While technology stocks typically make up the top holdings of environmental, social, and governance (ESG) focused funds, does technology really enable a sustainable future? Electricity and the internal combustion engine are two of the most transformative technologies in the last few centuries, but they also are two of the greatest sources of greenhouse gas emissions. In 2017, for example, transportation and electricity accounted for roughly 57% of greenhouse gas emissions in the US. That said, of course technology is an important part of the solution. Indeed, since its invention in 1800, the battery has been on a slow but steady trajectory of improvement and we believe it now stands at a tipping point, ready to offset much of the emissions from transportation and electricity.

If consumers were motivated primarily by environmental issues, they already would have adopted electric vehicles (EVs) in a big way. EVs have been around for more than 100 years and emit the equivalent of 4,350 pounds of carbon dioxide (CO2) per vehicle each year, less than half of the 11,400 pounds from the average gas-powered car. Because of their cost, consumers have not gravitated much toward battery powered vehicles, until now. Battery costs have declined to such an extent that the price of an average EV should drop below that of an average gas-powered car within the next two to three years.[1]

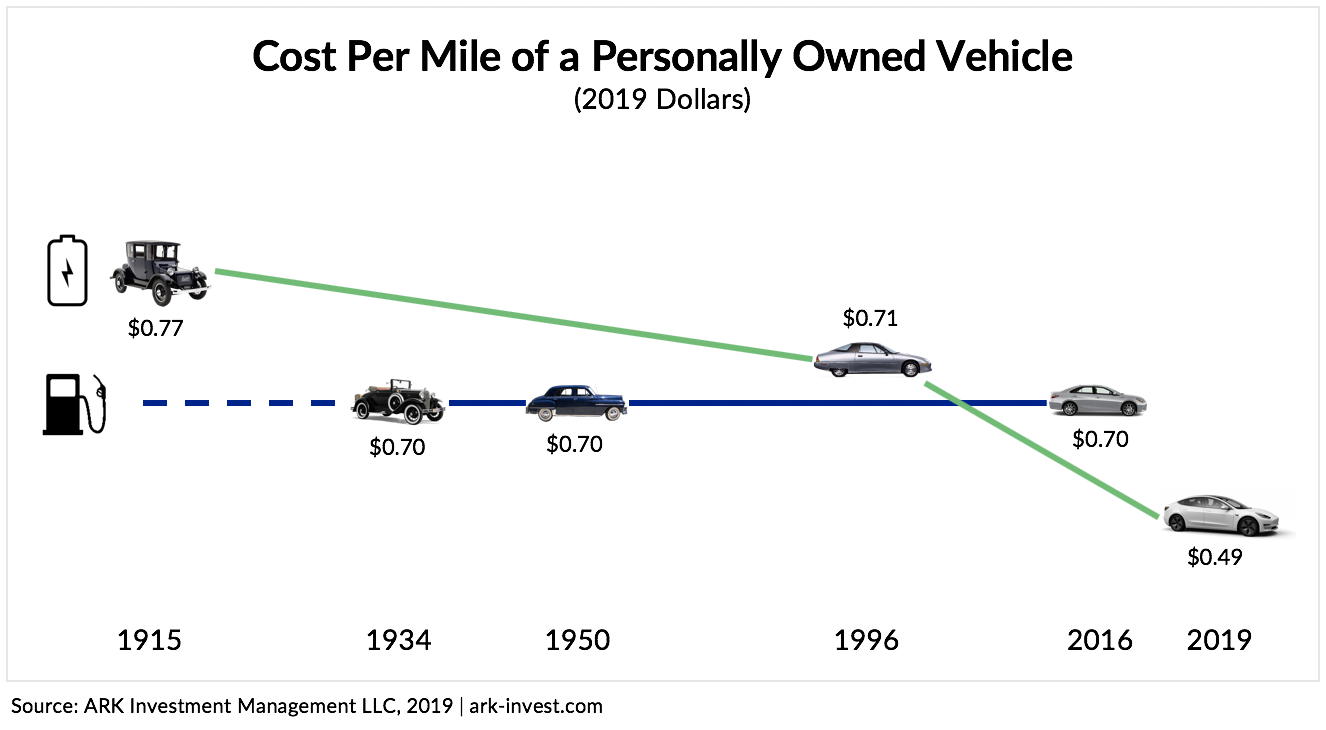

