#248: After the Pfizer/BioNtech Vaccine Shows 90% Efficacy, What Now? & More

1. After the Pfizer/BioNtech Vaccine Shows 90% Efficacy, What Now?

Pfizer/BioNtech’s 90% efficacy means that its vaccine prevented COVID-19 symptoms in 90% of the patients who received the vaccine, in contrast to those who received placebo. For context, the flu vaccine is 40%-60% effective while the measles and chickenpox vaccines are more than 90% effective. Although Pfizer/BioNtech’s data is the result of an interim analysis and could change before approval, their vaccine is likely to meet the FDA’s threshold of 50% efficacy, scoring a win for all mRNA vaccines for the first time in history.

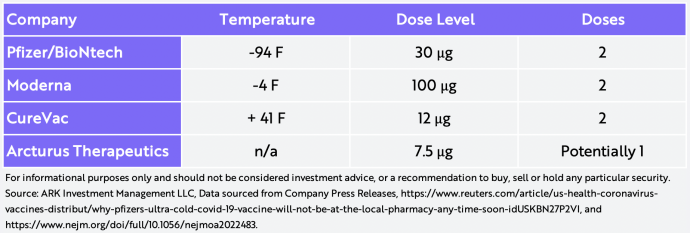

That said, mRNA vaccines are likely to face new challenges including storage temperatures, dosing regimens, manufacturing, and scalability, as illustrated in the table below. Typically, mRNA vaccines must be stored at cold temperatures, creating challenges for global distribution. To meet this challenge, Arcturus Therapeutics has perfected lyophilization, or flash freezing, which could sidestep cold temperature storage.

Dosing levels vary greatly among mRNA vaccines, with Moderna at the high end and Arcturus Therapeutics at the low end. Given toxicity concerns, dosing differences could become important. Most mRNA vaccines are one shot with a booster 30 days later. Although it is trialing different dosing regimens, Arcturus Therapeutics could roll out the only one-shot dose mRNA vaccine which, we believe, could become the best solution.

2. Apple’s M1 Chip Could Unravel Intel’s x86 Empire

In July we wrote that Apple could switch to ARM processors, with significant implications for Intel, the PC industry, and ultimately the cloud. This week Apple released its much-anticipated Mac lineup using a custom-designed M1 ARM CPU that is more powerful than even we expected. Manufactured on TSMC’s 5nm process, the 16 billion transistor chip is up to twice as fast as the Intel processor it will be replacing. For the same workload, the M1 uses 75% less power.

Playing by the classic disruption playbook, Apple started at the low end with a smartphone chip and then improved it enough over time to disrupt Intel potentially at the high end. While the Mac business is small, suggesting that its progress might not impact Intel significantly in the short term, the downstream consequences of Mac’s breakthrough could re-shape the entire computing industry. Roughly a third of developers are devoted to Mac so, in a few years when Apple completes its transition to ARM, the Intel ecosystem could lose a third of its developer base. At the same time, Amazon is deploying its ARM Graviton CPUs aggressively in the cloud.

While the x86 architecture accounts for roughly 99% of all PCs and servers today, we believe Apple’s shift to ARM during the next few years could push Intel’s share to 66%, shattering its business model and ushering in many new opportunities for the rest of the semiconductor industry.

3. China Cracks Down on Internet Platform Businesses in Response to their Monopolistic Behavior

On Tuesday, China’s State Administration for Market Regulation (SAMR) issued the first antitrust guidelines to curb the monopolistic behavior of the country’s internet giants. Among the highlights from the draft guidelines are the following:

- The rules target internet platform businesses.

- Players cannot enter into monopolistic agreements: horizontal, vertical, and hub-and-spoke, among others.

- Players cannot abuse their market dominance by selling below cost, refusing to deal fairly, and treating users and suppliers differently without justification, among other admonitions. Market dominance can be a function of market structure, financial health, and barriers to entry, among other factors.

- The SAMR will investigate concentration amassed illegally. Operator concentration camouflaged inside VIE structures will face anti-trust examination.

While not as newsworthy as the regulatory halt to Ant’s IPO in the prior week, these draft rules are triggering alarms in China’s internet ecosystem. Prior to this draft, China already had prohibited online travel agencies from price discrimination based on big-data, limited tipping on live-streaming platforms, and pulled back on leverage limits in online micro lending. The new draft rules seem even more disruptive.

In our view, the “guidelines” foreshadow two policy changes brewing in China: (1) an end to minimal intervention in the digital economy now that the internet behemoths have accumulated massive market power, and (2) added support for SMBs (small and midsize businesses) and the middle class as China evolves toward a self-reliant, consumption-driven economy.

Along with the halt to the Ant IPO, the new draft rules seem to be sending a strong message: when push comes to shove, no enterprise is above the State.

4. Robotaxis Could Create a Consumer Surplus Equivalent to Roughly 15% of US GDP

Automation often converts non-market activity into commercial activity. The washing machine took unpaid time spent cleaning clothes and monetized it through washing machine manufacturers and dry-cleaning service providers, among other beneficiaries. As food services continue to automate, the non-market activity associated with grocery shopping, food prep, and cleanup is likely to transform into commercial food preparation and delivery services.

According to our research, non-market activity like personal driving accounts for $3 trillion that is not captured in US GDP accounts, or ~15% of GDP. Excluding the time that personal drivers might be able to shift toward leisure activities, robotaxis should be able to deliver transportation-as-a-service for roughly $0.25 per mile, more than 60% lower than the $0.70 cost per mile associated with personally owned cars.

How will users spend the extra time that robotaxis will free up? ARK wouldn’t be surprised if companies like Netflix and Fortnite are prime beneficiaries.