Livestream Commerce Is Reviving Home Shopping

Introduction

In 1977, a cash-strapped advertiser in Clearwater, Florida, sent 112 electric can openers to a local easy-listening AM radio station as payment for ad services. In turn, feeling the pinch of competition from FM radio, the station owner decided to sell the can openers to his listeners—live, on air.

Surprisingly, the can-opener sale met with great success! And so, “The Bargaineers,” a new radio home shopping service was born. Within a decade, it migrated to television as the “Home Shopping Club,” eventually becoming the “Home Shopping Network,” with competitors like “QVC” soon following suit. The rest is history.

Or is it? A seemingly indestructible force in modern retail, live shopping continues to adapt to and capitalize on technological innovation.

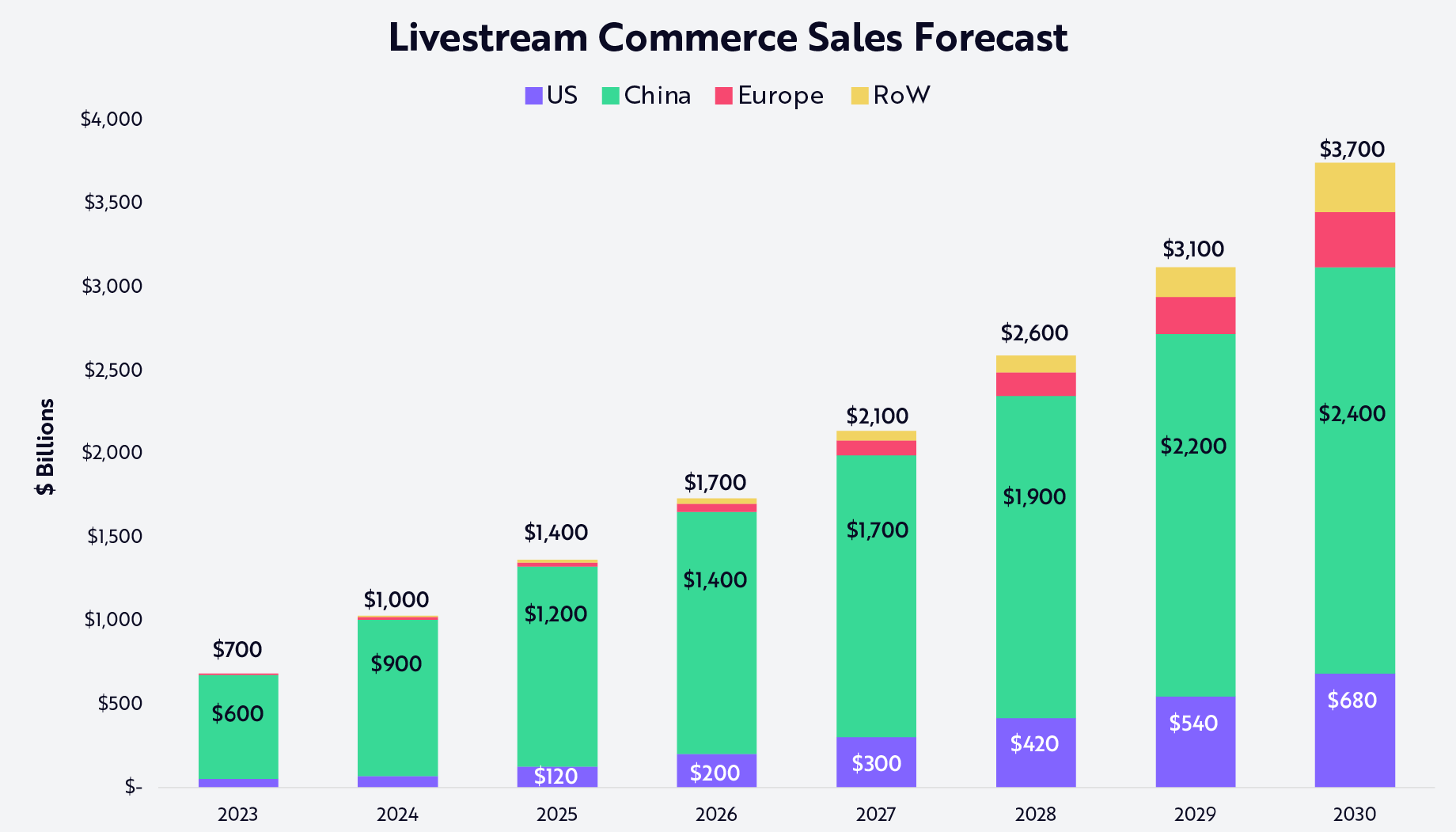

Facilitating at-home shopping on steroids, video-centric social media platforms are transforming consumer entertainment and shopping. Short-form videos and livestreams are beginning to dominate screen time and are becoming powerful retail channels. Livestream commerce—in which content creators showcase products in real-time, answer questions on the spot, and enable instantaneous purchases—exemplifies the convergence between entertainment and e-commerce. Already an estimated $900 billion market in China,1 livestream commerce could scale to $3.7 trillion globally by 2030.

China Is Leading the Global Trend

China’s mobile-first culture and thriving influencer economy have propelled livestream commerce to the forefront of the nation’s retail revolution. Because 99% of Chinese internet users access the internet on smartphones, mobile platforms have become the primary hubs for both entertainment and product discovery. After seeing an influencer recommend a product, an astonishing 85% of Chinese consumers make online purchases. Since 2019, by combining real-time product demos with the credibility of a trusted internet personality, livestream commerce has increased 73% at an annual rate, capturing ~60% of China’s e-commerce market in 2024.2

