#326: A Coinbase Insider Trading Case Highlights The SEC’s Focus On Digital Tokens As Securities, & More

- 1. A Coinbase Insider Trading Case Highlights The SEC’s Focus On Digital Tokens As Securities

- 2. Amazon Takes Another Shot At Healthcare By Acquiring Primary Care Provider, One Medical

- 3. Distributed Bitcoin Mining At Well Sites Could Be A Productive Way To Harness Natural Gas Emissions

- 4. OpenAI Has Released The Commercial Pricing Structure For Open Beta DALL·E 2

1. A Coinbase Insider Trading Case Highlights The SEC’s Focus On Digital Tokens As Securities

Last week, the DOJ and SEC charged a Coinbase employee criminally and civilly, respectively, with insider trading. Formerly a manager in Coinbase’s Asset and Investing Products division, the employee appears to have tipped off his brother and a close friend about not only the cryptoassets that Coinbase planned to list, but also the timing. As detailed in the SEC’s complaint, the listing of the cryptoassets on Coinbase led to higher prices, generating more than $1 million in profits for the perpetrators between June 2021 and April 2022.

Notably, the SEC deemed “at least” nine of the tokens cryptoasset securities based on the Howey test. The Howey test defines an “investment contract”––one type of security––as follows:

- An investment of money

- In a common enterprise

- With a reasonable expectation of profit derived from the effort of others

In this case, most of the SEC’s findings involved tokens issued explicitly to raise funds and support new projects, the third condition listed above. Some of the project founders claimed that listing on secondary trading venues like Coinbase would increase the value of their tokens upon the success of the project.

Also important to the SEC is the extent to which a project depends on a central team of operators. In 2018, former SEC Director William Hinman suggested that, upon reaching sufficient decentralization in the project’s operations, an asset issued originally as a security could be deemed a commodity, citing ether (ETH), the native token of the Ethereum blockchain. The SEC has not endorsed that position. In most cases thus far, the SEC has used enforcement actions to classify digital assets as securities.

In response to this case, Coinbase denied the claim that it listed unregistered securities on its platform, noting that the SEC had reviewed its listing policies without negative comment. It also called for more explicit rules to determine the status of digital assets.

Meanwhile, CFTC commissioner Caroline Pham called for more collaborative and open discussion about the classification of digital assets. She suggested that utility tokens and DAO (Decentralized Autonomous Organizations) tokens be classified as commodities––not securities––putting them under the CFTC’s jurisdiction.

2. Amazon Takes Another Shot At Healthcare By Acquiring Primary Care Provider, One Medical

Last week, Amazon (AMZN) announced its plan to acquire One Medical (ONEM), a primary care provider offering both in-person and virtual health care services for ~730,000 commercially insured members and ~40,000 Medicare beneficiaries in the United States. While the acquisition could help it control healthcare costs for its 1.6 million employees, we are skeptical that Amazon will be able to integrate, scale, or disrupt healthcare beyond its own organization.

In our view, Amazon is likely to run One Medical as an independently branded, brick-and-mortar subsidiary––like Whole Foods––hoping to bundle healthcare services with its Prime offering and/or create unique, in-person experiences by integrating One Medical, Whole Foods, and pharmacy services. In any scenario, Amazon is likely to walk before it runs with One Medical. By scaling the service first across its own employee base, much of it in distribution centers co-located near existing One Medical facilities, Amazon potentially could ramp into healthcare services––a market that “Big Tech” historically has failed to penetrate.

With little success thus far, Amazon has been focusing on healthcare for more than four years. Haven, a healthcare startup launched in partnership with Berkshire Hathaway and J.P. Morgan, closed its doors in 2021 after just three years and, to our knowledge, its other forays––Amazon Care and Amazon Pharmacy––have failed to gain national traction. Because it is acquiring healthcare expertise this time around, Amazon could have more success this time, given One Medical’s stellar track record, strong consumer brand, and thousands of well-compensated clinicians.

Despite potentially powerful synergies, however, cultural differences could limit the odds of success. Unlike many other healthcare providers, One Medical eschews the volume-based fee-for-service system, centralizes administration, and guarantees its providers a stable salary, seemingly delighting clinicians and patients. By contrast, Amazon’s success in delighting consumers seems to have come at the expense of the trust and well-being of its workforce, a risk that could limit the scaling of One Medical’s operations.

In our view, the deal highlights the value of innovative, primary healthcare models. Many Americans do not have strong relationships with primary care providers, so new options that increase access could begin to transform healthcare.

3. Distributed Bitcoin Mining At Well Sites Could Be A Productive Way To Harness Natural Gas Emissions

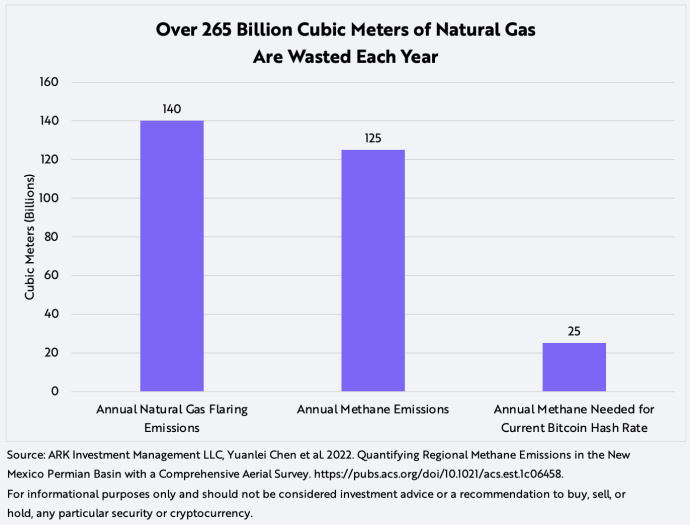

Generating over 265 billion cubic meters (bcm) of natural gas emissions each year, the oil and gas industry wastes vast amounts of energy that Bitcoin mining could harness productively, as shown below. Only 25 bcm, or ~10%, of natural gas emissions would be necessary to support Bitcoin’s current hash rate globally.

