#347: Year-End Message From Cathie Wood On Behalf Of ARK Invest, & More

1. Year-End Message From Cathie Wood On Behalf Of ARK Invest

We acknowledge that a risk-off market environment has pushed investors back toward benchmarks during the last two years, disadvantaging strategies that focus on disruptive innovation. While innovation solves problems and typically gains traction during difficult times, some companies may be cutting back on research and development and other investments to build cash as a buffer against the fallout from higher interest rates.

Fear of the future is palpable these days, but crisis historically has created opportunities.1 According to the latest BofA Fund Manager Survey, cash levels have not been this high since the 9/11 crisis in 2001, and investors are overweight bonds for the first time since April 2009. In December, the CBOE equity put/call ratio2 surged above 2.0,3 the highest level on record, surpassing the ratios in both the tech and telecom bubble and the Global Financial Crisis. In hindsight, both of those times were terrific opportunities to put funds to work in highly differentiated ways. To the extent investors have reserves of cash to put to work, ARK believes that this time will be no different and that innovation strategies will be prime beneficiaries when equity markets recover.

As you can see from our newsletters, ARK Invest is focused on the commercialization of new technologies during the next five years. In our final newsletter this year, we feature the likely proliferation of early-stage cancer screening tests that will save lives, artificial intelligence as the “assembly line” that will boost knowledge worker productivity dramatically, and the accelerated pace of rocket launches and space exploration thanks to private sector participation and Wright’s Law. As many know, ARK has centered its research on Wright’s Law, which differentiates our strategies. I do not believe that you will find this kind of research in most traditional financial institutions, highlighting ARK Invest’s role as a diversification strategy for asset allocators.

With many thanks for your support of ARK and the innovation that we believe will solve problems and transform the world in profound ways,

Cathie

[1] “Be fearful when others are greedy, and greedy when others are fearful.” — Warren Buffett. “In the midst of every crisis lies great opportunity.” — Albert Einstein. [2] Readers may consult Investopedia for further information on the put-call ratio. https://www.investopedia.com/ask/answers/06/putcallratio.asp. According to Investopedia, the put-call ratio is a measurement widely used by investors to gauge the overall mood of a market. A “put” or put option is a right to sell an asset at a predetermined price. A “call” or call option is a right to buy an asset at a predetermined price. If traders are buying more puts than calls, it signals a rise in bearish sentiment. If they are buying more calls than puts, it suggests that they see a bull market ahead. The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options. A put-call ratio of 1 indicates that the number of buyers of calls is the same as the number of buyers for puts. However, a ratio of 1 is not an accurate starting point to measure sentiment in the market because there are normally more investors buying calls than buying puts. So, an average put-call ratio of 0.7 for equities is considered a good basis for evaluating sentiment. [3] The Chicago Board Options Exchange’s (CBOE) Equity Put/Call Ratio hit 2.03 on December 21st, 2022.

2. Multi-Cancer Screening Tests Could Fetch $500 In Reimbursement

Unlike traditional screening tests, multi-cancer earlier detection (MCED) tests detect many types of cancer from a single blood draw. We estimate that MCED tests will supplement standard-of-care single-cancer tests within the next several years. Although MCED tests could reduce cancer mortality by 15% according to our research, payors are unlikely to approve widespread reimbursement for decades given the need for long-term outcome studies.

