#376: Will AI-Enabled User-Generated Content Undermine The Bargaining Power Of Creatives?, & More

1. Will AI-Enabled User-Generated Content Undermine The Bargaining Power Of Creatives?

The Screen Actors Guild/American Federation of Television and Radio Artists joined[1] more than 11,000 film and television writers on the picket line this month to stage the first strike by writers and actors since 1960. In the sixties, creators and creatives demanded[2] a share in the incremental revenue that big studios were generating from the rise of TV. Today, they have concerns[3] that studios will use generative AI to cut costs and, at the same time, they are demanding higher pay as streaming curtails their participation in residuals.[4]

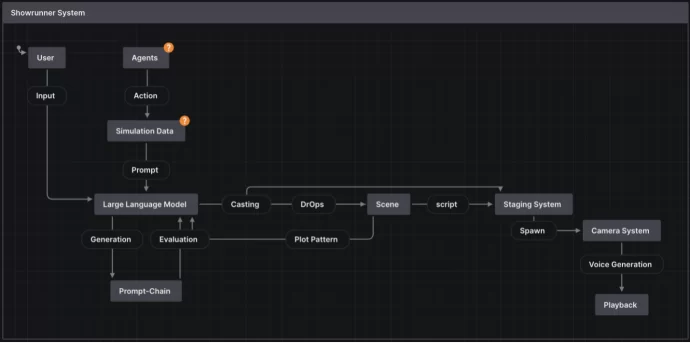

In our view, AI-mediated user-generated content (UGC) could cut content-creation costs dramatically, limiting the bargaining power of creatives on both fronts. Fable Studio’s SHOW-1[5] and Showrunner Agents are illustrative. SHOW-1 is an episodic content-generation platform that combines large language models (LLMs) and image diffusion models, enabling anyone to leverage existing intellectual property (IP) and create derivative video content, as shown below. In this example, users combine a language model and multi-agent simulation to create South Park episodes with characters—or semi-autonomous AI agents—who interact with each other and the environment.

Source: Fabel Studio, 2023 (https://fablestudio.github.io/showrunner-agents/). For illustrative purposes only and should not be considered a recommendation to buy, sell, or hold any particular security.

To create an episode, SHOW-1 takes three steps: (1) converts user input into a language model prompt including the title, synopsis, and a description of major events and scenes; (2) runs the simulation for approximately three hours; and (3) samples up to 14 events to construct scenes and optimize the progression of the plot, as shown below. Notably, users can inject[6] themselves into episodes.

Source: Fabel Studio, 2023 (https://fablestudio.github.io/showrunner-agents/). For illustrative purposes only and should not be considered a recommendation to buy, sell, or hold any particular security.

In our view, these provocative results are signaling a new genre of entertainment: interactive videos that blur the lines not only between video and video games but also between creation and consumption. SHOW-1 could be highlighting a shift in content creation and IP that potentially could disintermediate professional creatives and collapse the cost of new content creation.

As smartphones and platforms like YouTube and TikTok lowered, if not eliminated, barriers to video content creation, professional creatives still were able to capitalize on the quality gap between premium video films and TV shows at one end of the spectrum and user-generated videos like YouTube clips and TikTok videos at the other end. Now that end users can create and distribute AI derivatives of premium video films and TV shows, however, that quality gap could close rapidly.

2. Meta, Microsoft, Salesforce, And Cerebras All Made Exciting Moves In The AI Space Last Week

Last week, Meta launched the next-generation version of its open-source large language model (LLM), Llama2. Available at no cost for both research and commercial use, Llama2 is a stark contrast to close-sourced models like OpenAI’s GPT-4 and Google’s Palm 2. As it eschews OpenAI’s increasingly private development[7] trajectory, Meta seems convinced that the open-source community will accelerate and democratize the development of LLMs. That said, companies with more than 700 million active users will have to license[8] Llama 2, defending it against Meta’s largest competitors.

Meta also is partnering with Microsoft and Qualcomm[9] to optimize versions of Llama 2 on Windows devices and Qualcomm powered smartphones. As a result, it should enhance privacy while lowering both latency and cloud operating costs.

