Addressing Concerns During Periods of Market Volatility

Given the recent move in interest rates, intensified trade tensions, and increased market volatility, we would like to share some of our thoughts.

We presented two charts during our monthly mARKet update webinar this past week that offer some perspective.

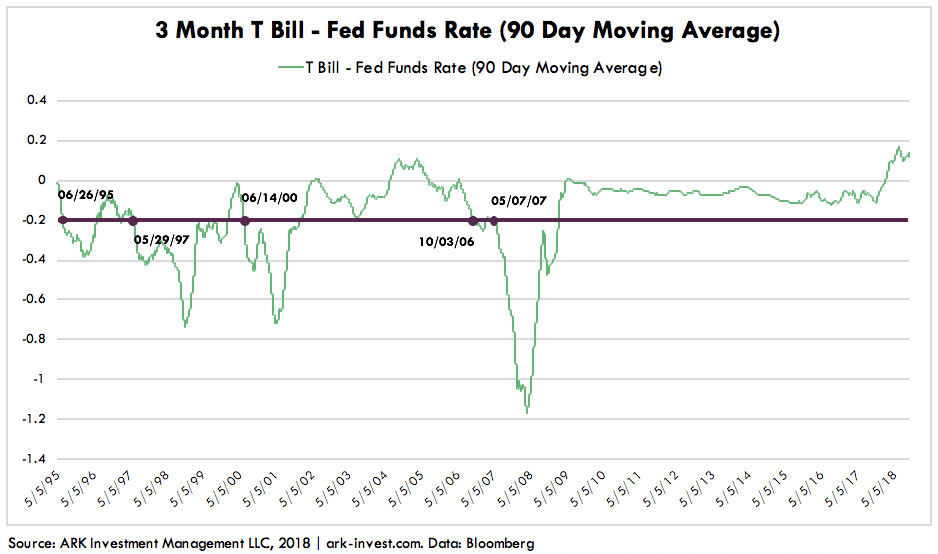

The chart above suggests that Fed policy is not tight. Before or during past crises, the Fed has ignored signals from the three-month Treasury Bill Rate and tightened too much or eased too late and too little, allowing the three-month Treasury Bill Rate to drop 20 basis points (bps) below the Fed funds rate. Today, the Fed seems to be following the economy in setting policy, not trying to get ahead of it or to cut it off. Indeed, the Treasury Bill Rate is nearly 20 basis points above the Fed funds rate, higher than it has been in nearly 25 crisis-prone years.

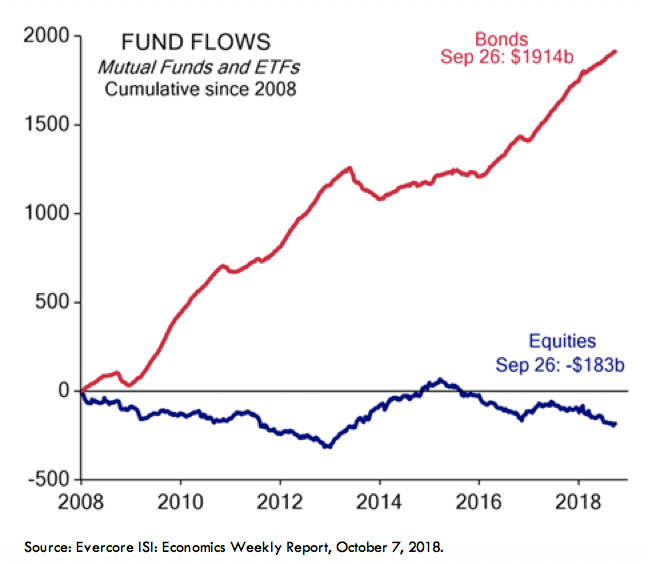

The chart below suggests that, even though equities have not been in a bear market for nearly ten years, funds have not followed the market up. While cumulative bond inflows have totaled roughly $2 trillion, equity flows have been negative since 2008. When, we wonder, will the reallocation from bonds back to equities begin?

Another concern is that the yield curve has been flattening, something we have been anticipating thanks to strong real GDP growth – pushing short term interest rates up – as inflation surprises on the low side of expectations thanks to technologically enabled innovation – holding long term interest rates down. We would not be surprised to see the yield curve invert in the “deflationary boom” that we are anticipating during the next few years, much like it did in the late 1800s/early 1900s, the last period during which multiple innovation platforms were evolving at the same time. During the past 50 years, inverted yield curves have been associated with recessions, so understandably investors are concerned. Based on our research, we are not concerned.

As for trade tensions, we believe that they are diminishing as the US now has deals with Mexico and Canada, our two largest trading partners, as well as South Korea, and our talks with Japan and Europe seem to be making progress. As a result, China has become somewhat isolated. During NikkoAM’s FOREWARD conference in Singapore in August, we learned that China may be willing to buy more US goods and to grant technology companies intellectual property rights but is not willing to limit subsidies to SOEs (state owned enterprises). If so, given my experience and view of the current US administration’s position, I believe that we not only will have a deal but that it will include widespread tariff reductions as well. Another (tariff) tax cut, global in scale, would be very bullish.

As it relates to the technology sector, my experience during periods of uncertainty is that innovative companies gain significant share in tumultuous times. Their shares get hit disproportionately in the early stages of a correction because they tend not to be big index players, but they recover much faster than many of the value traps that populate the traditional indexes in which investors seek safety. A good example in 2008-10 was Salesforce.com (CRM) which was not in most broad-based indexes. Chief Technology Officers at that time were told to cut their budgets 20-30% so they were forced to do things differently: they moved away from the enterprise license/maintenance model to “pay as you go”, the software as a service model. While tech spending dropped 20%+, CRM’s worst quarter for revenue growth was +20%![1] Its stock got hit hard in the early phase of the market’s decline, but it came out flying. Truth does win out once the emotional reaction (and the race back to benchmarks) ends.

During periods of market volatility, investors should concentrate their portfolios toward their highest conviction names, as “babies are thrown out with the bath water”. Investors should pick up the “babies”.