According to Wright’s Law, for every cumulative doubling in production, costs tend to decline by a fixed percent. Because the internal combustion engine is a mature technology, the cost to drive personally owned gas-powered cars has been stable for more than 75 years at roughly $0.70 per mile, adjusted for inflation, as shown below. Meanwhile, thanks to battery cost declines, the cost to drive a personal EV has been dropping every year, suggesting not only that EV prices will drop below gas-powered vehicle prices in 2022 but also that they will continue to fall thereafter. In fact, according to ARK’s research, EVs already are more competitive on a cost-per-mile basis despite their higher upfront costs, as also shown below, thanks not only to lower operating costs but also higher expected resale values. The tipping point for demand should occur when EV sticker prices drop below those of like-for-like gas-powered cars.

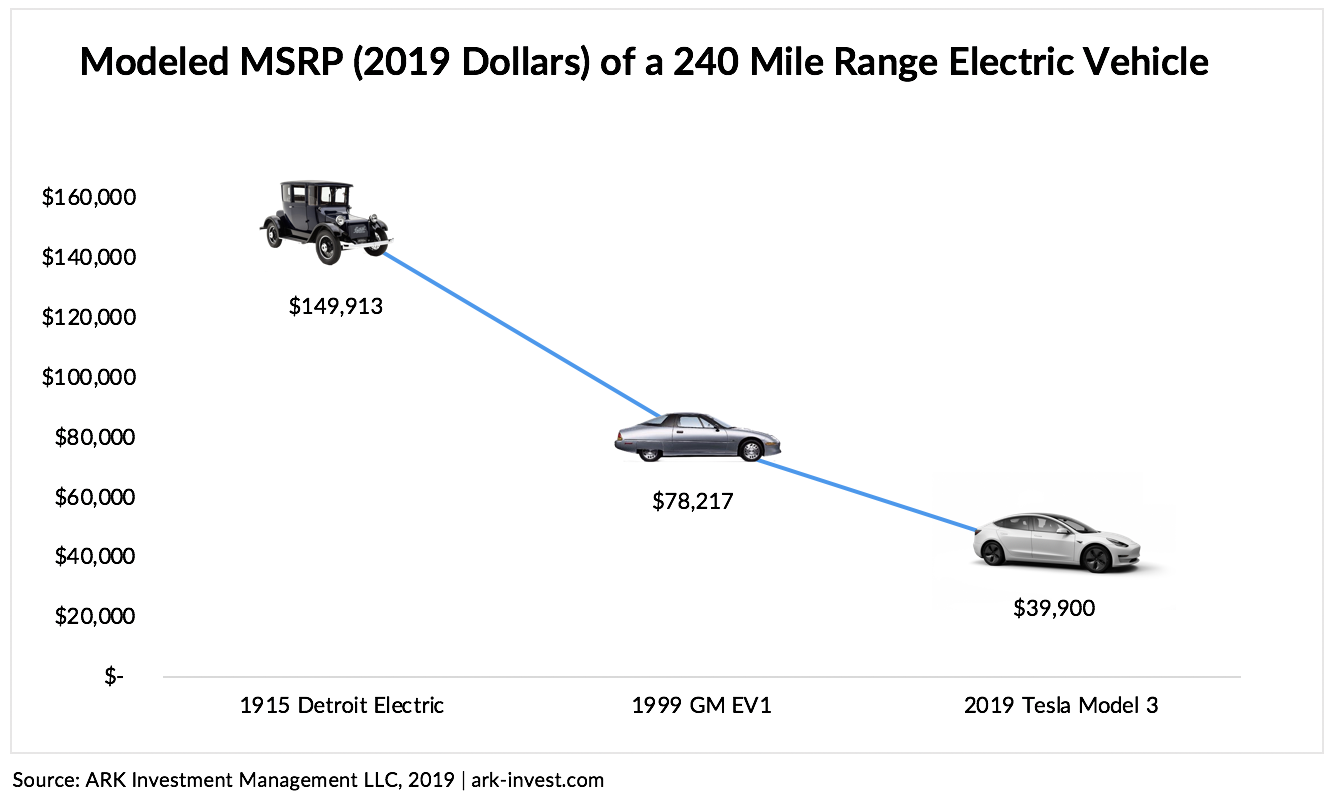

Battery cost declines are particularly important to sticker prices because the battery pack is an EV’s largest cost component, accounting for roughly 20-30% according to ARK’s research. Thanks to an acceleration in battery pack cost declines, the upfront cost of an electric vehicle has started to drop at a faster pace. The inflation adjusted price of the average EV has been cut in half twice within the last century, first from roughly $150,000 for the Detroit Electric in 1915 to $78,000 for the GM EV1 in 1999, and then to $39,000 for the Tesla Model 3 this year, as shown below. The first halving took 84 years and the second only 20. According to ARK’s research, the sticker prices of EVs will be comparable to those of gas-powered cars by 2022, causing a nearly 20-fold increase in global EV sales from roughly 1.5 million last year to 26 million in 2023, at which point they will account for 30% of all auto sales.

