Given its promising performance specs, resistive-random access memory’s (RRAM) potential is provocative in the information storage space, a segment of the technology market historically rife with disruption. While easy to assert the inevitability of disruption, more difficult is to determine the timeframe within which RRAM will take meaningful share.

Storage is one of the largest segments in the technology sector. In 2013, the global flash memory and hard-disk-drives (HDD) markets totaled $30B and $33B respectively. By 2018, each sub-segment is likely to hit $44B (flash, HDD), representing growth rates of 8%, and 6%, respectively. RRAM is unlikely to impact those growth rates meaningfully, though it will sow seeds of eventual disruption. As with previous disruptions in the storage market, RRAM will first grow by enabling applications that are not possible with existing low cost technologies.

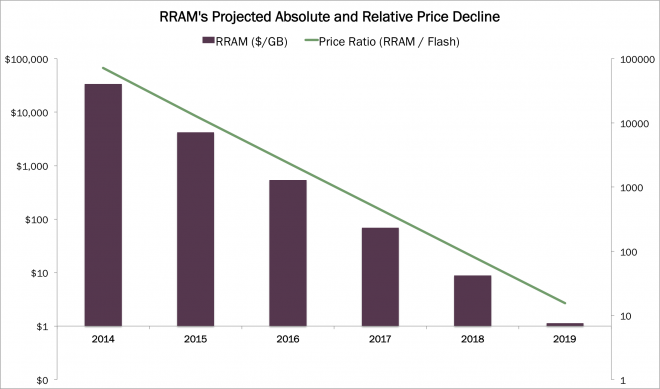

As RRAM volume ramps relative to the incumbent technologies, its growing scale will deliver faster price declines. The relative price decline eventually will deliver a product at a price point that will allow it to take share in more traditional storage applications.

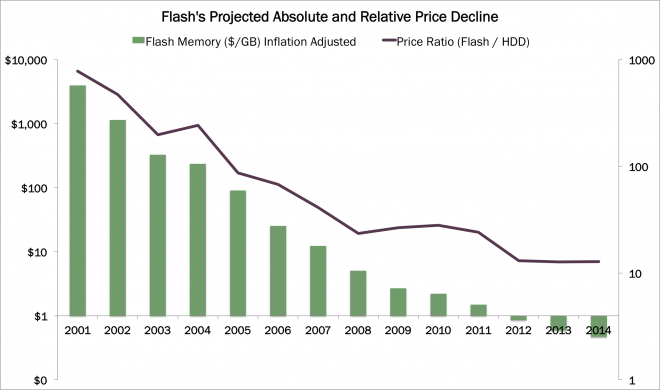

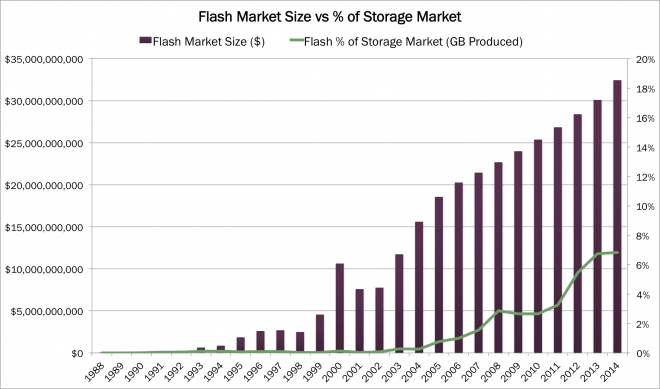

When will this transition occur? Perhaps instructive is the competitive dynamic evolving as flash memory, in the form of solid-state-drives (SSDs),[1] takes share from HDDs. Historically, HDDs’ low price/GB and high capacity have allowed them to dominate the personal computer (PC) memory market. Meanwhile, flash enjoyed widespread use in exploding new product categories like cell phones and other small consumer electronics to which HDDs were not suited. Consequently, economies of scale drove flash’s price/GB down absolutely and relatively, as displayed below.

