#341: If Electric Vehicle Prices (EV) Continue Declining, ARK’s EV Forecast Could Be Too Conservative, & More

1. If Electric Vehicle Prices (EV) Continue Declining, ARK’s EV Forecast Could Be Too Conservative

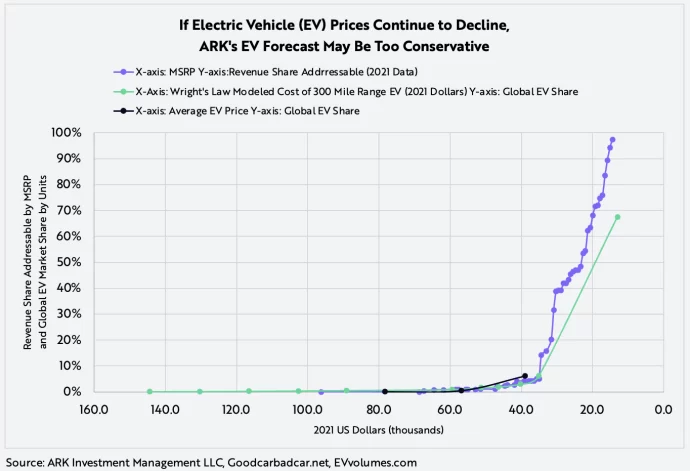

During our brainstorm on Friday, ARK discussed the possibility that our already high-end EV forecast could be too low. The chart below is work-in-progress that offers some perspective on this topic. The purple line depicts the price elasticity of demand for all cars, both gas-powered and electric: as prices drop, auto manufacturers can target a larger share of the market. According to the navy line, as the average price has declined during the last 10 years, EVs have increased their share of the global auto market.

According to Wright’s Law and ARK’s adoption model, as the cost to produce 300-mile range EVs continues to decline, their market share will approach ~67%, or 48 million units, in 2027, as depicted in the green line. This forecast incorporates a decline in total vehicle unit sales due to autonomous vehicles. The gap between the trajectory suggested by Wright’s Law in the green and the history of market share gains in the purple suggests that EVs are likely to capture a much higher share of the market than ARK has forecasted. Instead of 48 million units, EV sales would scale 8-fold from 8-9 million units this year to roughly 67 million in 2027!

That said, several forces could derail the 67-million-unit forecast. Perhaps because of materials shortages or technology issues, EV production will not be able to scale that quickly. Perhaps a severe decline in used car prices will pose more of a competitive threat than we anticipate.

Stay tuned as we continue to finalize our model and forecast.

2. Bitcoin: The Longer The Base, The More Powerful The Breakout (Or Breakdown)

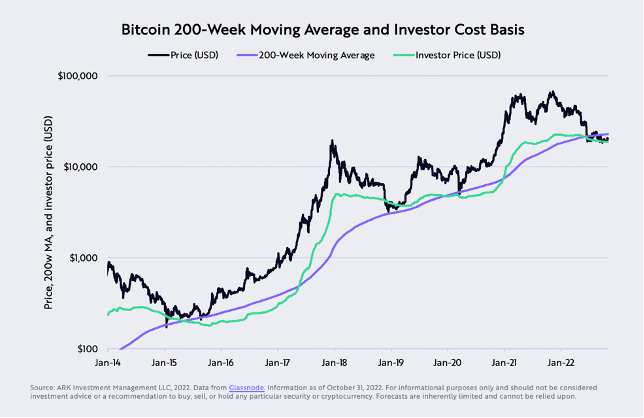

In this month’s edition of The Bitcoin Monthly, we highlight the strong base that bitcoin is developing. For the third consecutive month, as other asset prices have hit new lows, bitcoin has been trading between support at its investor cost basis ($18,814) and resistance at its 200-week moving average ($23,460), as shown below.

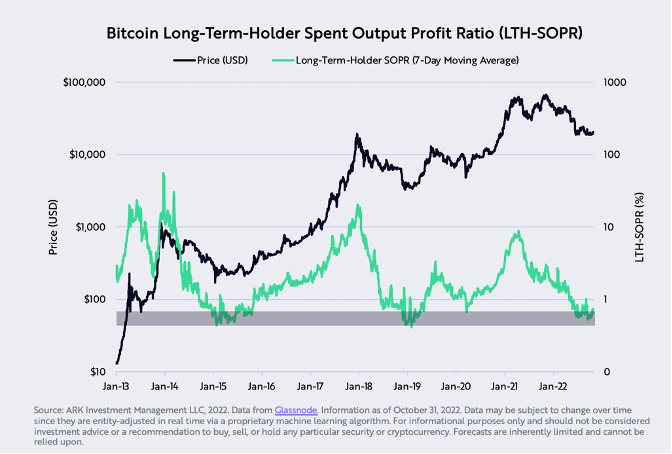

Holders seem to have capitulated, which is typical at or near bear market lows, as shown below. Long-term holder positions are trading at losses proportionate to those at previous market lows. In other words, holders with perhaps the highest conviction are facing losses.

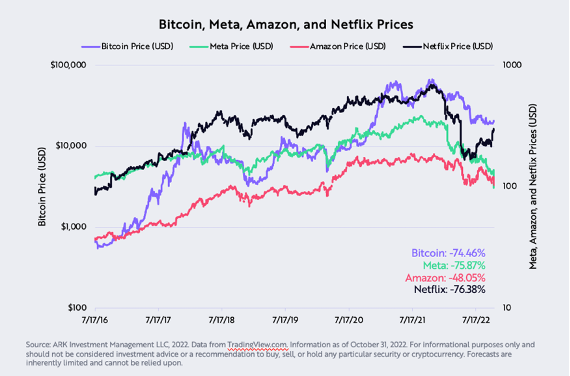

In the current risk-off environment, bitcoin has fared better than several high-profile large-cap equities, as shown below. From their all-time highs, the declines in META (Meta) and NFLX (Netflix) have exceeded that of BTC (bitcoin).

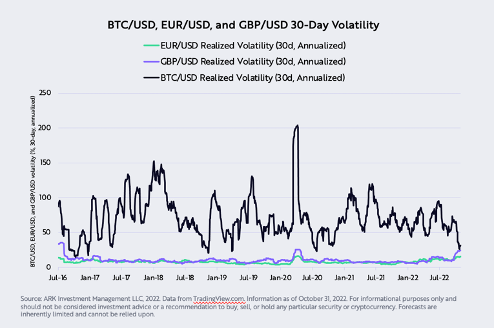

Additionally, bitcoin’s volatility has dropped relative to both equities and major currency pairs during this period of macro uncertainty and USD (dollar) strength, as shown below. For the first time since October 2016, bitcoin’s 30-day realized volatility is roughly equivalent to that of the GBP (British pound) and EUR 9euro). A few months after October 2016, bitcoin began its 20-fold move up to ~$20,000.

Given its recent price action, we wonder if bitcoin will lead the move back to risk-on assets.

For more details, please see The Bitcoin Monthly here.

3. In The Know With Cathie Wood: De-FAANG'd

On episode XXXV of “In the Know,” ARK CEO/CIO, Cathie Wood, weighs in on effects of the midterm elections, today’s economic landscape compared to the 70’s, interest rates, and what separates truly disruptive innovation from those being disrupted. As always, she discusses fiscal policy, monetary policy, market signals, economic indicators, and innovation. We invite you to watch the episode here and we hope you find this monthly series useful.