Even at high adoption rates, EVs probably will not dominate the installed base of autos globally for 15 years. That said, autonomous vehicles are likely to be powered primarily by electric drivetrains and should increase their share of miles traveled because they will be less expensive and more convenient than personal cars. We believe that when they debut in the next two to three years, shared autonomous vehicles (SAVs) probably will proliferate quickly, as did ridehailing just for its convenience, and will account for more than 50% of total miles traveled in fewer than 10 years. Even if the number of EVs on the road were to remain constant at today’s levels, the shift to SAVs would increase their share of vehicle miles traveled, accelerating the decline in emissions from the transportation sector and marking the peak in oil demand.

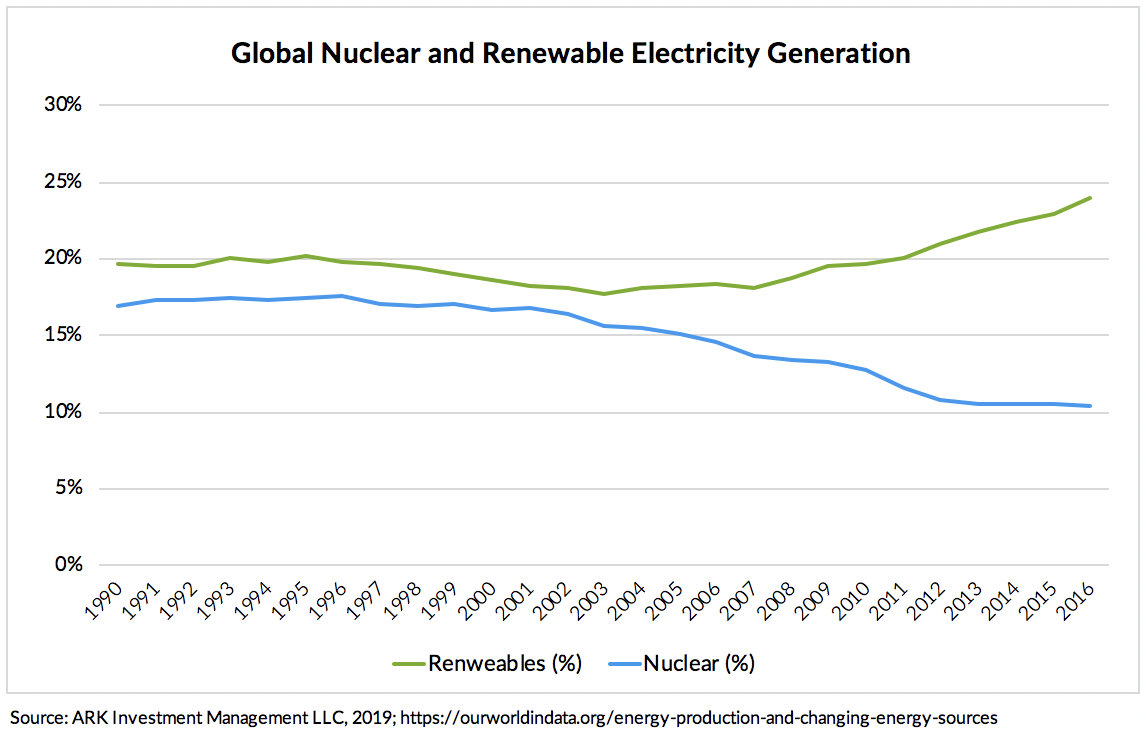

Batteries have the potential to reduce emissions even further as they transform electricity generation. Renewables tend to capture the headlines, distracting from other important trends impacting carbon emissions. As a percent of total electricity generation, for example, renewables have done little but offset nuclear power, another low source of emissions, for the past 15 years, as shown below.