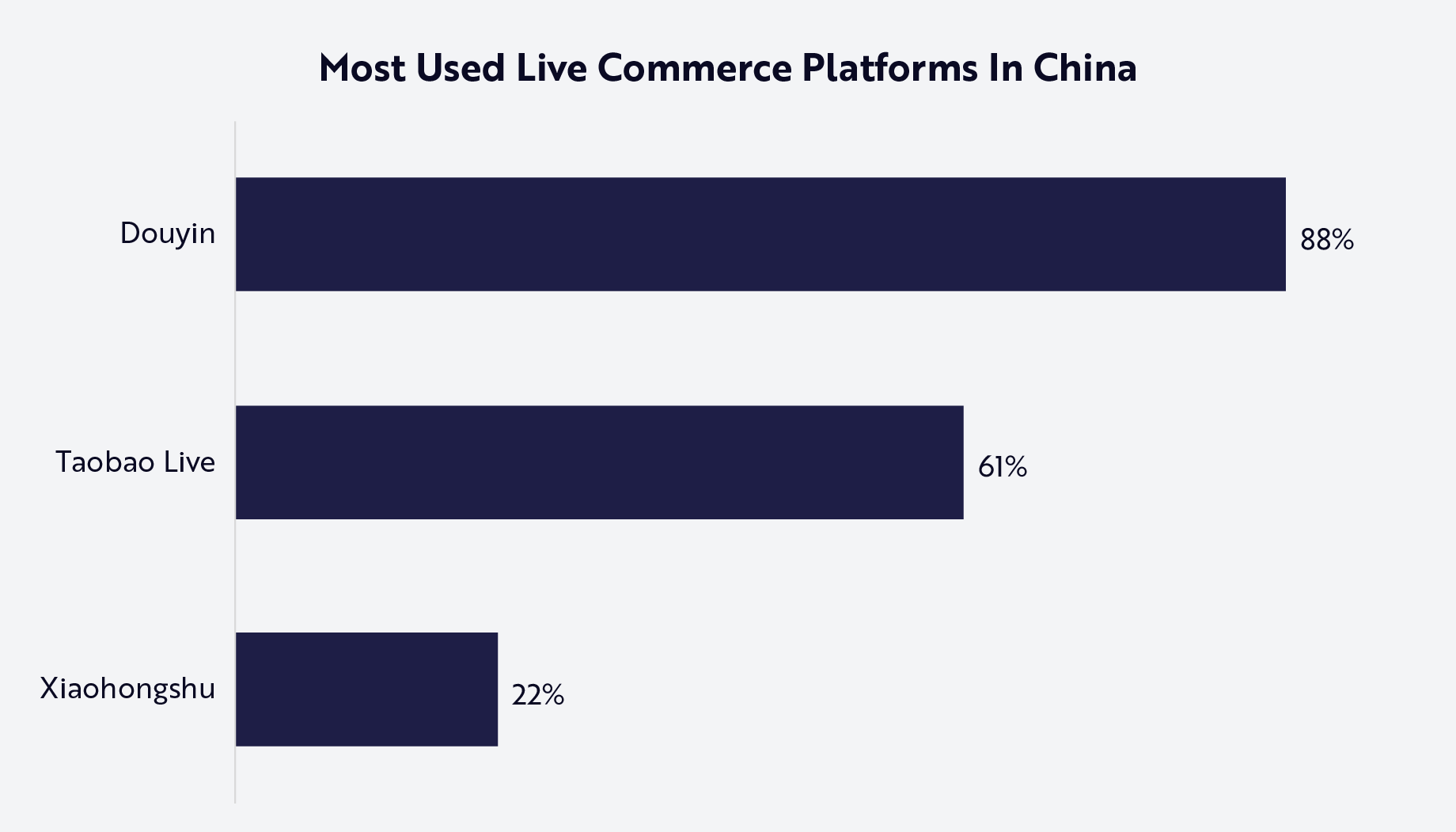

Platforms like Taobao Live, Douyin (TikTok in China, owned by ByteDance), and Kuaishou currently lead livestream commerce in China, offering seamless in-app purchasing experiences, integrated digital payment options, and extensive logistics networks. During the selling process, the live sessions often include entertainment, promotions, and flash sales that transform shopping into a dynamic social experience. As measured by traffic in 2023, Douyin was the largest platform, followed by Taobao Live (Alibaba) and Xiaohongshu (Little Red Book), as shown below.

Source: ARK Investment Management LLC, 2025, based on data from McKinsey 2023.3 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

In a shift sparked by the pandemic, groceries have become the top category purchased via live commerce in China, as shown below. Farmers use streaming to sell their produce and maintain livelihoods.4 The trend highlights how much consumers value convenience, immediacy, and transparency, preferring to see and hear discussions about products—especially fresh goods—in real time. Fashion and beauty also rank among the most popular segments, thanks to influencers who showcase trending styles, demonstrate products, and field audience questions on the spot.

.png)

*Note: Refers to % of respondents from McKinsey’s Global Live Commerce Survey. Source: ARK Investment Management LLC, 2025, based on data from McKinsey 2024.5 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

US Welcomes Rapid Growth

Livestream commerce in the US appears to be gaining momentum, as TikTok Shop surpassed the sales of both Shein and Sephora in 2024.6 Currently, livestream commerce represents ~5% of US e-commerce, well below the 60% in China.7

