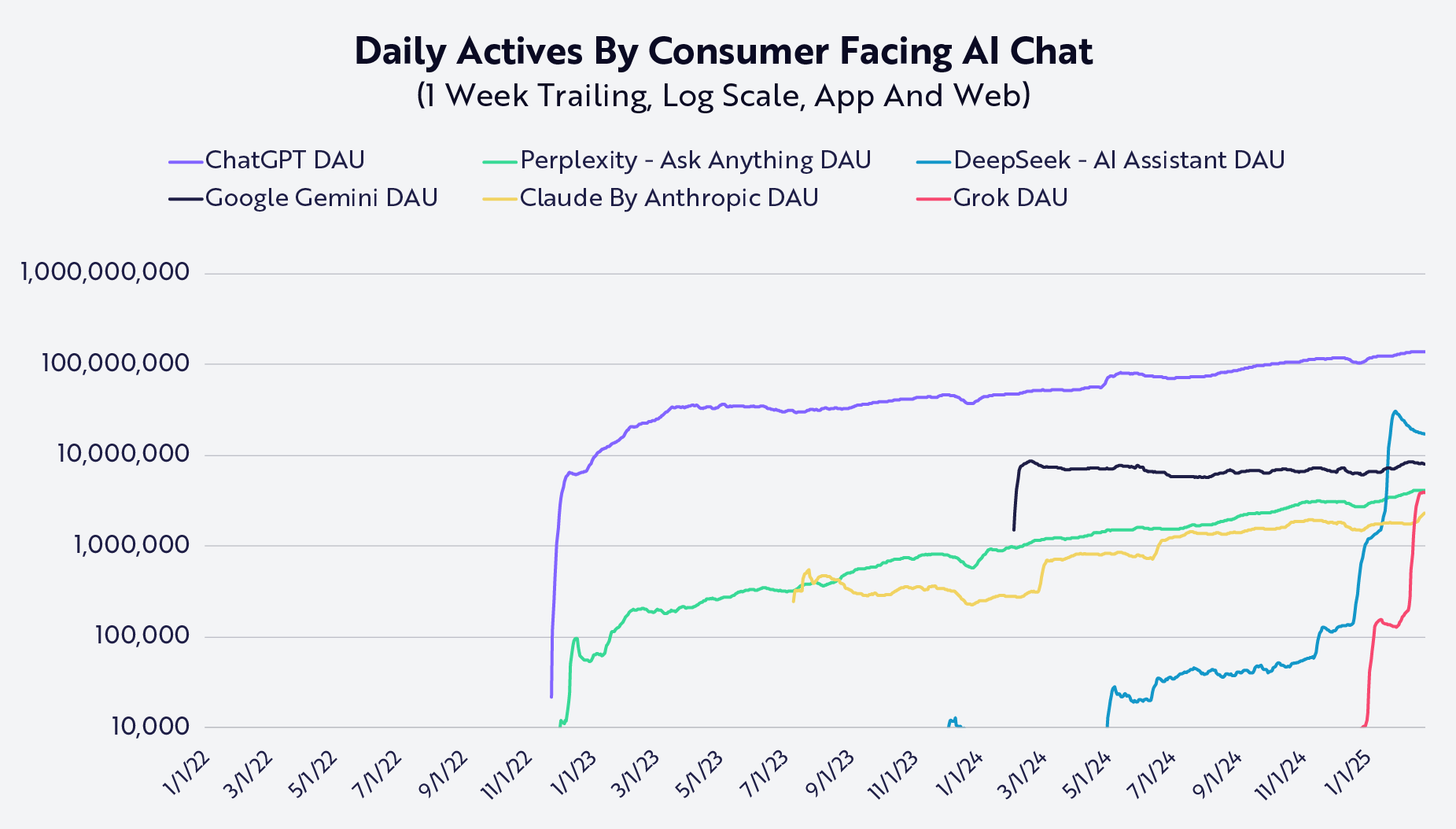

Based on those data, OpenAI commands the attention of ~80% of all daily active users accessing AI chatbots,19 its share even more dominant if adjusted for overall engagement. Presenting the same data in log scale gives a sense of the jockeying for position among the challengers. Given its recent app launch, upgraded capabilities, and differentiated access to X’s data, xAI’s Grok AI chat app has surpassed Anthropic’s Claude and seems poised to eclipse Perplexity’s Ask Anything. The flashy debut of R1, DeepSeek’s open-source reasoning model, quickly drove 10s of millions of users to its free service but already is showing signs of churn. Albeit on smaller bases, the challenger chatbots are outgrowing ChatGPT in percentage terms, except for Google’s Gemini, which is shrinking year-over-year.

