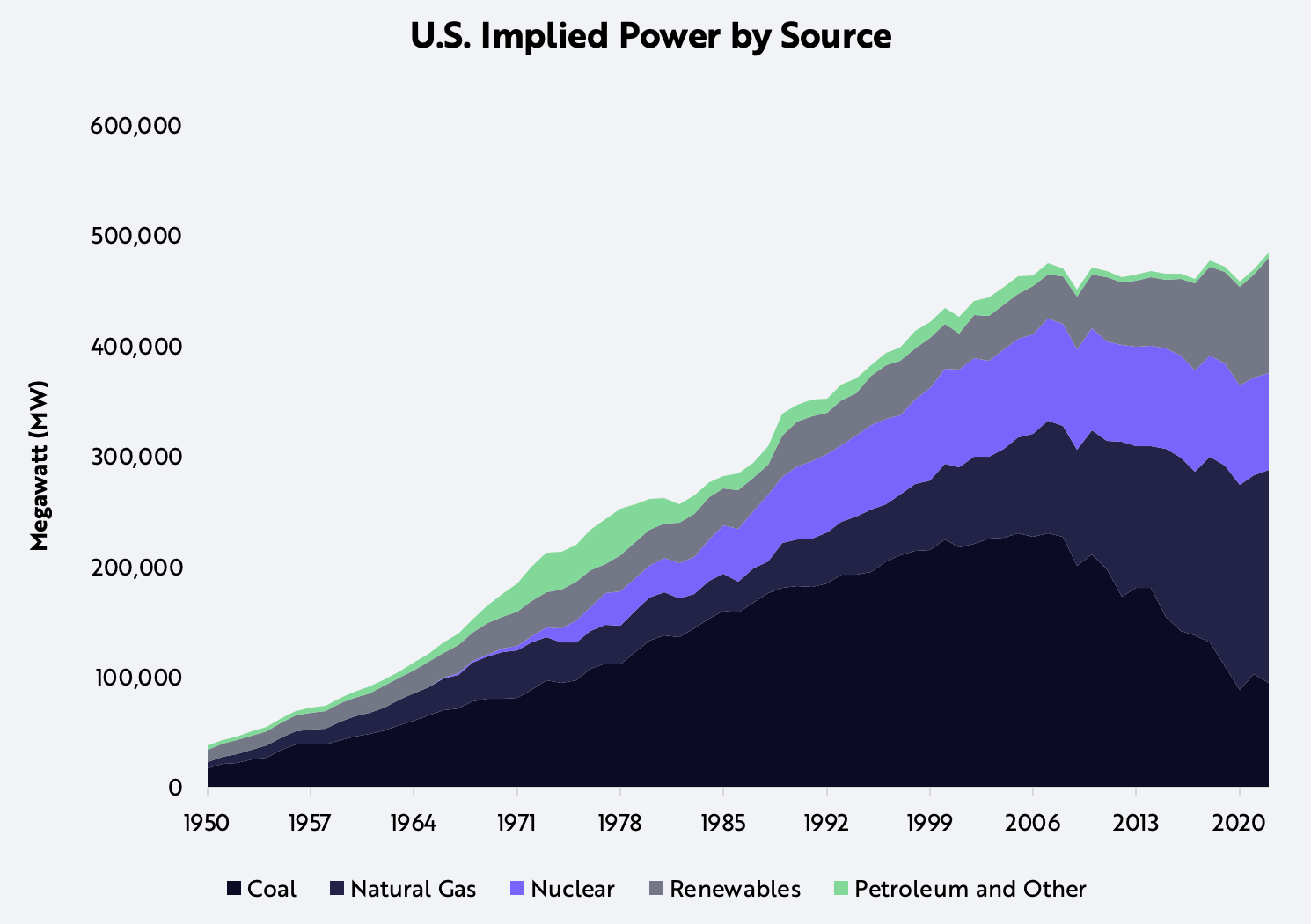

The International Energy Agency (IEA) has identified nuclear energy as vital to achieving net zero emissions by 20501; yet nuclear power in the United States has stagnated at ~20% of the energy mix since the Chernobyl disaster in 1986, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from EIA 2023 as of October 2023.2 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Source: ARK Investment Management LLC, 2024, based on data from EIA 2023 as of October 2023.2 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