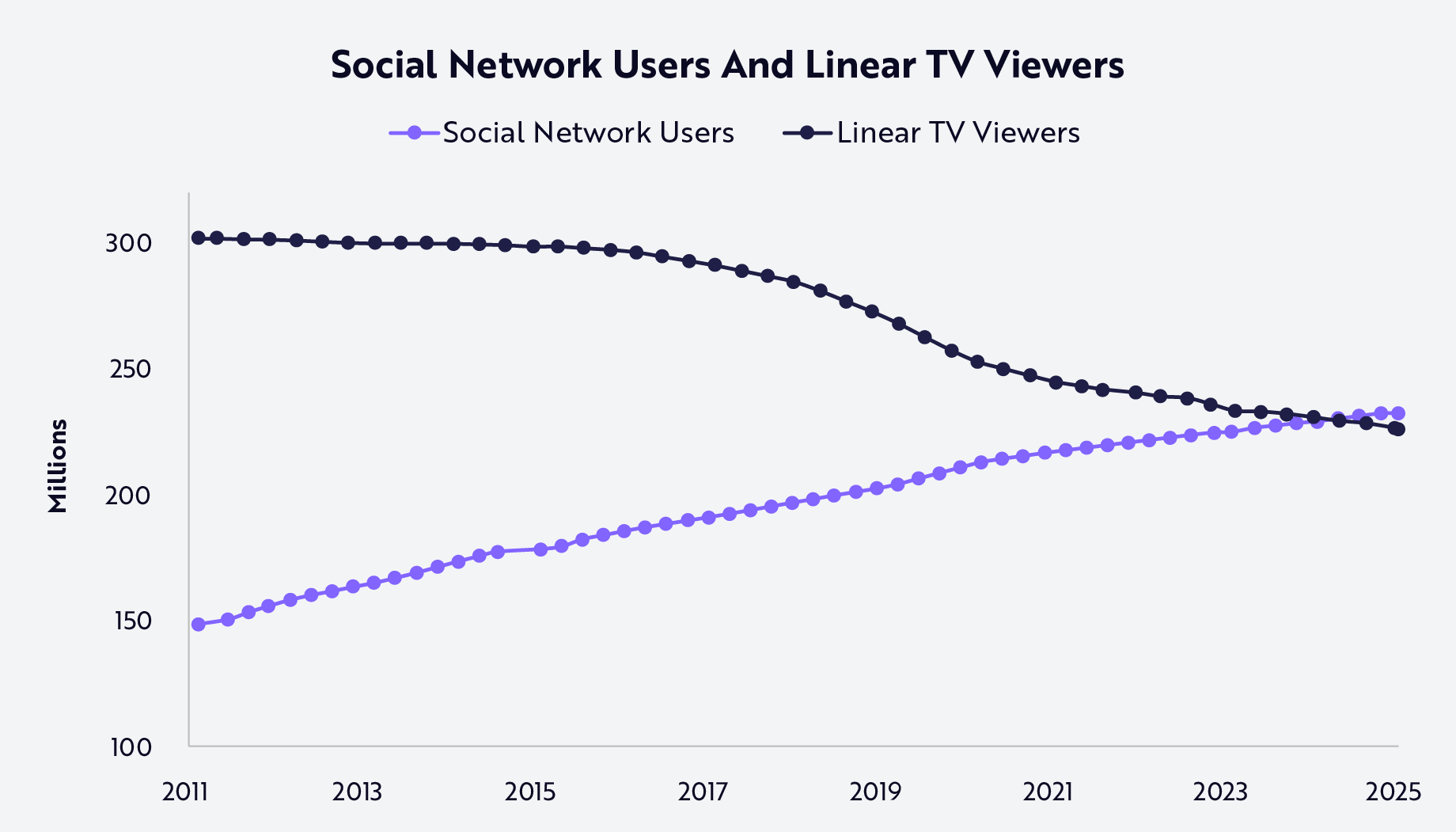

The shift from traditional TV to video-first social networks is catalyzing consumer adoption of live commerce in the US according to Emarketer, as shown below. The transition seems to be increasing the openness of social network users to interactive video content, creating a natural fit for shoppable livestreams. Influencer-led product demos also are capitalizing on this changing media landscape, blurring the lines between entertainment and retail.

Source: ARK Investment Management LLC, 2025, based on data from Emarketer as of October 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

