#352: AI On Big Tech Earnings: What We Learned, & More

1. AI On Big Tech Earnings: What We Learned

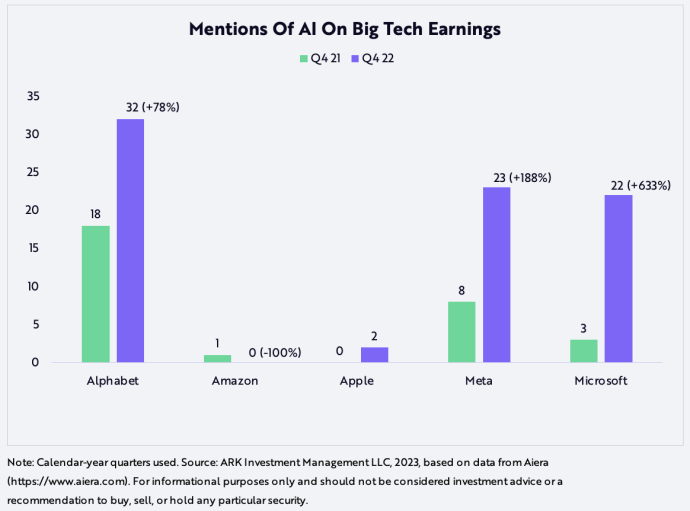

During the past few weeks, big tech earnings reports showcased artificial intelligence (AI), with total mentions of AI during Alphabet, Amazon, Apple, Meta, and Microsoft earnings calls more than doubling year-over-year. Microsoft’s mentions surged 633%, the largest increase, while Alphabet topped the absolute number of AI mentions at 32, exceeding those for Sales or Expenses. Tim Cook answered one question on AI during Apple’s call, while there were no mentions of AI on Amazon’s call.

Microsoft appears to be capitalizing most aggressively on the generative AI model frenzy spawned by OpenAI’s ChatGPT by deploying OpenAI models across its suite of products, including the launch this week of Teams Premium. Last month, CEO Sundar Pichai highlighted Alphabet’s focus on AI in a letter to all employees, calling it a huge opportunity. In Facebook’s earnings call, CEO Mark Zuckerberg expressed how excited he is about generative AI. Tim Cook highlighted Apple’s AI focus on health such as crash detection and electrocardiograms (ECGs) on the Apple watch but may be watching the generative AI market develop before picking more spots and, at the same time, taking a cut of all third-party AI services launched in the App Store. Lensa, for example, charges a fee for generating a wide range of self-portraits from a small sample of personal images.

Perhaps most puzzling in the face of Amazon Web Services’ (AWS) support of many AI services, its quarterly call focused on ongoing optimizations that are slowing its growth, particularly in more cyclical customer cohorts. Could ecommerce be less well-positioned to capitalize on generative AI technology, even with services like Alexa? We do not believe so.

2. 2023 Should Be A Historic Year For Next-Generation Long-Read DNA Sequencing

Next-generation DNA sequencing (NGS) is a textbook example of disruptive innovation. The convergence of breakthroughs in biochemistry, optics, and computation has reduced the cost of sequencing a human genome from nearly $3 billion in 2003 to just $200 in 2023. In ARK’s Big Ideas 2023, we explain how plummeting costs have created new products and services like molecular cancer testing.

In our view, the explosion of NGS innovation is likely to reshape the life sciences landscape, particularly the key players. Although its short-read technology established Illumina (ILMN) as the leader in DNA sequencing, its near-monopoly could diminish as long-read sequencing and novel short-read methods create another wave of discovery and innovation in life sciences.

Last year was a breakout year for long-read sequencing, Nature Magazine’s Method Of The Year. Two pioneers in long-read sequencing, Pacific Biosciences (PACB) and Oxford Nanopore (ONT.L), enabled scientists to sequence the first full human genome, unlocking the 8% that short-read sequencing could not access.

This year, the momentum could be stunning. One of the largest population studies in the US to date, the All of Us Research Program, aims to sequence one million Americans from diverse backgrounds. The project team noted recently that “long-reads have widespread value for establishing the most complete and accurate variant calls” for human genome sequencing, confirming previous small-scale studies and making a strong case for more population-scale, long-read projects.

Two years ago, ARK published its first Wright’s Law model for PacBio long-read sequencing, concluding that costs had declined nearly 30% for every cumulative doubling of data produced. Based on that model, we predicted that PacBio would sequence a clinical human genome for less than $1,000 by 2023. Somewhat faster than we expected, this quarter PacBio will launch the Revio system, incorporating data throughput 15x higher than its predecessor, the Sequel II system, at a list price of $995 per genome.

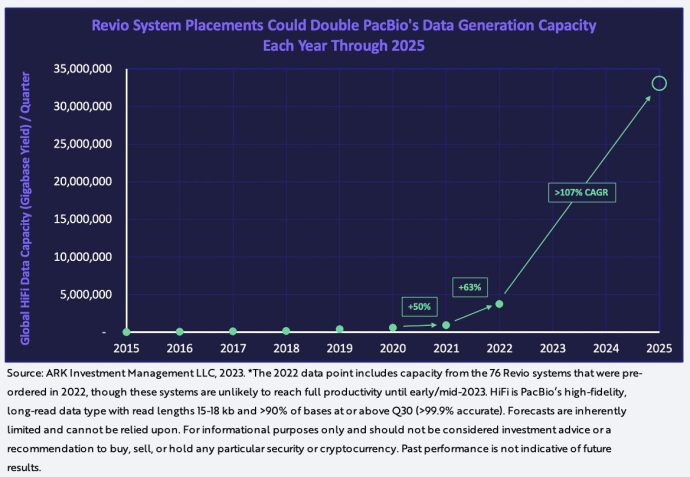

According to our estimates, Revio placements could expand PacBio’s capacity for generating high-quality, long-read data more than 100% per year for the next several years, as shown below. With this capacity, researchers should be able to generate statistically significant studies illustrating the unique benefits of high-quality, long-read data.

3. Regulations Have Prevented Amazon's Drones From Soaring

Last week, news broke that, in its first month of operations, Amazon’s Prime Air delivery program in Texas and California has served only ten households, suggesting that FAA regulations are impeding innovation. Based on a spate of regulations, unlike competitors with lighter vehicles, Amazon cannot fly its drones over roads, cars, or people. In contrast, Alphabet’s Project Wing has delivered more than 300,000 parcels to date in the US, Finland, and Australia.*

As highlighted in ARKs latest Big Ideas 2023, the meal and parcel drone delivery market could scale to $700 billion in revenue by 2030. Hopefully, regulators will help “pave” the way.

*Some reports note that the majority of Wing’s flights occur in Australia.