Last week, Microsoft raised eyebrows[10] with a new pricing schedule for Copilot, a Chat-GPT-like product that ~600 Microsoft enterprise customers are piloting. Designed to be an omnipresent assistant with enterprise-grade privacy across Microsoft’s Office Suite and Windows, Copilot will cost $30 per user per month,[11] adding significantly to the monthly $12.50-$57.00 cost per user for most of Microsoft’s existing Office plans.

Salesforce also unveiled pricing[12] for two AI-powered products for sales and customer service workflows, each priced at an average of $50 per user per month. Pricing will vary with usage levels.

Lastly, Cerebras, an AI chip startup building training infrastructure to compete with Nvidia, announced[13] that it is powering the Condor Galaxy supercomputer funded by Abu Dhabi. Cerebras aims to scale Condor Galaxy from 2 to 36 exaflops of computing power and become one of the world’s largest distributed computing networks by the end of 2024. Cerebras’s plan comes fast on the heels of Tesla’s roadmap[14] to deploy 100 exaflops of AI training hardware by the end of 2024. The race for exa-scale computing is underway!

3. Tesla’s Earnings Call Included Details That Some Investors May Have Missed

During its second-quarter earnings call last week, Tesla detailed some important, potential long-term drivers of value creation that Wall Street may have overlooked.[15]

First, Tesla suggested that its next-gen robotaxi is likely to generate “quasi-infinite” demand and the highest units of production per hour of any vehicle in history. ARK’s modeling suggests that global demand for autonomous ride-hail could create an ~$11 trillion[16] total addressable market over the next decade, and that robotaxis could account for more than two-thirds[17] of Tesla’s enterprise value in 2027.

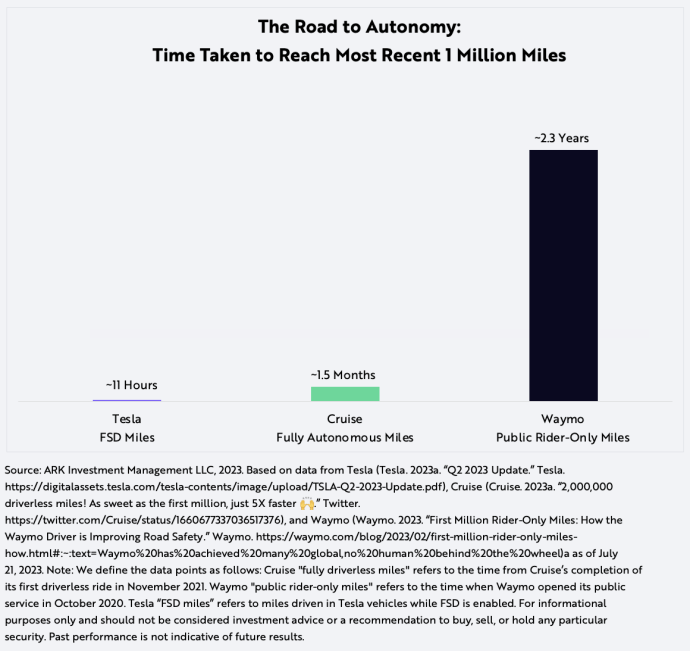

Second, Tesla disclosed early-stage discussions about licensing its Full Self Driving (FSD) software to a major automaker. ARK’s research suggests that very few traditional automakers will be able to create fully autonomous vehicles and that the market will consolidate rapidly as autonomous electric transport takes hold. We believe Tesla has the all-important data advantage now that its fleet is gathering more than 2 million miles of FSD data per day, as shown below.[18]

Finally, Tesla reiterated that NVIDIA cannot supply enough GPUs (Graphic Processing Units) to train the massive amount of data its fleet is generating.[19] As a result, our research suggests that Tesla’s ~$1 billion investment in Dojo, made with Tesla‘s in-house D1 chip, is necessary and will pay off over time.

[1] Whitten, S. 2023. “Actors union joins writers on strike, shutting down Hollywood.” CNBC. https://www.cnbc.com/2023/07/13/sag-actors-union-goes-on-strike-joining-hollywood-writers.html.

[2] Canfield, D. 2023. “Inside the 1960 SAG Strike, From Elizabeth Taylor’s Vacation to Ronald Reagan’s Star-Studded Meeting.” Vanity Fair. https://www.vanityfair.com/hollywood/2023/07/sag-strike-1960-elizabeth-taylor-ronald-reagan-explained.