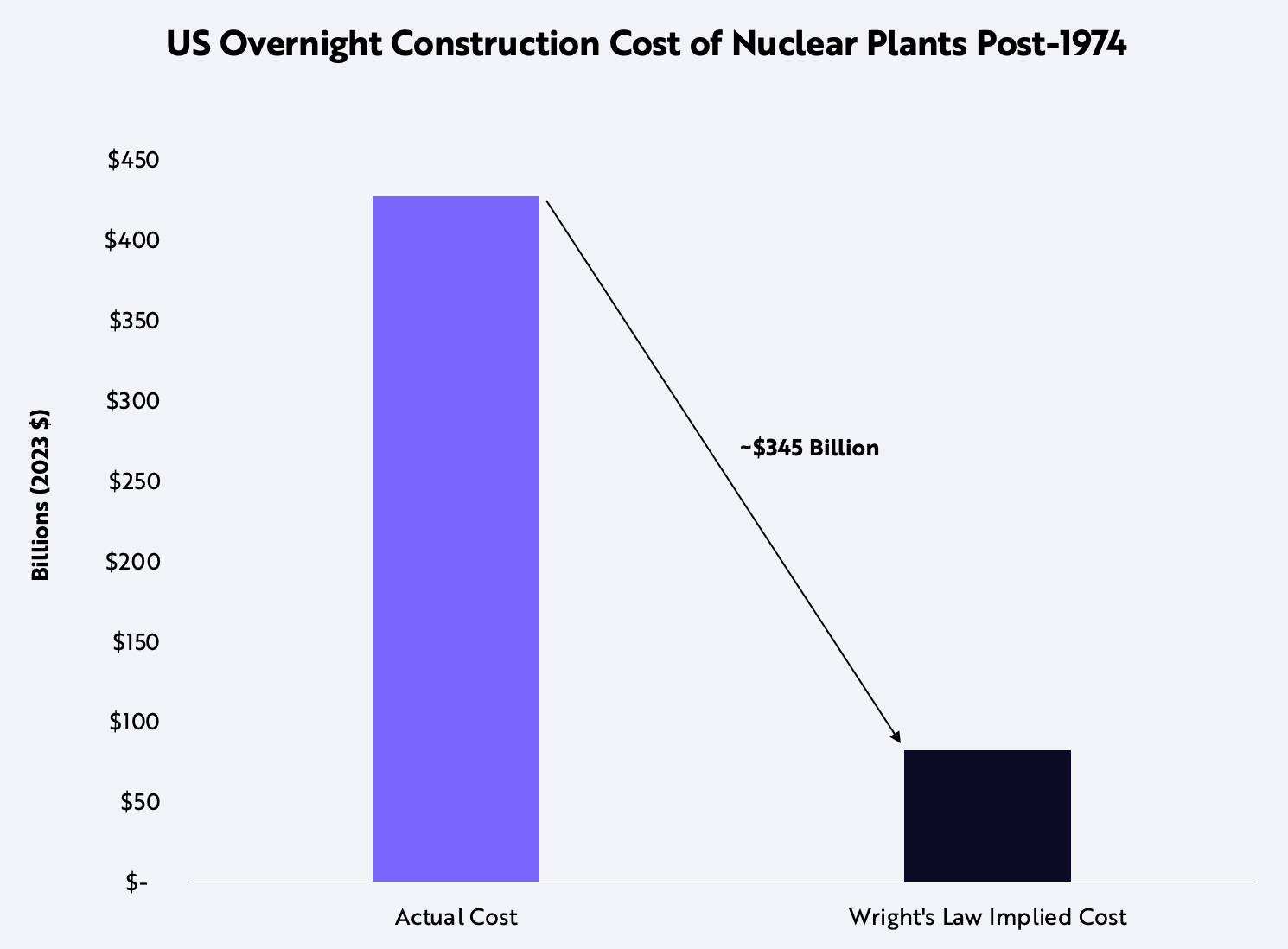

According to ARK’s research, stringent regulatory changes and anti-nuclear sentiment has stunted the buildout of nuclear capacity and caused cost overruns of ~$345 billion in the development of US nuclear plants, as shown below. Potentially reshaping the energy industry are the following: Small Modular Reactors (SMRs), advances in fuel technology, and increased regulatory support for nuclear energy.

Source: ARK Investment Management LLC, 2024, based on data from Lovering et al. 2016; IAEA 2023; EIA 2022; and World Nuclear News 2022 as of October 2023.3 Wright’s law aims to provide a reliable framework for forecasting cost declines as a function of cumulative production. Specifically, it states that for every cumulative doubling of units produced, costs will fall by a constant percentage.4 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Source: ARK Investment Management LLC, 2024, based on data from Lovering et al. 2016; IAEA 2023; EIA 2022; and World Nuclear News 2022 as of October 2023.3 Wright’s law aims to provide a reliable framework for forecasting cost declines as a function of cumulative production. Specifically, it states that for every cumulative doubling of units produced, costs will fall by a constant percentage.4 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