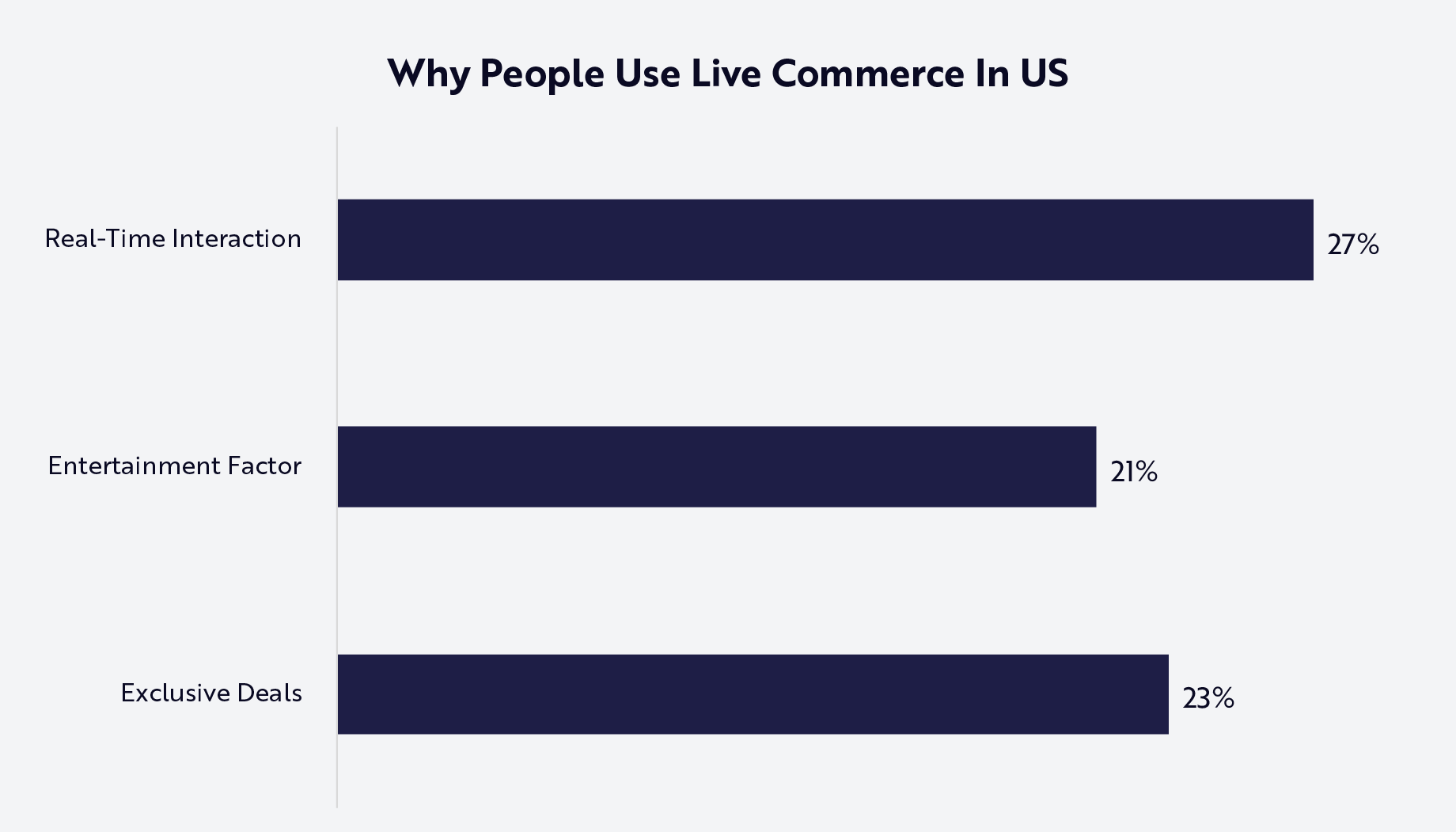

The ability to ask questions, receive real-time feedback, and transform shopping from a chore to a form of entertainment is delighting American consumers, as shown below.

Source: ARK Investment Management LLC, 2025, based on data from Agora 2024.8 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

From a consumer engagement perspective, interactivity appears to be the primary reason consumers are flocking to live commerce: shoppers can connect directly with sellers or influencers, ask questions, and receive personalized recommendations while enjoying a sense of community. Real-time engagement builds the trust that spurs impulsive buying behavior, rendering livestream commerce a powerful shopping medium across diverse product categories. In the US, the most popular categories sold through live commerce are in the lifestyle space, as shown below.

.png)

*Note: Refers to % of respondents from McKinsey’s Global Live Commerce Survey. Source: ARK Investment Management LLC, 2025, based on data from McKinsey 2024.9 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

