#340: Meta Is Betting Its Future On The Metaverse?, & More

- 1. Meta Is Betting Its Future On The Metaverse?

- 2. Apple Is Cracking Down On Crypto Features In The App Store

- 3. During The Last Four Years, Automakers Have Made Plans To Increase Electric Vehicle And Battery Investments By Thirteenfold

- 4. ArgoAI Has Dissolved, Highlighting That Autonomous Mobility Is A Difficult Problem To Solve

1. Meta Is Betting Its Future On The Metaverse?

On Thursday, Mark Zuckerberg’s Metaverse ambitions came under fire as Meta reported disappointing third-quarter earnings that sent META spiraling down ~20%. While its core platforms––Facebook, WhatsApp, and Instagram––are solid as measured by engagement and user growth, investors railed against the staggering capital that Zuckerberg is committing to the Metaverse. Moreover, Meta’s Reality Labs division lost $3.7 billion during the third quarter on revenue of only $285 million. Zuckerberg frustrated investors even more by noting that, “Reality Labs expenses will increase meaningfully again in 2023.”

Despite mounting macroeconomic challenges, Zuckerberg seems to be doubling down on his “quest” to control the future of computing. In our view, if augmented and virtual reality (AR and VR) were to become the next mobile and at-home computing platforms, the return on investment could dwarf the $10-15 billion per year that Meta currently is spending to secure leadership in the space. That said, if AR and VR do not scale to the mass-market, Meta’s current pace of investing could be a colossal mistake.

2. Apple Is Cracking Down On Crypto Features In The App Store

In an update to its App Store Review Guidelines last week, Apple introduced changes to public blockchain use that could have significant ramifications for the industry, and perhaps for Apple. The new guidelines state that users should route non-fungible token (NFT) purchases through Apple’s In-App Purchase system and that “apps may allow users to view their own NFTs, provided that NFT ownership does not unlock features or functionality within the app.” In other words, Apple will take a 30% cut on sales while limiting the payment flexibility and, even worse, the functionality of an NFT in-app. In our view, the latter stipulation will discourage communities from enhancing NFT utility beyond trading and status-signaling. How rewarding will a game be if Apple prevents users from unlocking NFT features and functionality?

Apple also banned other unlocking features: “Apps may not use their own mechanisms to unlock content or functionality, such as license keys, augmented reality markers, QR codes, cryptocurrencies and cryptocurrency wallets, etc.”

Apple seems to be targeting emerging forms of decentralized authentication. Services like Sign-In With Ethereum (SIWE), for example, use private keys stored in crypto wallets to let users log into applications––an alternative that we believe has far more security and privacy than login methods depending on central identity providers like Apple, Google, and Facebook. At the same time, Apple also is acknowledging the benefits of such a service with plans to roll out its own private key-based authentication service, Passkey, on Apple hardware. Barring users from signing in and unlocking features/content with an external crypto wallet, Apple seems focused more on locking users into its own hardware platform than offering access to more open, decentralized identity solutions. This crackdown suggests that Apple views public blockchain technology as a threat to its platform. We wonder if it also will preclude Apple from becoming the platform of choice for future blockchain-based innovation and, at the same time, draw anti-trust scrutiny.

3. During The Last Four Years, Automakers Have Made Plans To Increase Electric Vehicle And Battery Investments By Thirteenfold

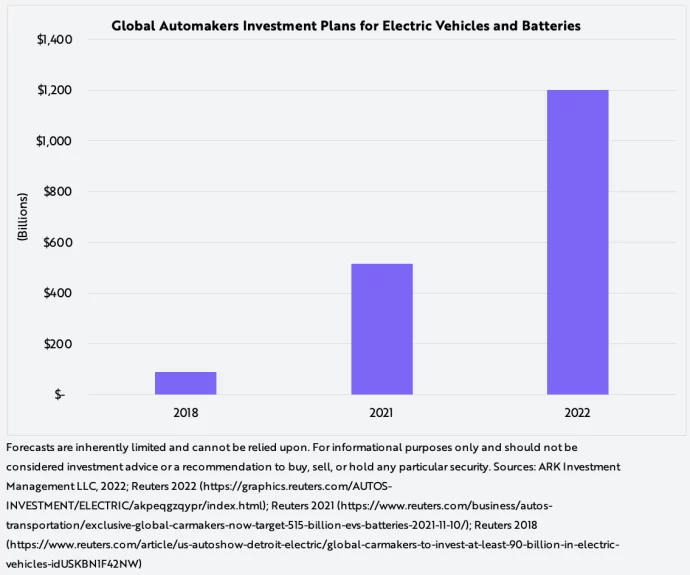

Last week, Reuters released its third installment of a series that tracks automaker plans to invest in electric vehicles and batteries. Since its first analysis in 2018, these investment plans have scaled 13-fold, from $90 billion to $1.2 trillion, as shown below.

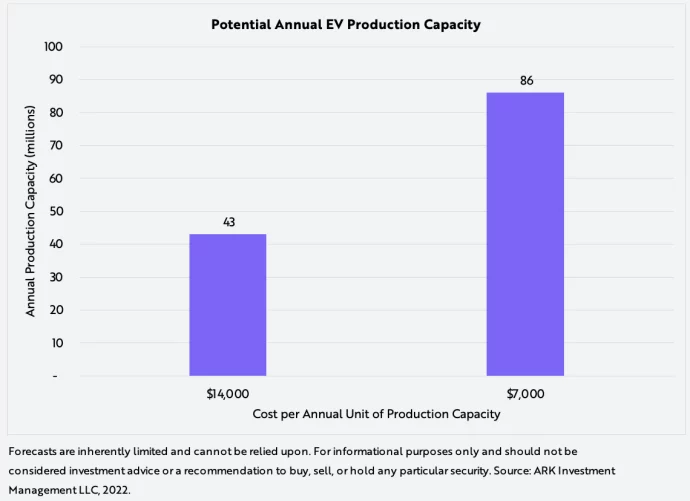

Automakers will focus ~$600 billion of the $1.2 trillion investment on electric vehicles (EVs), which, depending on capital efficiency, suggests that EV production could scale from 8-9 million units this year to a range of ~40 to ~90 million units. According to ARK’s research, as of 2016, the auto industry had invested more than $14,000 in fixed assets per unit produced. At that fixed-cost base, $600 million would provide capacity for ~43 million EVs annually. Previously, Ford suggested that efficiencies could lead to a 50% reduction in capital investment for the production of EVs. Tesla has proved that forecast to be true. As a result, $600 billion could facilitate the production of roughly 86 million EVs per year, as shown below, roughly in line with total global auto production today.

Reuters’ report is focused on global automaker capital spending plans through 2030, but ARK believes that competition will increase investment plans and accelerate timelines. Many traditional auto manufacturers are likely to go bankrupt as the industry transforms––from internal combustion engine to batteries and from human-driven to autonomous.

4. ArgoAI Has Dissolved, Highlighting That Autonomous Mobility Is A Difficult Problem To Solve

Last week, Ford and Volkswagen shut down ArgoAI, their joint venture focused on robotaxis. The parent companies will absorb some but not all of Argo’s employees.

In our view, autonomous taxis will be a winner-takes-most market within specific geographies. To their credit, Cruise and Waymo already have launched commercial services, and Tesla could trump all competitors with the billions of miles of real-world driving data that will be crucial to autonomous mobility. The largest casualty to date, Argo was valued at more than $7 billion two years ago. A winner-takes-most market suggests the high likelihood of more failures. In our view, few companies are likely to create successful autonomous platforms.