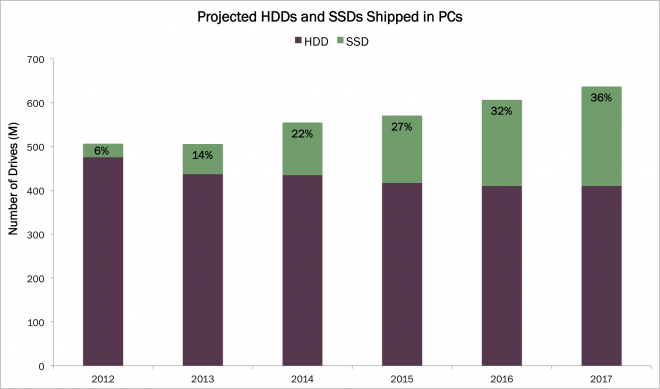

This absolute and relative price decline, along with improvements in storage capacity, allowed SSDs to break into the enterprise market in 2010 and the consumer market in 2012. Since SSDs are faster, smaller and more rugged than HDDs, they have been more competitive in certain markets, even at higher price-points. As shown above, in 2012, flash crossed a compelling threshold for the average consumer at $1/GB and 10x the price of HDDs. SSDs in PCs have skyrocketed since 2012, and are projected to continue, putting a damper on HDD shipments.

Five years ago, PC HDD revenues towered over PC SSD revenues at $30.6B and $6.8B, respectively. By 2017, while SSDs are projected to account for 36% of unit volumes, as shown above, by revenues PC HDDs $23.5B should barely top PC SSDs $22.6B.

HDDs will not disappear, remaining in hybrid solid state drives (SSHD) for some time to come, but SSDs likely will become the standard for consumer storage over the intermediate term. HDDs might then be primarily relegated to enterprise mass storage applications.

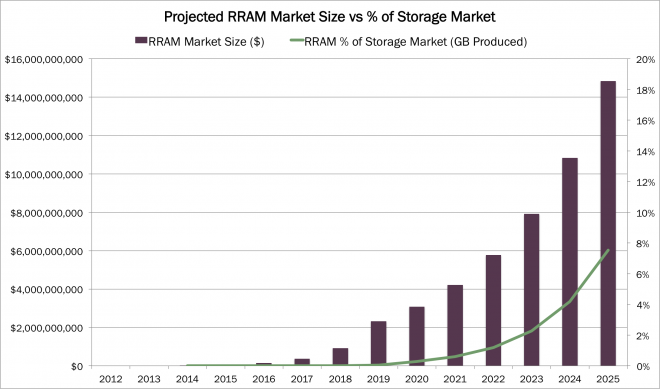

Flash is likely to enjoy its consumer reign for only a few years, as shown below. If RRAM’s price point drops to $1/GB and 10x the price of flash, its superior density, speed and energy efficiency will erode flash’s dominance in mobile devices like tablets, smartphones, USB drives, and SD cards by 2019.

Such a dramatic price decline will depend upon the rapid uptake of RRAM, at a growth rate three times faster than that experienced by flash in its first five years on the market. Two defensible assumptions support such dynamics: retrofitting existing flash fabrication plants, and the maturing of RRAM as the internet of things (IoT) booms.

Crossbar’s CEO, George Minassian, claims that flash fabrication plants will require minimal investment to convert and ramp RRAM production. By contrast, flash required completely new infrastructure. RRAM’s density is twice that of flash and should facilitate a more efficient utilization of fabrication space. Additionally, IoT is expected to populate the world with 25 billion additional devices between 2015 and 2020, driving demand for well-suited RRAM into overdrive.

If successful in taking significant share from flash, economies of scale will drive RRAM to a price point competitive with HDDs, enabling it to move into data centers and eroding one of HDDs last compelling use cases. By this point, though, Flash may have already largely displaced HDDs in data centers, as pointed out by Wikibon.[2] Between 2021 and 2022 RRAM could cross the 10X price threshold with HDDs. By 2025, RRAM could be a $15B global market, accounting for 7.5% of the total storage market,[3] as pictured below.

When flash became a $15B market in 2004, it accounted for less than 0.5% of the total storage market, as can be seen below. Its share had been held down by greenfield infrastructure requirements and markets totaling hundreds of millions of units (cellphones) instead of tens of billions of units (IoT).

Flash and HDDs face serious threats if the promise of RRAM is realized, because it will enable an explosion of applications in the IoT, allowing it to become price competitive. Currently, while only Adesto [4] and Panasonic [PCRFY] have products on the market thus far, Crossbar, Hewlett-Packard [HP], Toshiba [TOSBF], SanDisk [SNDK], Sony [SNE], Micron [MU], Intel [INTC] and Samsung [SSNLF] are racing to bring RRAM to large-scale commercial applications.

Don’t be surprised, therefore, when electronic devices access storage 20 times faster in ten years’ time. Ending six months of silence, Crossbar announced on December 15th, 2014 that it is one major technological breakthrough closer to terabyte on a chip commercialization.