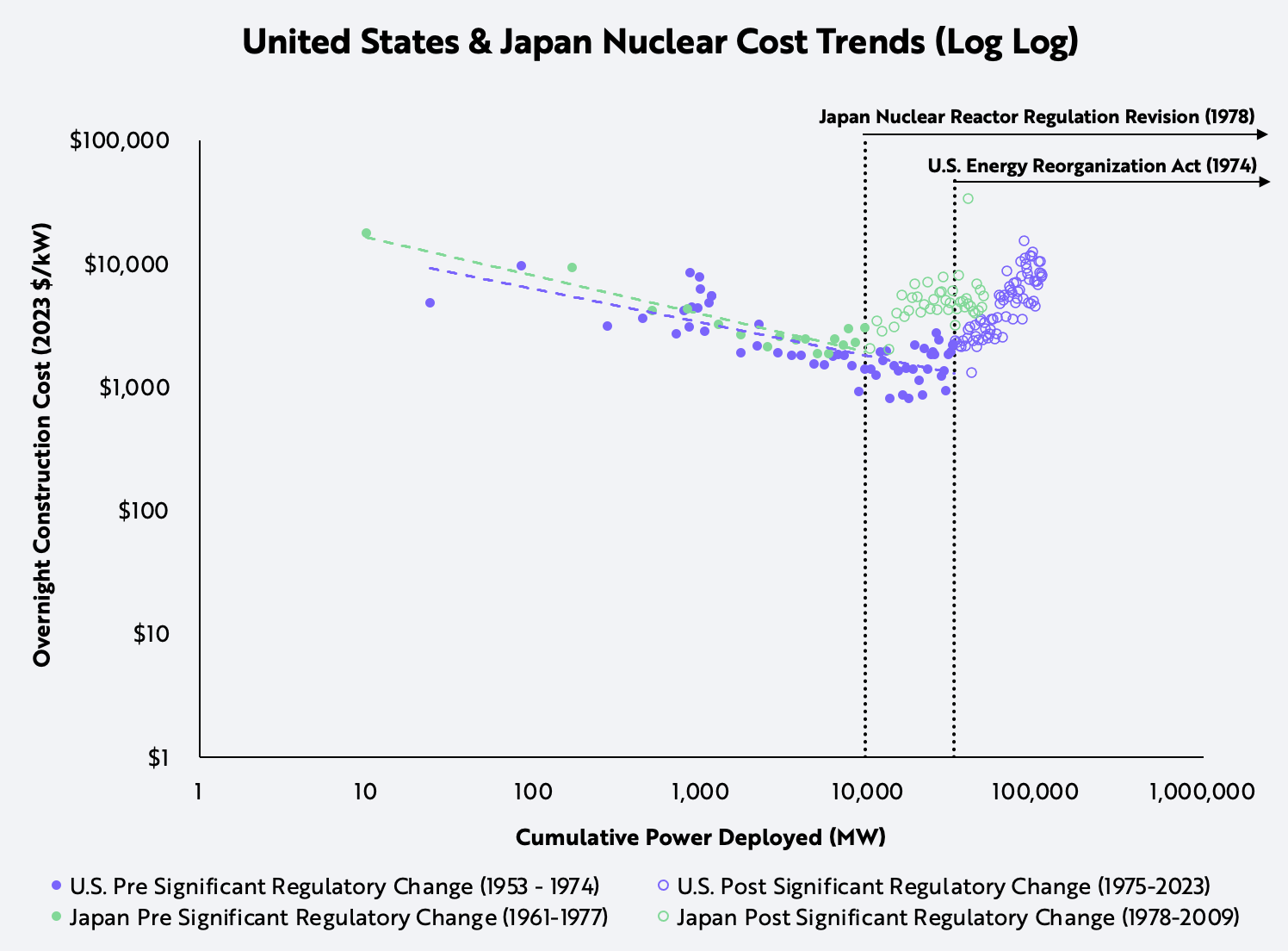

Leveraging the work of Lovering et al.,5 we analyzed how regulatory shifts derailed nuclear technology cost declines that the learning curves associated with Wright’s Law had projected.6 Before regulatory actions and increased anti-nuclear sentiment led to unnecessary cost increases, the buildout of nuclear facilities in both the US and Japan followed learning curves of ~20% in overnight construction costs (OCC),7 as shown below.

Regulatory changes in the mid to late seventies put an end to that progress. In the US, the 1974 Energy Reorganization Act separated the Atomic Energy Commission into the Nuclear Regulatory Commission and the Energy Research and Development Administration. In Japan, the 1978 amendment of the Japanese Nuclear Reactors Regulation Law led to the creation of the Nuclear Safety Commission.8 Both regulatory agencies introduced more stringent licensing measures, which increased costs significantly, also shown below.

Source: ARK Investment Management LLC, 2024, based on data from Lovering et al. 2016; IAEA 2023; EIA 2022; and World Nuclear News 2022 as of October 2023.9 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Source: ARK Investment Management LLC, 2024, based on data from Lovering et al. 2016; IAEA 2023; EIA 2022; and World Nuclear News 2022 as of October 2023.9 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

