Every day enough data is added to the world’s digital universe to fill 1.45 billion Apple [AAPL] iPhone 6s. Yet, lots of data will simply remain a pile of 1s and 0s, eventually dissolving into the ether, unless it’s analyzed and turned into actionable, useful data. The uses of this data are nearly infinite, from optimizing quick delivery of a package to predicting voting trends from a sea of Twitter [TWTR] feeds.

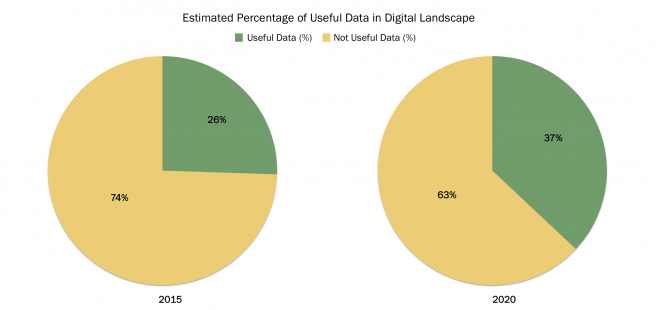

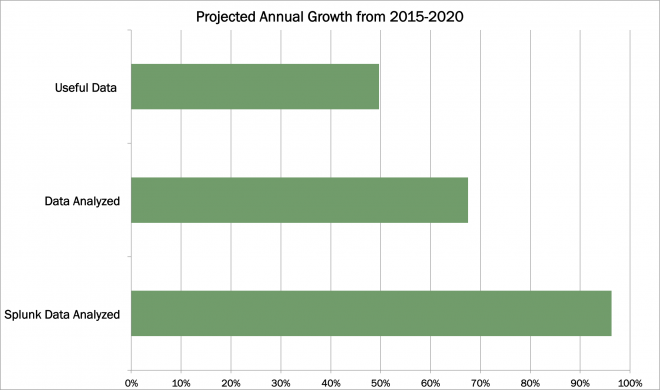

Useful data is a subset of the digital universe. Currently, this subset stands at a quarter of all data, and will grow to 37% by 2020, according to an ongoing joint study by EMC and the International Data Corporation (IDC).

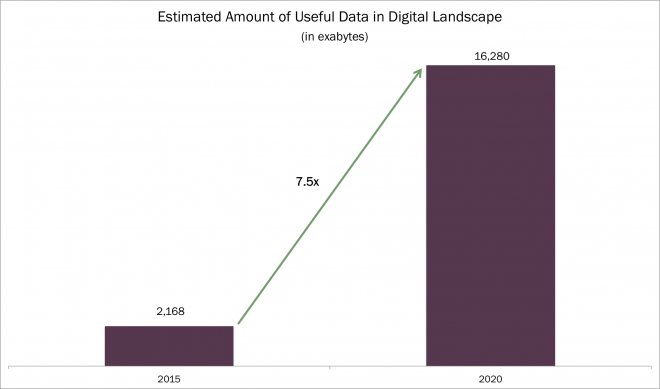

As it increases share in a rapidly expanding universe, useful data is in the process of exploding. Between 2015 and 2020, useful data is expected to grow 7.5 fold, as shown below.

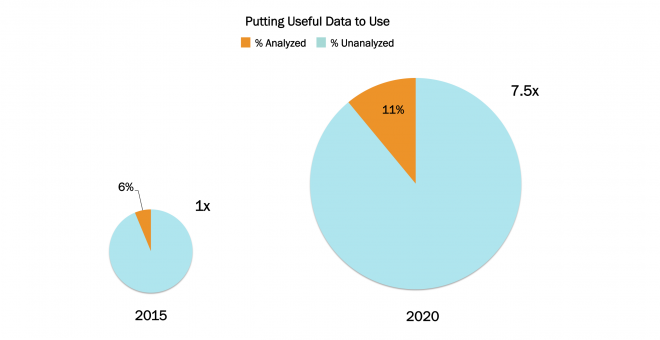

The opportunity to derive insights from rich data is similarly evolving rapidly. Yet, an overwhelmingly large proportion of useful data is left unanalyzed for lack of affordable hardware and software sophisticated enough to ingest, store, and analyze the volume, variety and velocity of data.

As the graph above shows, analyzed data is gaining share because companies recognize the value of useful analytics. Consequently, the big data start-up space is growing rapidly. Hortonworks [HDP] and New Relic [NEWR] made headlines with IPOs at the end of 2014, while companies like MapR and Cloudera are considering their own offerings. Splunk [SPLK] has been a leader in Big Data since going public in 2012. The amount of data Splunk analyzes is likely to grow almost twice as fast as is useful data, as shown below.

Splunk’s positioning as a broad yet powerful analytics tool for machine-generated data is driving growth as devices proliferate. Splunk’s combination of ecosystem partners, its thriving app-store, and integration into various aspects of a company’s operations creates a sticky platform. Splunk is increasing its market share despite charging a 10 fold price premium per gigabyte analyzed, a testament to the value of the company’s platform and the return on investment (ROI) it generates for customers.

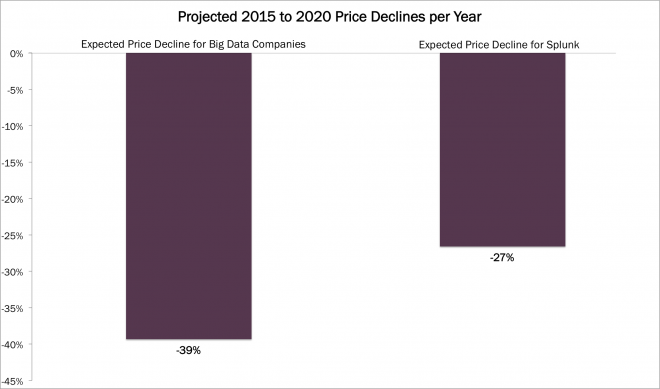

Splunk is riding down the technology cost curve, providing an increasingly valuable service at lower price points. Though Splunk has cut list prices by roughly 25% annually over the last few years, revenues have grown 45-80% per year. Splunk will continue to increase revenue despite falling prices in part because its expected price erosion should be less severe than other Big Data companies.

Taking into account projected pricing and the rapid increase of data analyzed, Splunk’s addressable market will be in the hundreds of billions of dollars by 2020. Its revenue and market share growth, despite premium pricing, speaks to the value of its platform. Splunk is on pace to surpass $2.5B annual revenue in 2020, a five fold increase above its 2015 projections, while only penetrating 1% of its addressable market.