#275: Is Inflation or Deflation the Bigger Risk to (or Opportunity for) Equity and Fixed Income Markets?, & More

1. Is Inflation or Deflation the Bigger Risk to (or Opportunity for) Equity and Fixed Income Markets?

During the last nine months, in response to a V-shaped recovery, global equity markets rotated away from growth stocks toward value stocks. Commodity prices soared, increasing fears of inflation and higher interest rates, while the earnings growth of cyclically sensitive companies offered stiff competition to that of growth companies given the short-term time horizons of most investors in the public equity markets. Dramatizing these dynamics, during the three months ended March the 10-year US Treasury bond yield doubled to 1.74%,1 a record-breaking increase for such a short period of time.

While others extrapolated those trends into the future, ARK has maintained that inflation would prove temporary thanks both to the base effects caused by the price collapses last year and to supply chain bottlenecks that will cause double- and triple-ordering of supplies, a massive inventory overhang, and a commodity price collapse. With the exception of oil, we believe cracks in the commodity markets are becoming clear. During the past six weeks, lumber prices have dropped more than 46% from $1,686 to $897.90 per thousand board feet while copper prices have dropped roughly 12.78% from $4.77 per pound to $4.16.2 We believe oil prices will not be far behind, despite the significant cutbacks in energy-related capital spending, particularly if drivers in the ride-sharing space take advantage of the lower total cost of EV ownership.

In our view, exacerbating the cyclical deflation will be two secular sources of deflation, one good for economic activity and another bad. Please read our latest market commentary (published on May 21st) or view our latest YouTube update (published on June 4th) to learn more about our thoughts.

[1] Source: Bloomberg

[2] Source: Bloomberg. Information as of 6/18/21

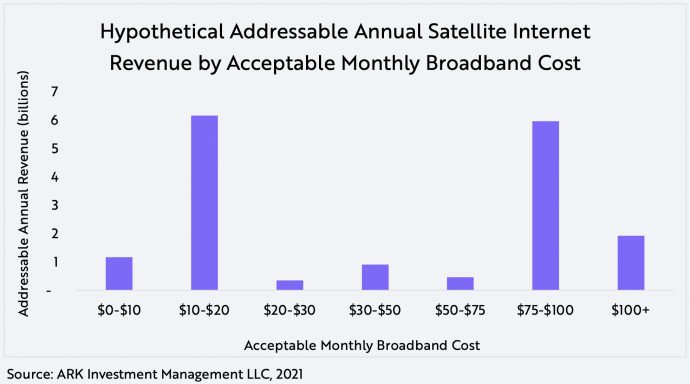

2. How Big is the Market for Satellite Broadband?

For evidence that the new space race is underway, look no further than the satellite broadband market. SpaceX’s Starlink satellites account for half of the roughly 3,000 active satellites orbiting Earth today. Sizing the market opportunity for satellite broadband is complicated by the complexity of the system. Attempting to model the opportunity, ARK makes the following assumptions:

- Bandwidth is the key constraint on the number of users a satellite system can support.

- The system will oversubscribe by a factor of 20 because not everyone is online at the same time.

- Individuals are willing to pay 2% of GDP per capita for broadband internet.

ARK’s research suggests that satellite broadband will evolve into two market segments, creating a global revenue opportunity of roughly $17 billion annually with a constellation of 12,000 satellites, as shown below. Ultimately SpaceX hopes to launch 42,000 satellites and the addressable market could grow to over $40 billion as bandwidth increases with more satellites.1 We believe one customer segment will pay roughly $75-$100 per month, and another $10-$20 per month. Early adopters will be at the high end of the market, giving SpaceX the opportunity to drive costs down the satellite broadband learning curve and setting it up to tap into the low end of the market.

Stay tuned for an open-source version of this model in which you will be able to change its key assumptions and assess their impact on the total addressable market for satellite broadband.

[1] This model does not include the mobility end market, nor commercial customers.

3. Finally, Scientists Have Sequenced 100% of the Human Genome

Recently, thanks to state-of-the-art long read sequencing from both Pacific Biosciences and Oxford Nanopore, the Telomere-to-Telomere (T2T) Consortium, an open community of genomics researchers, published the first complete assembly of the human genome. Unlike the draft sequence the Human Genome Project announced in 2003, the new assembly has no gaps and delivers base-level accuracy several orders of magnitude greater than its predecessor. We recently asked how this new genome assembly might improve genetic testing and received excellent responses from members of the T2T Consortium among others that we plan to summarize in an upcoming piece.

4. Wu Dao 2.0 Is 10x Larger Than GPT-3

When OpenAI announced it in 2020, GPT-3 made headlines for its massive size at 175B parameters. One year later, China’s Beijing Academy of Artificial Intelligence has unveiled a new 1.75T parameter model, Wu Dao 2.0, that is 10x larger than GPT-3. Like Google’s MUM, Wu Dao is multi-modal: it can perform tasks beyond language processing such as image generation and recognition. While its performance relative to other state-of-the-art models needs to be validated, GPT-2 and GPT-3 have shown that performance does increase in tandem with model size, at least for natural language models. Also unclear is whether the model is merely the result of a lab project or an enabler of commercial applications in the near term. Unequivocally clear, however, China believes AI is an arms race, and is investing accordingly.