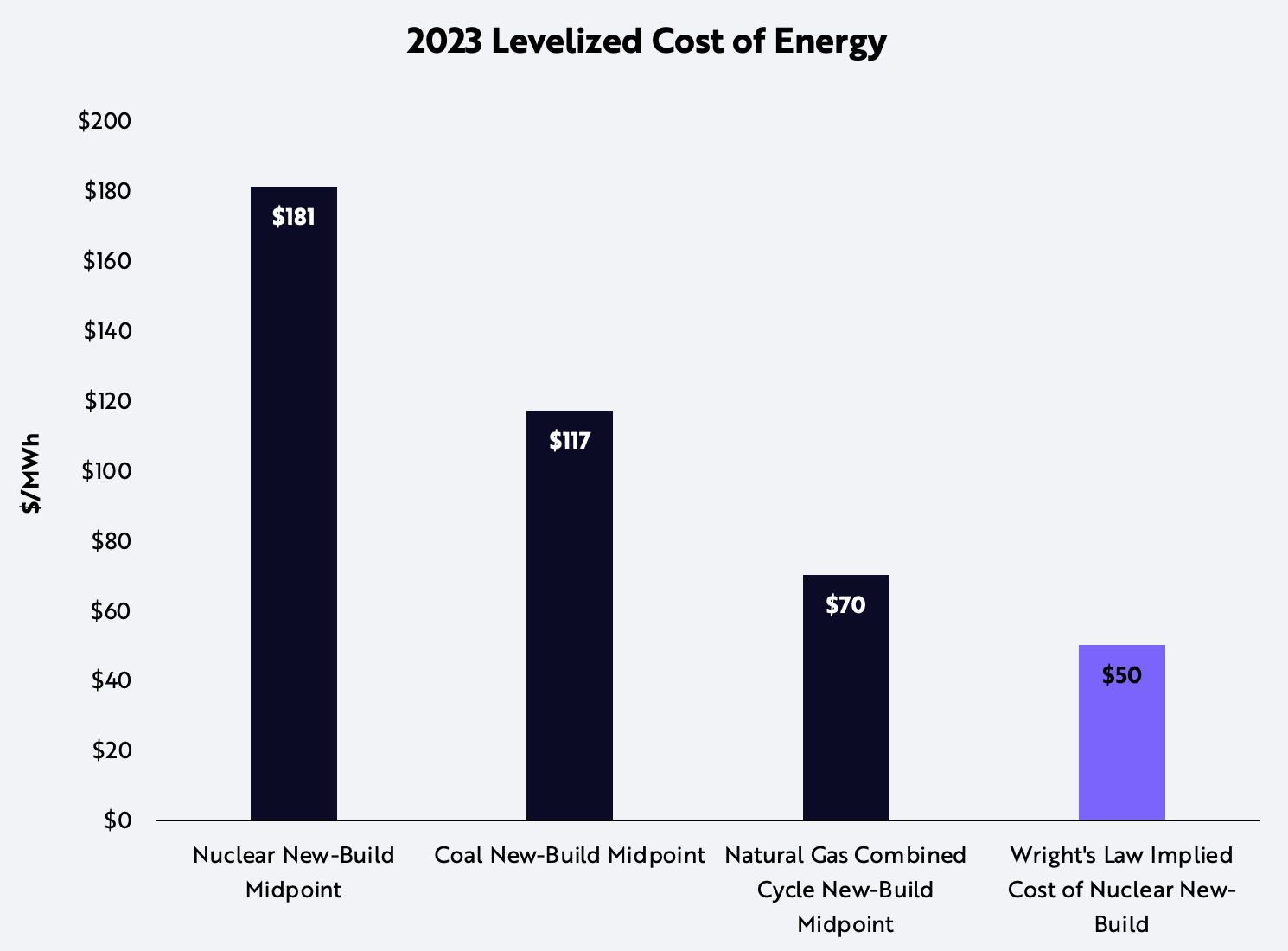

Without such stringent regulations, our research suggests that lower cost trajectories could have saved the US and Japan approximately ~$480 billion in real terms (2023 dollars). The US would have benefited by ~$345 billion, or ~72% of the total. Extrapolating the cost trends before regulations derailed them, we estimate that the Levelized Cost of Energy (LCOE)10 of a newly built nuclear plant in the US today would be ~$50/MWh,11 less expensive than natural gas plants based on Lazard’s LCOE 2023 analysis, as shown below.12

Source: ARK Investment Management LLC, 2024, based on data from Lazard 2023 as of October 2023.13 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Source: ARK Investment Management LLC, 2024, based on data from Lazard 2023 as of October 2023.13 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

In addition to its cost-effectiveness, nuclear power provides a reliable, continuous, carbon-free supply of energy, important characteristics now that an explosion in demand for artificial intelligence (AI) is taxing the electricity consumption of data centers. Already, Microsoft is recruiting SMR experts to capitalize on cost-efficient, compact plant designs with advanced fuels like TRISO.14

Thanks to the U.S. Advanced Reactor Demonstration Project and other emerging government support programs, nuclear cost overruns should reverse course as countries look for robust clean energy solutions to meet their net carbon emissions reduction commitments.15 SMR developers like Oklo, X-energy, and TerraPower should benefit, as should companies focused on nuclear fuel and supply chains, like Cameco and Centrus Energy Corp. If innovators and regulators can align to lower unnecessary costs, nuclear is likely to play a meaningful role in the global energy mix during the next 20-25 years.