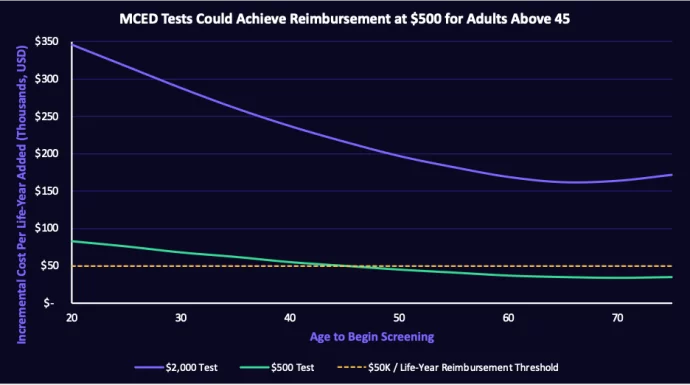

Based on current performance data, payors might reimburse MCED tests priced at $500 for adults aged 45-75, as shown below.1 Based on the 90% reduction in cost-of-goods-sold (COGS) to well below $500 during the past five years, molecular diagnostics companies could generate gross profits and compete for business at that price. Once the Centers for Medicare and Medicaid Services (CMS) set a reimbursement price, MCED vendors probably will opt to increase the performance of tests and stabilize COGS, not drive them lower at the expense of performance.

Source: ARK Investment Management LLC, 2022, data as of December 26, 2022.For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell, or hold any particular security.

[1] Using a standard $50,000 / Life-Year threshold, payers may consider a $500 MCED test cost-effective for adults over 45.

3. Generative AI Is Likely To Have Meaningful Macroeconomic Impacts

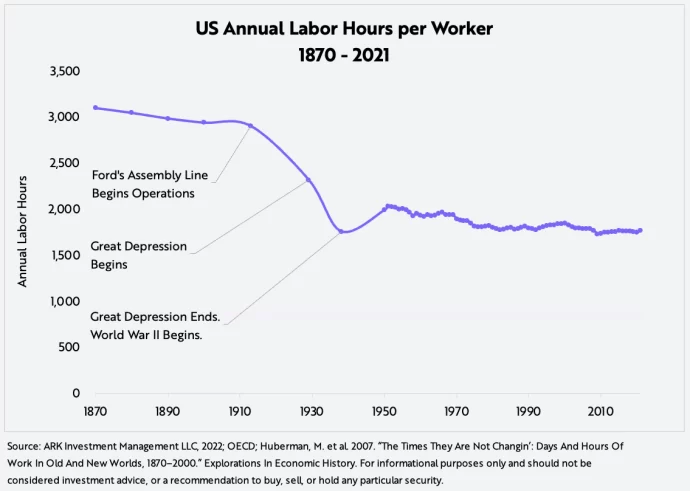

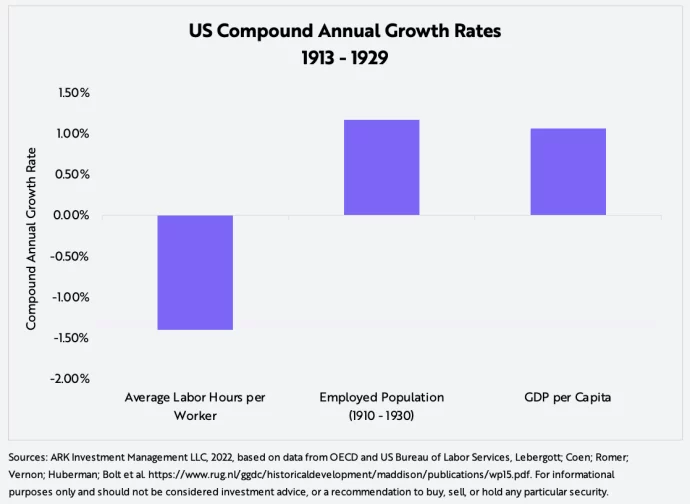

While the US labor force has grown consistently from 12 million in 1870 to more than 150 million in 2021, the number of labor hours per employee has declined at a compound annual rate of 0.37% per year, as shown below. Thanks to technologically enabled innovation, labor is producing more while working less. In the early 1900s, Ford’s pathbreaking concept of an assembly line accelerated the annual decline in working hours per employee more than four-fold to ~1.39% per year until the Great Depression and World War II arrested it, as shown in the second chart below.

