#299: Nuanced Crypto Debates Focus on the Tradeoffs In Blockchain Networks, & More

1. Nuanced Crypto Debates Focus on the Tradeoffs In Blockchain Networks

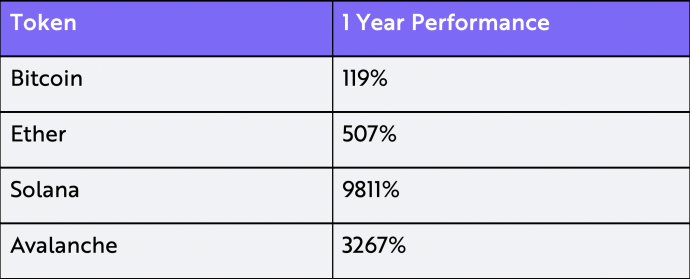

Rhetoric in the crypto space these days is beginning to suggest that Bitcoin is dead and Ethereum is outdated. Some say that newer smart contract blockchains that enable faster and cheaper transactions are the future. The recent token appreciation associated with blockchains like Solana and Avalanche, shown below, combined with endorsements by top crypto funds like a16z, Multicoin Capital, and Three Arrows Capital, seem to support the changing narrative.

For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security or cryptocurrency.

Source: Data sourced from a third party (Coingecko as of 12/17/21)

One of the primary functions of a public blockchain is to maintain an open and verifiable database that does not rely on a central intermediary to process and validate transactions. The information stored in such a database can vary widely––from histories of transfers and account balances, to contracts describing and enforcing financial obligations, to digital property rights for a piece of artwork.

Recent debates focused exclusively on the competitive advantages of newer, faster public blockchains remind us of the Bitcoin scaling debate in 2015. In our view, they are misguided because they overlook the fact that each blockchain optimizes and maintains the integrity of its stored data in a distinctive way, making tradeoffs to achieve the functionality and security appropriate for a specific use case.

Arguably, Bitcoin offers the most profound function of blockchain technology, the foundation for “self-sovereign” digital money. Competing in the “money revolution” requires assurances of data integrity and preclusion from censorship in the face of nation-state level attacks. Benefiting from a “fair launch” and in forgoing functionality like smart contracts, only Bitcoin has optimized for this use case by maximizing decentralization. Often considered a criticism, Bitcoin’s reluctance to evolve its design is, in our view, a feature that provides the stability and consistency required to serve as a true global money.

Smart contract blockchains like Ethereum, in contrast, are competing in a “technology revolution,” best illustrated by the rise of decentralized finance and NFTs. In other words, they offer a generalized, programmable interface for deploying many applications. While censorship resistance remains important, the “technology revolution” requires diversified functionality and higher throughput to accommodate more use cases, often at the expense of the level of decentralization and stability offered by Bitcoin.

There is constant pressure to keep pace with changes in technology. Ethereum’s incumbent status yet pressure to fulfill the Ethereum 2.0 vision and Solana’s breakneck speed yet occasional outages demonstrate how tough the competition is in the “technology revolution.” As the market is deciding the appropriate level of decentralization required for each use case, evolving networks run the risks of centralization and, in our opinion, a reversion to the institutional status quo.

Comparing blockchains without recognizing their distinctive designs, use cases, and value propositions is misleading and counterproductive. Crypto opportunities are evolving in parallel, each requiring different network implementations and design tradeoffs. In our view, the diversity will create competition that will be healthy for the crypto space overall.

2. New Long-Read Sequencing (LRS) Discovery Could Expand the Market for Non-Invasive Prenatal Testing

A recent publication by Dennis Lo et al. demonstrates that long-read sequencing (LRS) could have clinical utility in the non-invasive prenatal testing (NIPT) market. Currently dominated by short-read sequencing (SRS), NIPT is one of the largest and most rapidly expanding clinical sequencing markets.

Because the cell-free DNA (cfDNA) in plasma samples is small, say <200 base pairs (bps), the NIPT market has settled on SRS: if the starting material is small, LRS—which can read fragments in the range of 10k—100k bps—would be overkill. Undercutting the status quo, however, Lo et al.’s use of Pacific Biosciences (PACB, “PacBio”) HiFi sequencing enabled them to discover that long cfDNA (>1k bps) exists at a median percentage of 10.9%, 12.9%, and 22% in the first, second, and third trimesters of pregnancy, respectively. Importantly, the finding suggests that long cfDNA fragments could contain novel, clinically relevant information, a discovery that we believe will expand the NIPT market.

Leveraging their previous work, the authors show that LRS can signal with nearly 90% accuracy whether large cfDNA fragments came from maternal or fetal tissue. The technique relies on a sequencer’s ability to detect both DNA mutations and epigenetic alternations like methylation.1

The ability to differentiate maternal from fetal tissue-of-origin (TOO) for cfDNA molecules should open new markets in the NIPT space. Identifying maternal and fetal inheritance patterns, future LRS-based NIPT approaches could simplify the detection of both de novo mutations and recessively inherited monogenic disorders. Lo et al. also demonstrate that LRS could be used to detect pregnancy complications like preeclampsia.2

Lo et al. provide fascinating insights into long cfDNA biology and proof-of-concept for several LRS-enabled applications within the prenatal setting. While we recognize the challenges of scaling clinical LRS, such as throughput, cost, sample preparation, and consistency, our LRS cost-decline research suggests that most of these barriers could erode rapidly.

[1] Lo et al. utilized PacBio methylation sequencing. We note that Oxford Nanopore (ONT.L) technology also can read DNA methylation.

[2] Alongside other multi-analyte approaches for detecting preeclampsia.

3. Innovation Stocks Are Not in A Bubble: We Believe They Are in Deep Value Territory

In a new blog, we share ARK’s thoughts regarding the volatility of our strategies in recent months. An excerpt is included below, and we invite all of you to read the full piece at ark-invest.com.

Because the global economy is undergoing the largest technological transformation in history, most benchmarks could be in harm’s way. Unlike many innovation-related stocks, equity benchmarks are selling at record high prices and near record high valuations, 26x for the S&P 500 and 127x for the Nasdaq on a trailing twelve-month basis.1 Yet, the five major innovation platforms which involve 14 technologies are likely to transform the existing world order that the benchmarks represent. As a result, we believe “tried and true” investment strategies will disappoint during the next five to ten years as DNA sequencing, robotics, energy storage, artificial intelligence, and blockchain technology scale and converge.

With a five-year investment time horizon, our forecasts for these platforms suggest that our strategies today could deliver a 30-40% compound annual rate of return during the next five years. In other words, if our research is correct – and we believe that our research on innovation is the best in the financial world – then our strategies will triple to quintuple in value over the next five years. Yet, as this year winds to a close, investors seem more interested in “playing it safe” and moving closer to benchmarks that, in our view, are unlikely to generate even average returns during the next ten years. Much like the early years of ARK’s research on and investing in electric vehicles (TSLA) and bitcoin, disruptive innovation seems to be in deep value territory. Based on the last eight years of our research, the opportunities will scale from $10-12 trillion today, or roughly 10% of the global public equity market cap, to $200+ trillion during the next ten years.

For a deeper dive into this blog, please read the full piece here.

[1] Data sourced from a third party (BBG as of 12/16/21 close)