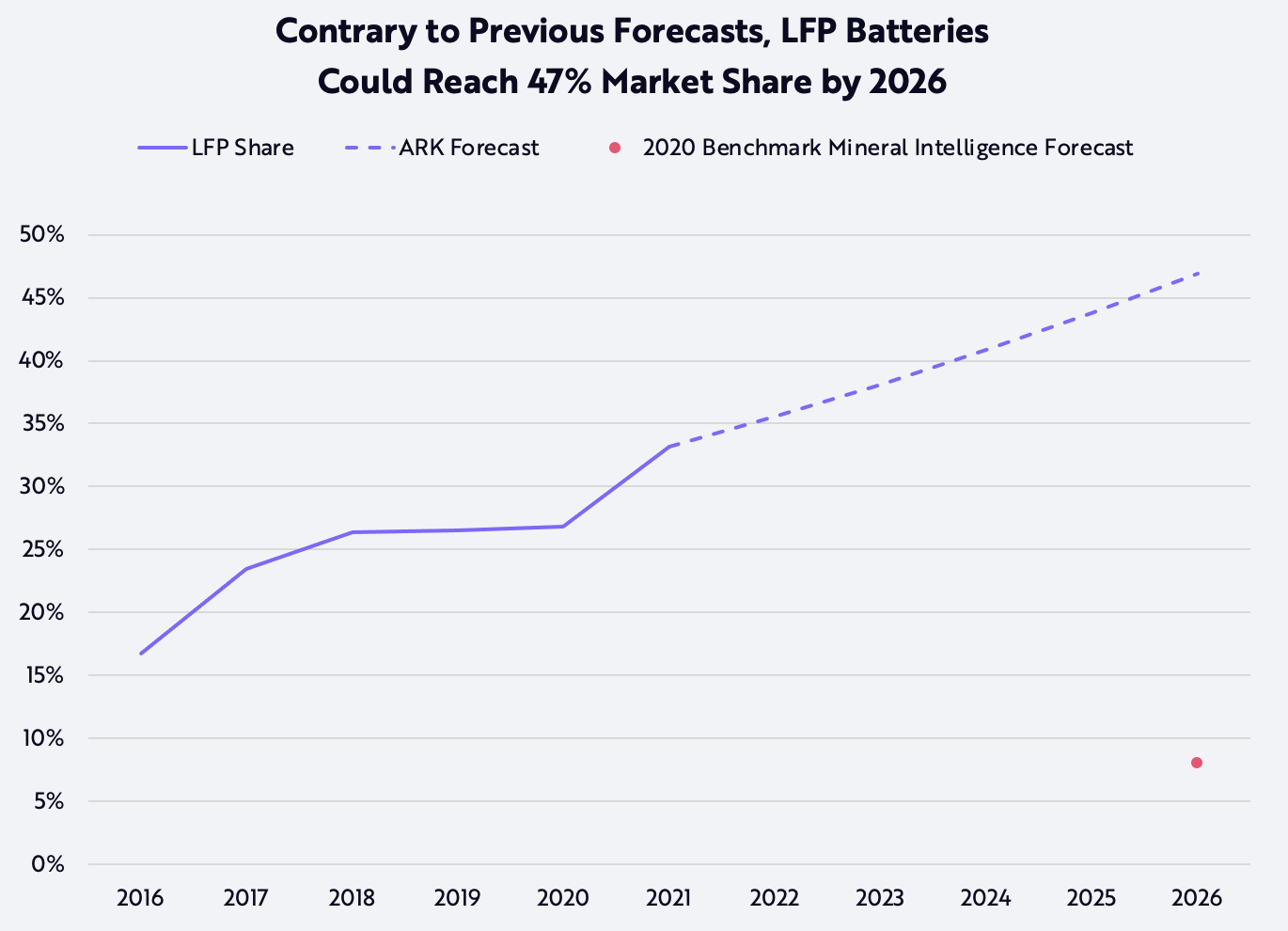

Lithium Iron Phosphate Could Take 47% Of The Battery Market By 2026

In tandem with their rapid penetration of the electric vehicle (EV) market, we believe lithium-ion batteries are gaining mind share. The recent spike in commodity prices has highlighted the dependency of batteries on raw materials. Lithium-ion batteries have two electrodes: an anode and a cathode. In EVs, the dominant cathode chemistries are lithium nickel manganese cobalt (NMC) and lithium iron phosphate (LFP). For the past five years, most battery experts had expected that NMC cells would gain share at the expense of LFP cells.[1]

ARK’s research suggests that continued cost declines, nickel supply constraints, and improving EV efficiency should continue to propel the market share of LFP cells from roughly 33% in 2021 to ~ 47% by 2026, as shown below. Important to watch from a competitive point of view will be the rate at which automakers shift toward LFP batteries while meeting the range that consumers demand. Auto manufacturers with superior drivetrain efficiency should be able to shift to LFP batteries and save thousands of dollars per car.