This year, generative AI breakthroughs, ChatGPT and Dalle-2, could catalyze another period of accelerated declines in working hours per employee. This time around, AI would be the “assembly line” for knowledge workers, reducing annual labor hours per employee at a rate not seen since the early 1900s.

Concluding that this innovation will cause mass unemployment harkens back to centuries-old reactions to technological disruption. Our research suggests quite the opposite: the market opportunities created by AI have the potential to lead to much higher employment and Gross Domestic Product (GDP), and arguably a better quality of life, despite a decline in average working hours.

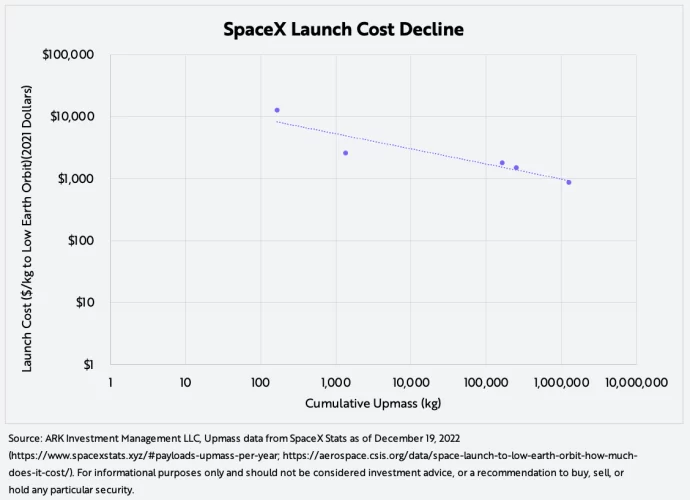

4. Thanks to SpaceX, Rocket Launches Finally Are Submitting To Wright’s Law

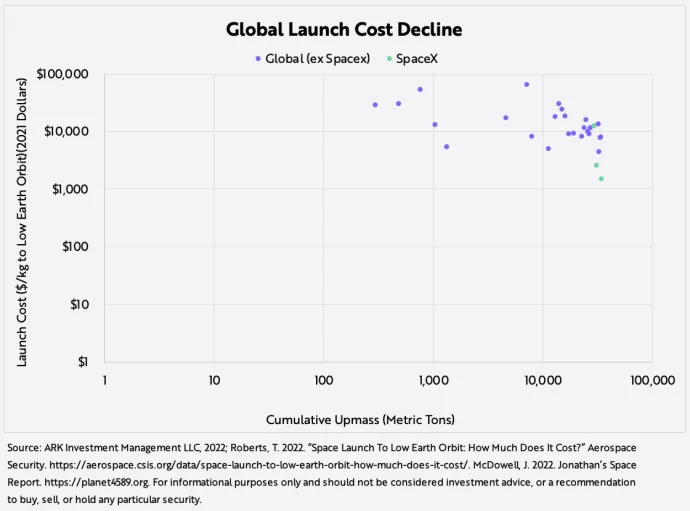

Wright’s Law states that, for every cumulative doubling in the number of units produced, costs associated with a given technology decline by a constant percentage rate. Of course, costs will decline only if companies focus their operations on lower costs. For decades, governments seem to have operated the space industry with little notion that lowering costs might drive demand. Then, SpaceX entered the market, as shown in the two charts below.

SpaceX clearly is delivering on the cost declines predicted by Wright’s Law. More precisely, ARK’s modeling suggests that SpaceX already has lowered the cost per kilogram to orbit by two orders of magnitude, as shown below, or a ~15% cost decline for every cumulative doubling of mass to orbit. Because it drives demand for rocket launches with its Starlink satellites, SpaceX has the economic incentive to optimize and drive costs lower.

As SpaceX develops the Starship rocket, we believe launch costs will continue to fall. Now, the important questions are: How quickly will SpaceX get Starship into orbit, and how soon will SpaceX deploy a reusable Starship?