#375: As AI Costs Decline, Anthropic Is Upgrading Its Language Model, & More

1. As AI Costs Decline, Anthropic Is Upgrading Its Language Model

Last Tuesday, OpenAI competitor Anthropic upgraded its language model, Claude 2, surpassing OpenAI’s GPT-4 in analytic writing and coding. While somewhat weaker than GPT-4 in performing reasoning tasks, Claude 2 has three times the context window of GPT-4, which allows it to analyze documents and engage in dialogues up to 75,000 words. Importantly, Claude 2’s training data are current—up to early 2023—whereas GPT-4’s training predates September 2021.[1]

Anthropic has not changed the pricing for the upgraded model, because its performance has improved so much, a win for AI users.[2] Relative to OpenAI’s services, Anthropic’s were priced efficiently even before Claude 2 dropped costs per token to roughly one quarter those of GPT-4. Thanks to Anthropic’s upgrade, the cost of an AI writing model scoring in the 90+ percentile on the written and verbal portions of the GRE dropped four-fold in just one week.

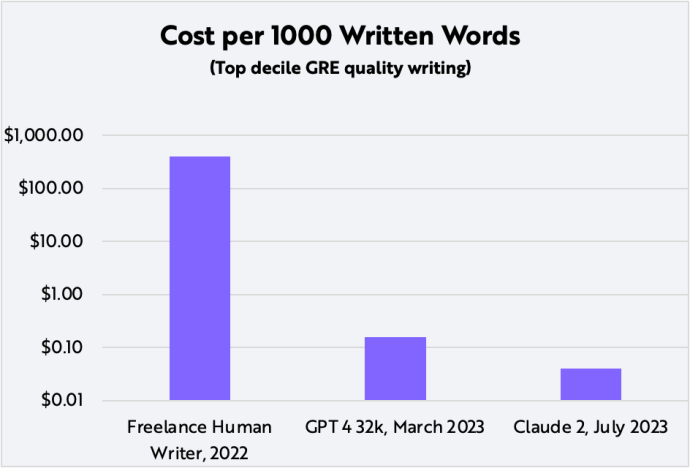

Measured over several years, the cost decline for generating written material is even more provocative. A professional human writer sufficiently talented to score in the 90th percentile on the GRE might charge $0.40 per word to produce copy. Similarly performative language models offered by OpenAI and Anthropic can “write” at a cost of $.16 and $.04, respectively, per thousand words, as shown below. In other words, the cost to produce well-reasoned, coherent written material has fallen ~4-fold over the past week and ~10,000-fold during the past year.

Source: ARK Investment Management LLC, 2023, based on data from Cummings 2023, OpenAI, and Anthropic as of Jul 15, 2023. See Cummings, A. 2023. “Freelance Writing Rates: How Much Should Freelance Writers Charge?” https://www.ashleyrcummings.com/news/how-much-should-freelance-writers-charge. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

2. The Summary Judgment In SEC v. Ripple Labs Brings Welcome Clarity To Crypto

Last week, the outcome of a significant legal case inched the crypto community closer to regulatory clarity. District Judge Analisa Torres issued a summary judgment[3] in the U.S. Security and Exchange Commission’s (SEC) case[4] that accused Ripple of selling $1.3 billion worth of unregistered securities through several methods. Judge Torres’ judgment elucidated which of Ripple’s XRP sales constituted unregistered securities offerings.

Torres did agree with the SEC that Ripple’s early private token sales to institutional investors constituted an unregistered securities offering because they passed the Howey test.[5] They involved “an investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

That said, Torres sided with Ripple in an important way: Ripple’s other token transactions—programmatic sales on public exchanges and for employee compensation—did not meet the Howey test. In other words, in the open market, XRP purchasers did not know they were buying the tokens from Ripple and, therefore, could not have believed they were involved in an investment contract. As for the use of XRP as compensation, Judge Torres ruled that employees were not making an investment.

The judgment clarified further that “XRP, as a digital token, is not in and of itself a contract, transaction, or scheme that embodies the Howey requirements of an investment contract.” In other words, the circumstances in and around the asset offering—not the characteristics of the asset—are the relevant variables.

Torres’ judgment could have significant ramifications for digital asset issuers and exchanges, clarifying how they can and cannot sell or facilitate the sale of digital assets. Major exchanges like Coinbase, Kraken, and Crypto.com already have re-listed the XRP token on their trading platforms.

Importantly, the court’s decision does not set a precedent that other courts must follow. In fact, both the SEC and Ripple are likely to appeal District Judge Torres’ judgement to higher courts.

That said, we believe the judgment will have a positive impact: the judicial system is likely to focus on the facts and circumstances around existing SEC suits, calling into question Chairman Gensler’s views[6] that the “vast majority” of digital assets are securities.

