The Retail Robot is ready to transform shopping. Robotics have shown their worth in the manufacturing industry, increasing product quality while reducing factory footprint, production time, and costs. Now they are ready to bring the advantages of automation to retail. For the past four years gross margins have been falling for major retailers, but Amazon [AMZN] is an exception and ARK believes this can be attributed, in part, to the use of retail robot in its distribution centers. ARK’s research shows that online and brick and mortar retail companies are at a competitive crossroads, which places robots in fertile territory for adoption.

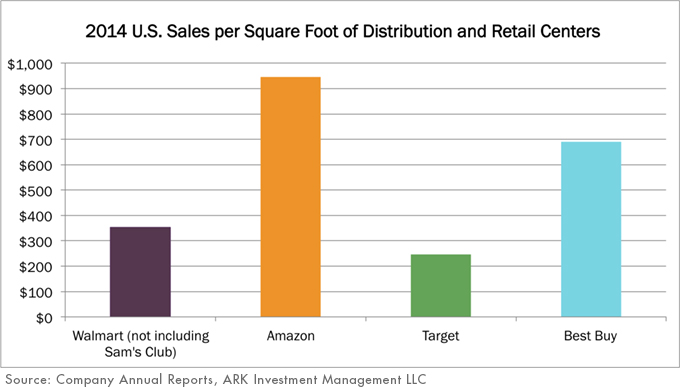

As shown below, when accounting for distribution center and retail floor space, mass-market retailers have lower sales per square foot than Amazon.[1] This fact alone isn’t all that surprising: brick and mortar stores need space for displaying products while keeping them accessible to customers wandering the store, whereas distribution centers can maximize the use of vertical space and count on trained employees to pluck items off the shelves. Despite having lower sales efficiency, Walmart [WMT], Target [TGT], and Best Buy [BBY] have remained financially competitive due to their higher margins, but this is quickly changing.

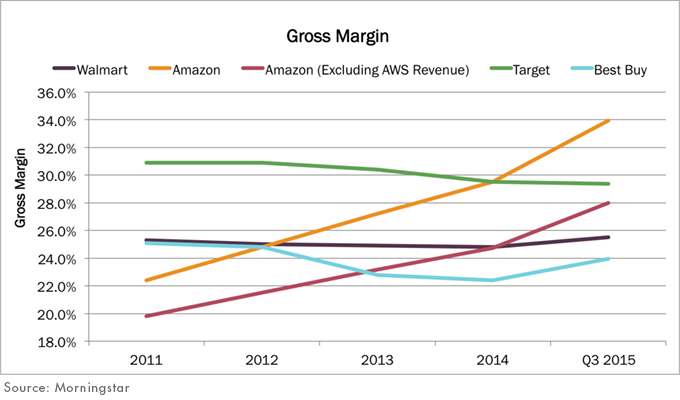

In 2014 Amazon’s domestic gross margin reached that of Target’s (as shown below). Even excluding the impact of Amazon Web Services, a naturally higher margin business, the company’s gross margin has exceeded Walmart’s and Best Buy’s within the past two years.