Source: ARK Investment Management LLC, 2025, based on data from Similarweb and SensorTower as of March 7, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

That said, the jockeying is in early stages. Google search captures roughly 10x20 the number of daily active users that ChatGPT commands, but history suggests that early tech leads tend to compound. Measured over multiple timeframes, OpenAI is adding more absolute users per day than any of the competing proto-operating systems and is extending its lead, as shown below.

Source: ARK Investment Management LLC, 2025, based on data from Similarweb and SensorTower as of March 7, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Is this interpretation of the distribution channel for AI access and management too narrow? Meta might argue that it excludes Meta AI’s 700 million monthly active users, while Google might claim that its AI-driven search results reach more than a billion people, and Apple might highlight an Apple Intelligence’s active user base that encompasses every user that has upgraded to the most recent version of its software. Such claims are common during technology transitions. Incumbents try to embed disruptive technologies as “features”—which users find unsatisfactory.

In our view, users are flocking to ChatGPT, Grok, Perplexity, and Claude for good reason, despite ostensibly comparable AI products from Google, Meta, and Apple. AI is a fundamentally new platform with a new set of radically different capabilities. The winning interface will enable and encourage users to tap into those radical capabilities. By contrast, simply pasting an AI chatbot onto a platform optimized for a different set of features and capabilities seems a losing strategy.Is OpenAI destined to win? AI has the steepest performance curve of any technology in history that ARK’s research teams have modeled. Our analyses suggest that AI performance per dollar will double every 4 – 5 months through the end of the decade, an innovation velocity that suggests a high degree of strategic uncertainty.

Consumers and businesses are likely to spend more on these systems as their capabilities increase. Our research suggests that AI software spending could scale 33%-48% at an annual rate from $1.2 trillion last year to ~$7-13 trillion per year in 2030.21 The operating system that distributes and powers that software should scale even faster.

-

1

Firefly Aerospace. 2025. “Firefly Aerospace Becomes First Commercial Company to Successfully Land on the Moon.”

-

2

Intuitive Machines. 2025. “IM-2 Mission.” See also Faust, J. 2024. “IM-1 lunar lander tipped over on its side.” SpaceNews.

-

3

Musk maintains that the second explosion is a minor setback, since the next ship will be ready within 4 to 6 weeks. See Musk, E. “Today was a minor setback…” X. See also Musk, E. “It was an upper stage / ship failure tbh…” X.

-

4

Firefly Aerospace. 2025. “Blue Ghost’s shadow seen on the Moon’s surface!...” X.

-

5

SpaceXNow. 2025. “Statistics.”

-

6

SpaceX. 2018. “How Not to Land an Orbital Rocket Booster.” YouTube.

-

7

ARK Investment Management LLC. 2025. “Big Ides 2025.”

-

8

The White House. President Donald J. Trump. 2025. “ESTABLISHMENT OF THE STRATEGIC BITCOIN RESERVE AND UNITED STATES DIGITAL ASSET STOCKPILE.”

-

9

Based on data from Glassnode as of March 7, 2025.

-

10

National Constitution Center. 2025. “The United States Constitution.”

-

11

Carter, N. 2025. “Announcement couldn't have gone better…” X.

-

12

Mazzone, C. and K. Baskar. 2025. “Texas Senate approves bitcoin reserve plan.” KXAN.

-

13

Metz, C. 2025. “A.I. Start-Up Anthropic Closes Deal That Values It at $61.5 Billion.” The New York Times.

-

14

Palazzolo, S. and C. Weinberg. 2025. “OpenAI Plots Charging $20,000 a Month For PhD-Level Agents.” The Information.

-

15

U.S. Department of Labor, Bureau of Labor Statistics. 2024. “EMPLOYER COSTS FOR EMPLOYEE COMPENSATION – SEPTEMBER 2024.”

-

16

Replit. 2025. “Introducing Replit Agent.”

-

17

SWE-bench is a dataset that tests systems' ability to solve GitHub issues automatically. The dataset collects 2,294 Issue-Pull Request pairs from 12 popular Python repositories. Evaluation is performed by unit test verification using post-PR behavior as the reference solution. See Jiminez, C. et al. 2024. “SWE-bench: Can Language Models Resolve Real-World GitHub Issues?” arXiv.

-

18

Dillet, R. 2025. “OpenAI now serves 400M users every week.” TechCrunch.

-

19

According to research conducted by ARK Investment Management LLC, based on data from SimilarWeb as of March 6, 2025.

-

20

Average 1.25 billion daily visitors. Based on data from Similarweb and Google as of the March 6, 2025, calculated on a trailing week basis.

-

21

ARK Investment Management LLC. 2025. “Big Ides 2025.” See section on “AI Agents,” pp. 15-28.