[3] Galván, A. 2023. “Hollywood actors say strike is a battle for workers’ rights amid AI’s rise.” Axios. https://www.axios.com/2023/07/18/hollywood-strike-sag-aftra-wga.

[4] Robb, D. 2023. “Are Streaming Residuals Being Slashed? As WGA’s Own Data Shows, It’s Complicated.” Deadline. https://deadline.com/2023/04/hollywood-strike-streaming-residuals-wga-producers-1235325130/.

[5] Mass, P. et al. 2023. “To Infinity and Beyond: SHOW-1 and Showrunner Agents in Multi-Agent Simulations.” Fabel Studio. https://fablestudio.github.io/showrunner-agents/.

[6] The Simulation. 2023. “Cartman’s Fatal Attraction.” Twitter. https://twitter.com/fablesimulation/status/1681352917218107392?s=20.

[7] Xiang, C. 2023. “OpenAI’s GPT-4 Is Closed Source and Shrouded in Secrecy.” Vice. https://www.vice.com/en/article/ak3w5a/openais-gpt-4-is-closed-source-and-shrouded-in-secrecy.

[8] Robinson, K. 2023. “Meta’s new A.I. is an open-source breakthrough with fine print to freeze out competitors.” Fortune. https://fortune.com/2023/07/18/meta-llama-2-ai-open-source-700-million-mau/.

[9] Qualcomm. 2023. “Qualcomm Works with Meta to Enable On-device AI Applications Using Llama 2.” https://www.qualcomm.com/news/releases/2023/07/qualcomm-works-with-meta-to-enable-on-device-ai-applications-usi.

[10] Warren, T. 2023. “Microsoft puts a steep price on Copilot, its AI-powered future of Office documents.” The Verge. https://www.theverge.com/2023/7/18/23798627/microsoft-365-copilot-price-commercial-enterprise.

[11] Microsoft. 2023. “Furthering our AI ambitions – Announcing Bing Chat Enterprise and Microsoft 365 Copilot pricing.” https://blogs.microsoft.com/blog/2023/07/18/furthering-our-ai-ambitions-announcing-bing-chat-enterprise-and-microsoft-365-copilot-pricing/.

[12] Salesforce. 2023. “Salesforce Announces General Availability And Pricing For GPT-Powered Features For Sales And Service, Secured Through Einstein GPT Trust Layer.” Field Technologies Online. https://www.fieldtechnologiesonline.com/doc/salesforce-announces-general-availability-and-pricing-for-gpt-powered-features-for-sales-and-service-secured-through-einstein-gpt-trust-layer-0001.

[13] Cerebras. 2023. “Introducing Condor Galaxy 1:a 4 ExaFLOP Supercomputer for Generative AI.” https://www.cerebras.net/blog/introducing-condor-galaxy-1-a-4-exaflop-supercomputer-for-generative-ai/.

[14] Soja, J. 2023. “Tesla Touts A Roadmap For AI Compute That May Help It Achieve Full Autonomy.” ARK Disrupt Newsletter. ARK Investment Management LLC. https://ark-invest.com/newsletters/issue-372/#2-tesla-touts-a-roadmap-for-ai-compute-that-may-help-it-achieve-full-autonomy.

[15] Schultz, C. 2023. “Tesla skids 10% after earnings disappoint; other EV stocks go in reverse.” Seeking Alpha. https://seekingalpha.com/news/3989395-tesla-skids-10-after-earnings-disappoint-and-drags-down-other-ev-stocks.

[16] ARK Investment Management LLC. 2023. “Big Ideas—Autonomous Ride-Hail.” https://ark-invest.com/big-ideas-2023/.

[17] International Monetary Fund Datamapper. 2023.

[18] Keeney, T. et al. 2023. ““ARK’s Expected Value For Tesla In 2027: $2,000 Per Share.” ARK Investment Management LLC. https://ark-invest.com/articles/valuation-models/arks-tesla-price-target-2027/ Tesla. 2023. “Q2 2023 Update.”

[19] Tesla. https://digitalassets.tesla.com/tesla-contents/image/upload/TSLA-Q2-2023-Update.pdf. Tesla. 2023b. “Tesla, Inc. (TSLA) Q2 2023 Earnings Call Transcript.” Seeking Alpha. https://seekingalpha.com/article/4618254-tesla-inc-tsla-q2-2023-earnings-call-transcript.