3. Roku And Shopify Expand Their Partnership To Enhance Both The Consumer Experience And Product Sales

In an expanded partnership announced[7] last Tuesday, Roku will offer Action Ads to Shopify merchants who now will be able to advertise and sell products to Roku’s viewers. Because Roku Pay will power the merchant checkout process, viewers can purchase products on Roku’s remote control with just a few clicks. Today, both Walmart and DoorDash use Roku Action Ads.

In 2021, Roku and Shopify partnered[8] to give merchants the ability to build, purchase, and measure connected TV (CTV) ad campaigns. Now, Shopify merchants will have access[9] to additional data focused on customer purchasing trends.

Of course, TV shopping is not new. In 2001 and 2006, respectively, QVC and The Home Shopping Network (HSN) launched[10] “shop-by-remote” services.

Today, however, TV shopping is a completely different experience. Thanks to improved advertising technology and a larger e-commerce ecosystem, connected TV supports more granular targeting methods,[11] freeing advertisers from the wasteful ad campaigns that have clogged linear TV channels. While QVC and HSN focused on individuals who sought out TV shopping channels, CTV advertising is extending TV shopping’s potential to all advertising video-on-demand (AVOD) viewers.

Now, TV shopping has the potential to operate at a scale not possible for QCV and HSN. In 2007, for example, HSN’s gross merchandise value (GMV) totaled $3 billion,[12] a fraction of Shopify’s trailing twelve-month $204 billion.[13] While QVC’s and HSN’s internal buyer and merchandise teams sourced products manually, Shopify’s merchant base determines its product offerings.

On CTV, product diversity and advertising should increase over time as Shopify lowers sellers’ barriers to entry. With more mature technology, now TV could be ready to scale the shopping experience.

[1] See Anthropic. 2023a. “Model Card and Evaluations for Claude Models.” https://www-files.anthropic.com/production/images/Model-Card-Claude-2.pdf; OpenAI.2023. “GPT-4.” https://openai.com/research/gpt-4.

[2] As of this writing, Claude 2 was available at 1.1 cents per 1k tokens for prompts and 3.3 cents per 1k tokens for completions, whereas GPT-4 32k is priced at 6 cents per 1k tokens for prompts and 12 cents per 1k tokens for completions. See Anthropic. 2023b. “Model Pricing.” https://www-files.anthropic.com/production/images/model_pricing_july2023.pdf.

[3] United States District Court Southern District of New York Securities and Exchange Commission. 2023. Case 1:20-cv-10832-AT-SN Document 874. https://www.nysd.uscourts.gov/sites/default/files/2023-07/SEC%20vs%20Ripple%207-13-23.pdf.

[4] U.S. Security and Exchange Commission. 2023. “SEC Charges Ripple and Two Executives with Conducting $1.3 Billion Unregistered Securities Offering.” https://www.sec.gov/news/press-release/2020-338.

[5] The Howey Test refers to the U.S. Supreme Court case for determining whether a transaction qualifies as an “investment contract,” and therefore would be considered a security and subject to disclosure and registration requirements under the Securities Act of 1933 and the Securities Exchange Act of 1934. See also Reiff, N. 2022. “Howey Test Definition: What It Means and Implications for Cryptocurrency.” Investopedia. https://www.investopedia.com/terms/h/howey-test.asp.

[6] Helms, K. 2022. “SEC Chair Gensler Insists Most Crypto Tokens Are Securities — Says ‘The Law Is Clear.’” https://news.bitcoin.com/sec-chair-gensler-insists-most-crypto-tokens-are-securities-says-the-law-is-clear/.

[7] Savitz, E.J. 2023. “Roku Stock Soars on Shopify Deal for Click-to-Buy TV Advertising.” Barron’s. https://www.barrons.com/articles/roku-stock-price-shopify-deal-ads-83e47c97.

[8] Roku. 2021. “Roku Announces New Shopify App for Small Businesses to Easily Launch and Measure TV Streaming Ad Campaigns.” https://newsroom.roku.com/news/2021/09/roku-announces-new-shopify-app-for-small-businesses-to-easily/9jsjpsnr-1632176034.

[9] Roku. 2023. “Roku and Shopify partner to bring checkout to TV streaming.” https://advertising.roku.com/resources/blog/roku-shopify-partner-to-bring-checkout-to-tv-streaming.

[10] D’Innocenzio, A. 2006. “HSN to launch shop-by-remote TV service.” NBC News. https://www.nbcnews.com/id/wbna14346619.

[11] Thompson, J. 2023. “CTV Advertising—What It Is and How It Works.” Madhive. https://www.madhive.com/resources/article/CTV-advertising.

[12] GlobeNewswire. 2009. “HSN, Inc. Reports Fourth Quarter and Full Year 2008 Results.” https://www.globenewswire.com/news-release/2009/03/03/393504/10796/en/HSN-Inc-Reports-Fourth-Quarter-and-Full-Year-2008-Results.html.

[13] Shopify. 2023. “Financials.” https://investors.shopify.com/financial-reports/default.aspx.