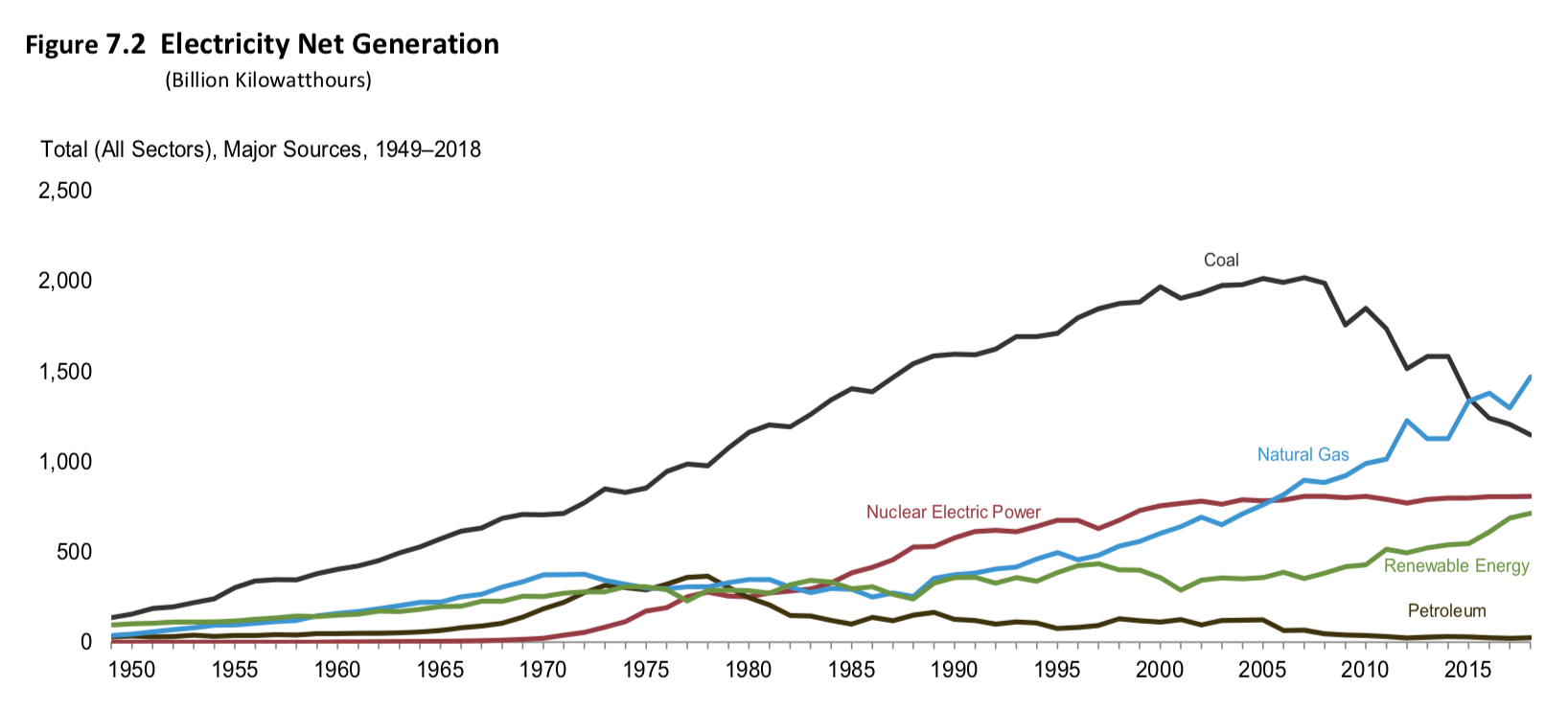

A second trend, particularly noticeable in the US, is the substitution of natural gas for coal in electricity generation, as shown below. While more environmentally friendly than coal, natural gas is not as clean as renewables. That said, utility scale energy storage– massive batteries – should curtail the growth of natural gas plants and remove underutilized and/or inefficient generation.