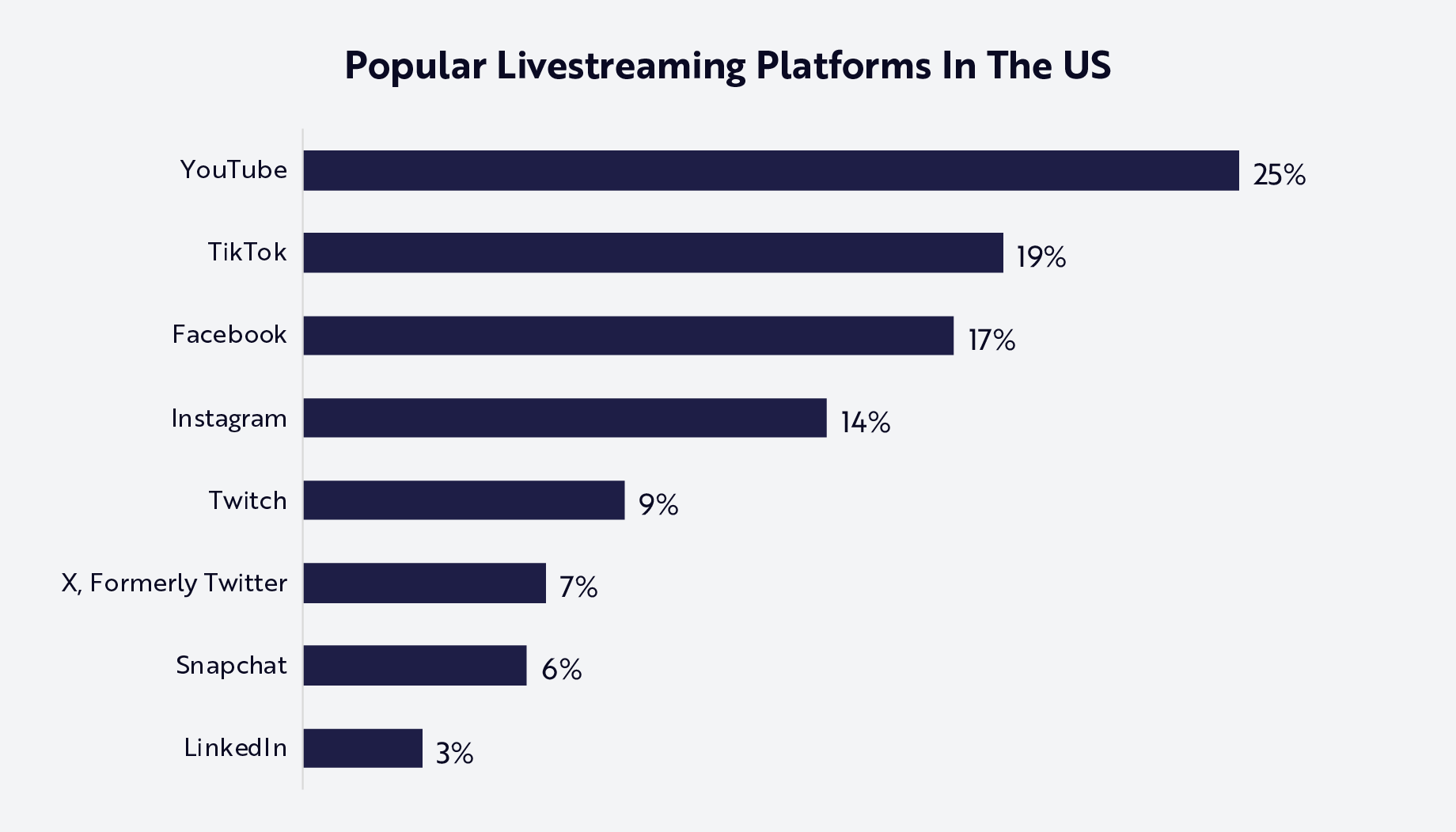

Platforms like YouTube, TikTok, and Instagram are popular destinations for social media sharing and entertainment, as shown below. They offer natural channels through which live video sellers can reach target audiences, hoping to encourage discovery, engagement, and instant purchases.

Note: Chart does not denote a 1:1 market share of live commerce sales. ARK Investment Management LLC, 2025, based on data from Emarketer 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