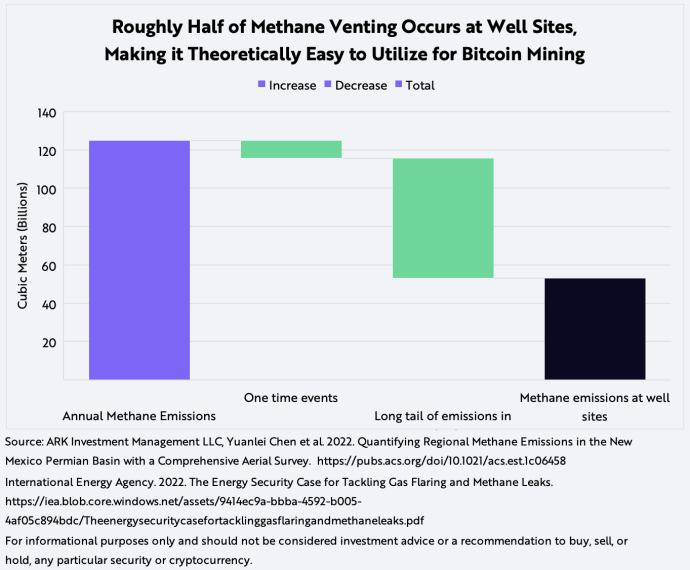

The oil and gas industry will not be able to capture all 265 bcm of emissions and convert them into electricity easily. ARK estimates that only half of all vented methane emissions occurs at well sites, the easiest and most productive locations for Bitcoin mining, as shown in navy below.

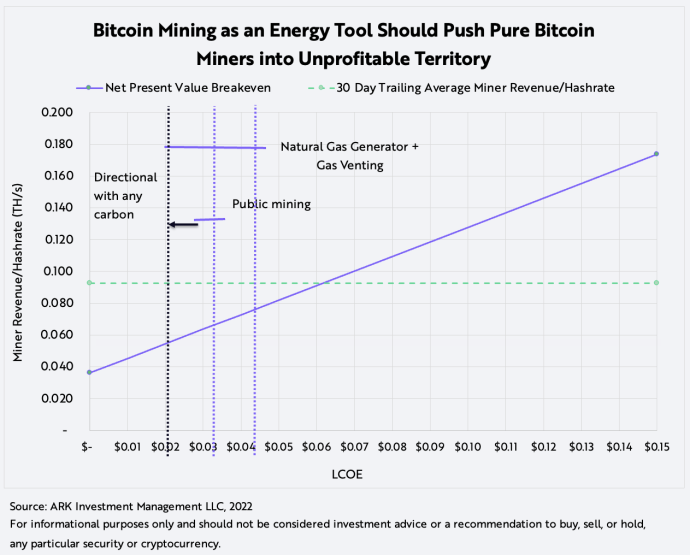

ARK’s research suggests that installing natural gas generators at well sites and using methane that otherwise would be vented could generate electricity at a cost much lower than public bitcoin mining companies pay today. If faced with no supply constraints on mining hardware, Bitcoin miners could harness vented methane and undercut “pure play” Bitcoin mining companies, pushing them into unprofitable territory. If utility regulators were to introduce carbon abatement pricing plans, mining bitcoin with vented methane would become that much more attractive.

While other ways to harness vented methane exist, ARK believes that Bitcoin mining is ideal: it is highly scalable with modular hardware that can be transported to and shifted among operating well sites. We look forward to sharing more research on this topic in a forthcoming series of ARK articles.

4. OpenAI Has Released The Commercial Pricing Structure For Open Beta DALL·E 2

OpenAI’s DALL·E 2 image generation model has enthralled the world with its creative images. This week, the company released the tool in open beta and announced commercial pricing.

Beta users will receive 50 free generations per month and will be able to purchase 115 additional generations for $15. Each generation will produce four images for ~$0.03 per image. According to our estimates, the compute cost to generate an image––the inference cost––is roughly $0.005 per image, suggesting a business model with 80%+ gross margins, in-line with best-in-class SaaS companies.

Notably, OpenAI is not restricting the commercial use of its generated images: “Starting today, users get full usage rights to commercialize the images they create with DALL·E, including the right to reprint, sell, and merchandise.”

Based on a recent ARK survey, to generate moderately complex images on par with those produced by DALL·E 2, human labor would cost ~$150––5.25 hours of human input at an average hourly wage of ~$29. For perspective, with DALL·E 2 OpenAI customers could produce 5,000 images for the price they would pay a graphic designer to produce a single image. In our view, to achieve success in this new world, graphic designers will have to harness powerful, generative AI tools like DALL·E 2 to compete and serve their customers well.