Source: https://www.eia.gov/totalenergy/data/monthly/

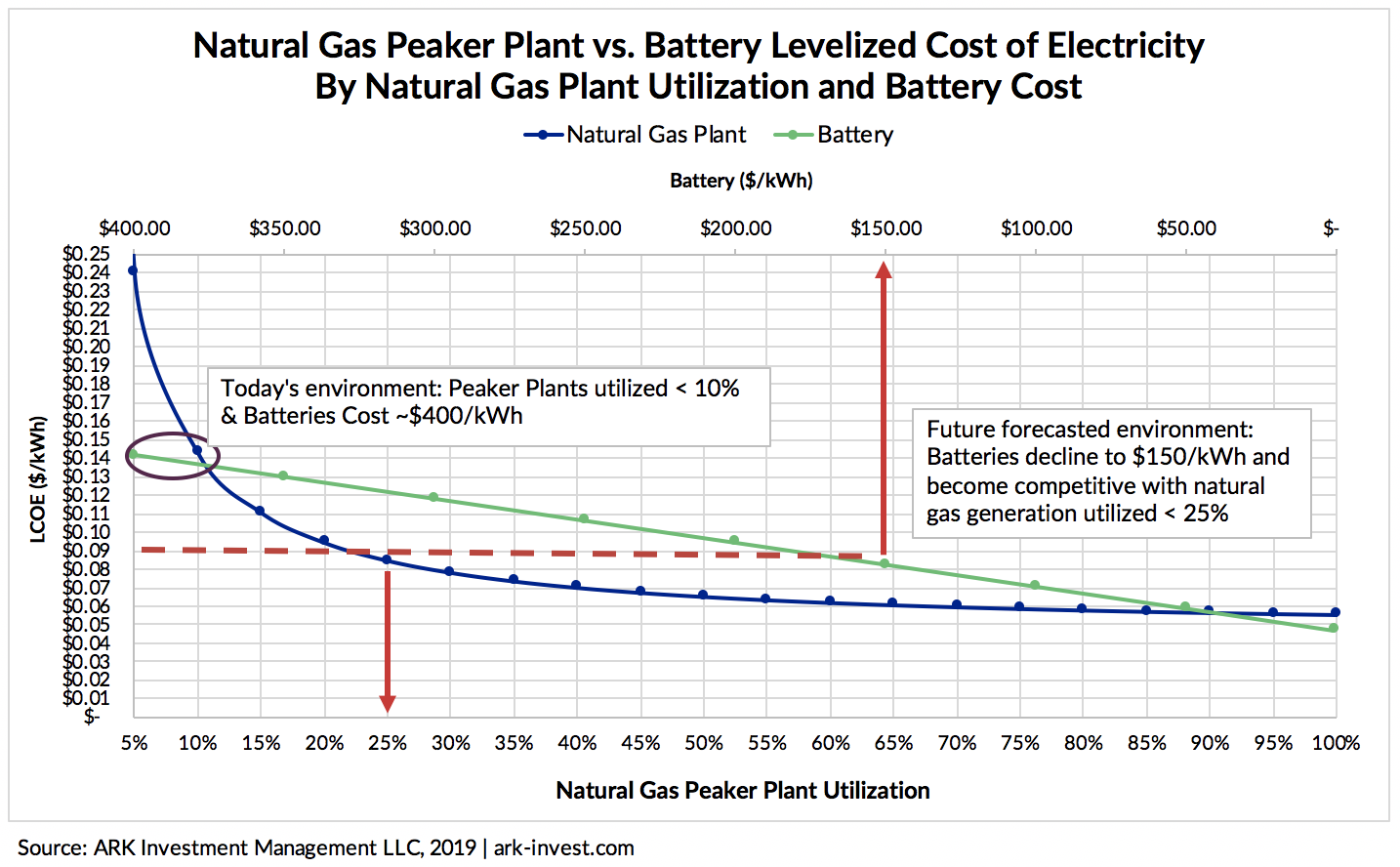

The chart below compares the cost of electricity generated from natural gas peaker plants to the cost of that from battery-based energy storage, highlighting two scenarios. The brown circle depicts the scenario we face today: the average natural gas peaker plant is utilized ~10% of the time in the U.S. resulting in a levelized electricity cost of ~$0.14/kWh.[2] The red lines show ARK’s forecast: utility energy storage costs should drop from $400/kWh to $150/kWh in the next five years, pushing the cost of electricity down by roughly 30% to ~$0.09/kWh and undercutting natural gas plants that operate 25% of the time or less.[3]