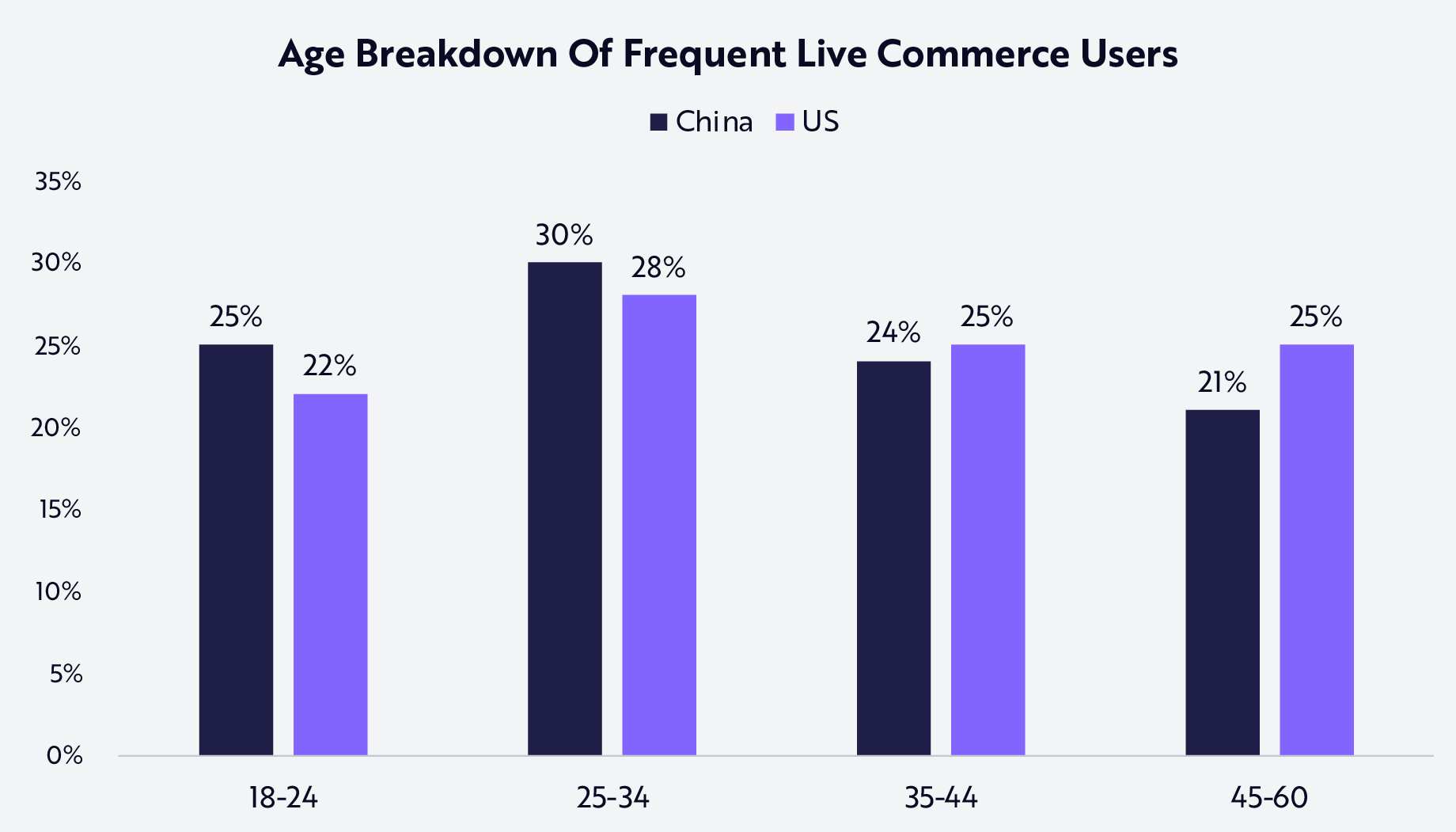

Live commerce resonates with audiences of all ages in both China and the US, as shown below. Younger viewers, particularly Gen Z and Millennials, frequent platforms like TikTok and Instagram for live shopping experiences that integrate naturally into their social media habits. Older consumers may frequent Facebook and YouTube, where the format of live shopping closely resembles the familiar experience of shopping on live TV channels like QVC and HSN, but with more real-time interaction and community engagement than on linear TV.

Source: ARK Investment Management LLC, 2025, based on data from McKinsey 2024.10 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Why Livestream Commerce Works and What Brands Can Learn

Livestream commerce deploys strategies to captivate audiences and drive conversion. Auction-style events create excitement as viewers bid competitively for deals, while flash sales and limited-time offers create a sense of urgency and stimulate impulse purchases. Live product demonstrations include convenient links for the direct purchase of goods and services. To build trust and engagement, hosts often use interactive tactics like giveaways, exclusive discounts, and live Q&A sessions, features that not only foster community participation but also provide immediate feedback that connects and informs customers in a dynamic shopping environment.