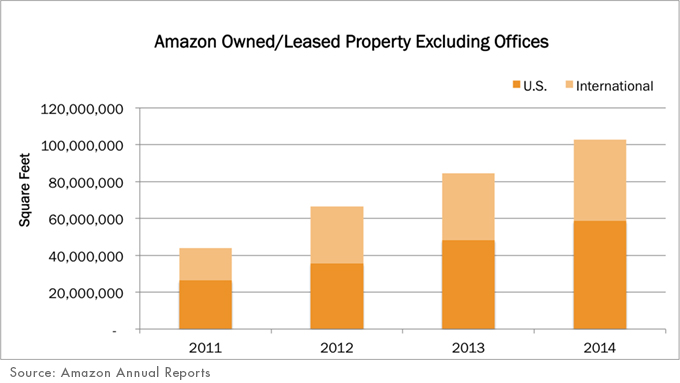

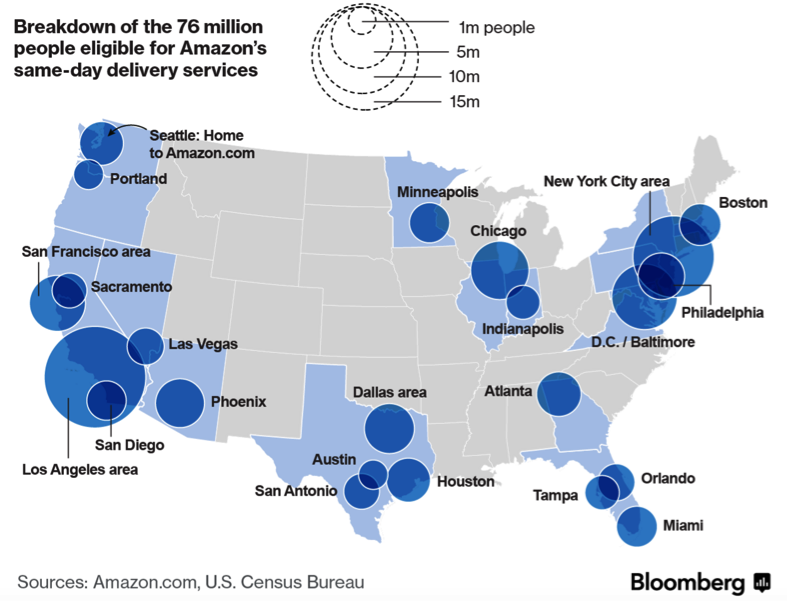

As shown below, Amazon has more than doubled its distribution footprint since 2011. In addition to Amazon’s increasing margins applying competitive pressure, its growing logistics network is increasing the convenience of ordering through Amazon. All the while, Amazon’s sales efficiency has remained stable throughout the rapid growth. In part, this is explained by the logistical agility and short shipping times that these distribution centers enable. Bloomberg research shows that almost one in four U.S. residents are now eligible for Amazon’s same-day delivery.

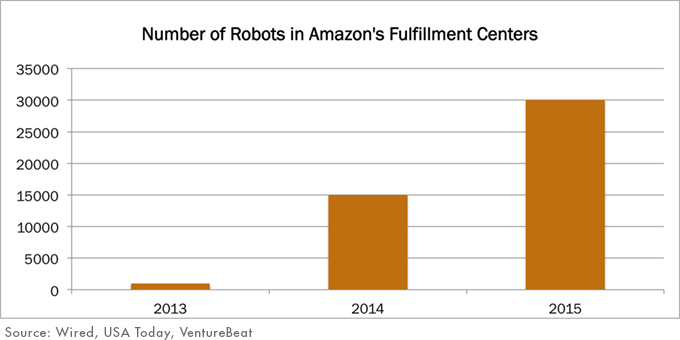

While pricing pressure has driven other retailer’s margins down, Amazon has managed to increase its margins. ARK believes this is due in part to its acquisition and implementation of Kiva Robots. In 2013 Amazon introduced 1,000 robots into its distribution centers and has already ramped to using 30,000 robots. The speed at which Amazon is introducing new retail robot speaks to the benefit being derived from them, and there is still a ways to go before Amazon’s distribution centers reach robot saturation. ARK calculates that if all of Amazon’s distribution centers adopted robots they would install roughly 210,000 robots during the next few years.

It is likely that the increasingly competitive landscape will push retailers to begin adopting new robots and technology. The trend is just taking shape now with a number of companies experimenting with robot implementations. Best Buy installed “Chloe,” a robotic arm that retrieves items that shoppers select from a tablet, Lowes [LOW] is testing OSHbot, a retail robot sales assistant, Panera Bread [PNRA] is replacing cashiers with tablets, and Ralph Lauren [RL] is working with Oak Labs to install smart fitting rooms.

ARK believes that there are certain categories of retail—grocery, food service, customizable goods, in-store service-driven, and niche-focused—that will be able to adapt industrial innovation technology to their advantage in order to drive in-store sales productivity and maintain a competitive edge. But, as has occurred with cloud computing, general merchandise retailing is likely to concentrate in the at-scale infrastructure provider. Amazon is the first mover in this respect, but regardless of which company champions this space; it paints the automation technology providers supporting companies’ efforts in good light.