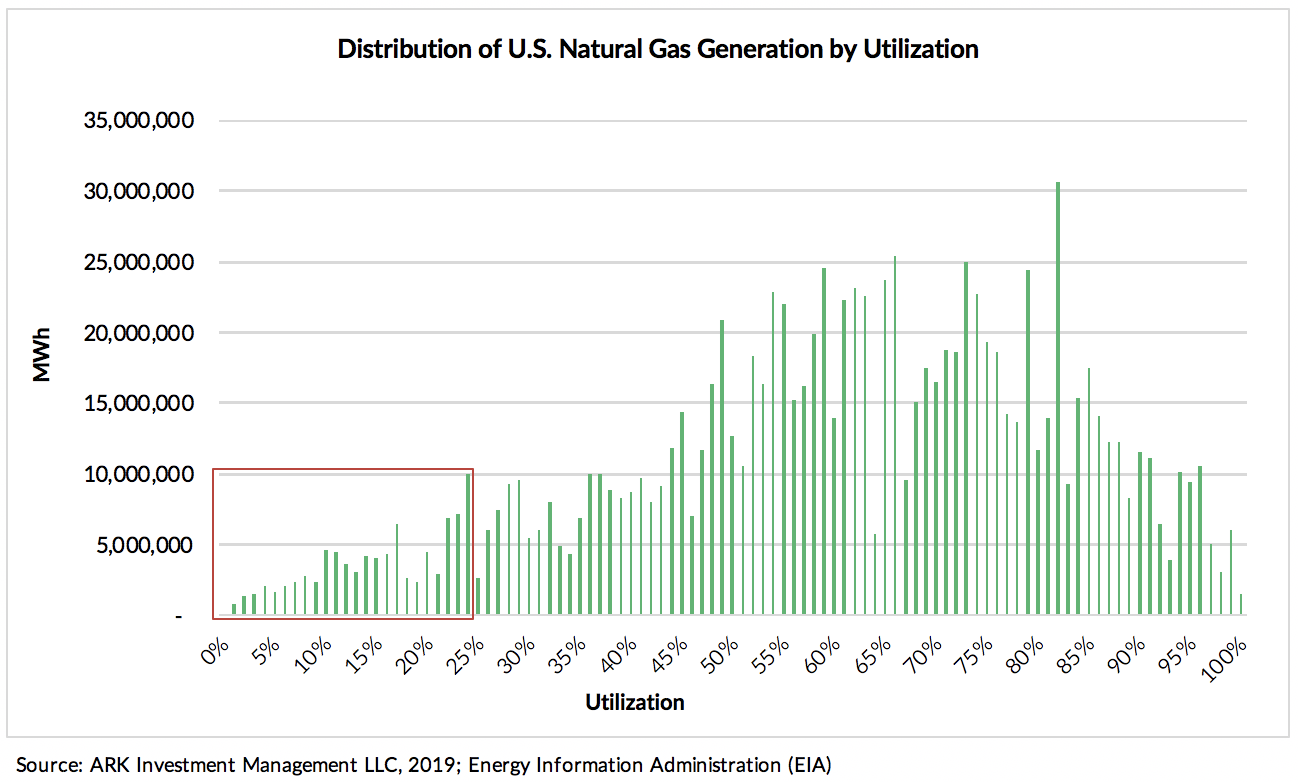

Energy storage solutions already are competing for peaker plant additions. While the average utilization of natural gas plants in the U.S. is roughly 55%, many are on line less than 25% of the time, as shown in the chart below. According to ARK’s research looking at resources utilized less than 25% of the time globally, just 5,000 gigawatt hours of storage capacity could replace all of the underutilized facilities– whether powered by natural gas, coal, or liquids. Replacing all underutilized generation with energy storage would reduce carbon emissions from electricity generation by roughly 1.3 gigatons, or 9.5%, annually. For perspective, Tesla’s utility storage goal is up to 1,000 gigawatt hours, which would put it at 20% of that global goal.

We believe that as the vehicle fleet grows increasingly electric, the transportation and electricity sectors will begin to converge, both cutting emissions. The pace of this change seems to be accelerating. During the first half of 2019, for example, over 60% of trade-ins for the Tesla Model 3 were non-luxury vehicles,[4] suggesting that owners may be internalizing the lower total cost of ownership and expanding the size of the premium market. At the same time, PG&E is planning the world’s largest battery deployment instead of investing in natural gas plants, and GE is shutting down an uneconomic natural gas plant 20 years early. While the battery will not remove existing greenhouse gas emissions from the atmosphere, it could play an outsized role in curbing their growth as it transforms transportation and, along with renewables, reorganizes the grid and the generation of electricity.