Livestream commerce represents a significant opportunity for brands and retailers to reach consumers in a more immediate, engaging, and authentic way. To leverage live streaming for growth, brands collaborate with influencers and/or subject-matter experts who resonate with their target audiences, transforming them into active participants. “Buy now” buttons and direct links reduce friction in the purchase journey, while exclusive offers and giveaways incentivize real-time purchases. Importantly, retailers also gain access to data and real-time analytics that enable them to adjust their strategies: if audience engagement spikes when emphasizing particular product features, presenters can spend more time highlighting and describing those features. As a result, businesses can tailor and personalize their messaging in real time, keeping viewers engaged and poised to convert.

The Opportunity

Livestream commerce is going global. Thanks to the combination of entertainment, social interaction, and attractive instant buying opportunities, consumers can enjoy an increasingly dynamic, experiential, and accessible shopping experience. Our research suggests that livestream commerce could scale 24% at an annual rate during the next five years, from $1 trillion today to ~$3.7 trillion globally in 2030, as shown below. Leading the movement, China’s livestream commerce should grow ~20% at an annual rate to $2.4 trillion, while the US scales 47% at an annual rate to $680 billion.

Source: ARK Investment Management LLC, 2025, based on data from McKinsey 2024, CoreSight Research 2023, Emarketer 2024, Statista 2025, and Dolby.io 2025.11 Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.