Source: ARK Investment Management LLC, 2022

Forecasts are inherently limited and cannot be relied upon.

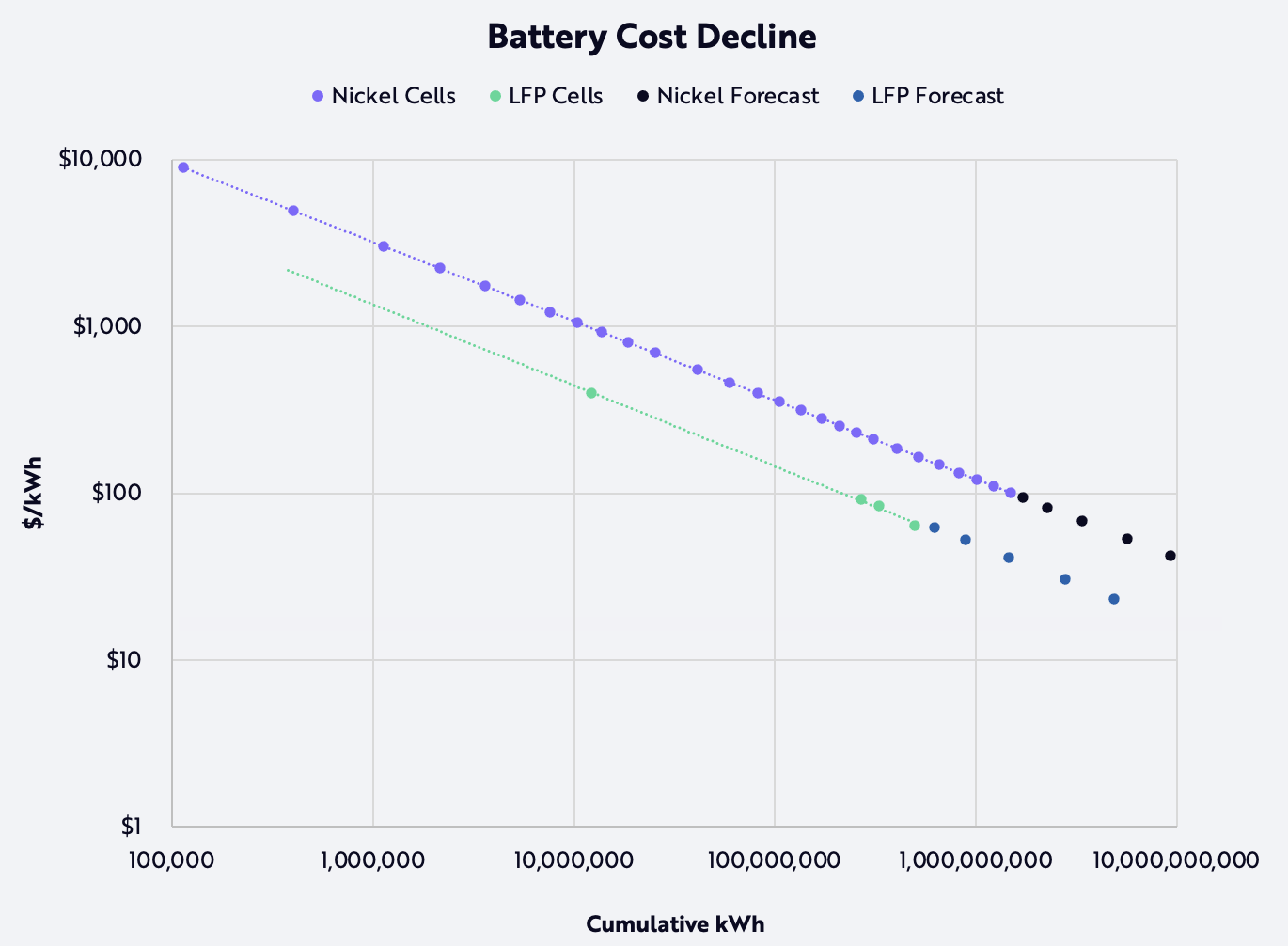

Why will LFP batteries gain share? Simple: they are less expensive today and on course for faster cost declines than NMC batteries. According to ARK’s research based on Wright’s Law, the cost of both NMC and LFP batteries will decline by ~28% for every cumulative doubling of production. The important differences between the two are: 1) LFP cells already cost ~$70/kWh, 30% less than NMC cells’ ~$100/kWh, as shown below, and 2) the production necessary to hit a cumulative doubling of LFP-based EVs is ~7 million, one-third that of the ~20 million necessary for NMC-based EVs.[2]

Source: ARK Investment Management LLC, 2022; Data derived from: EV Volumes; Bloomberg New Energy Finance; Snow Bull Capital; ICCSino; GGII; JP Morgan; CIAPS

Forecasts are inherently limited and cannot be relied upon.

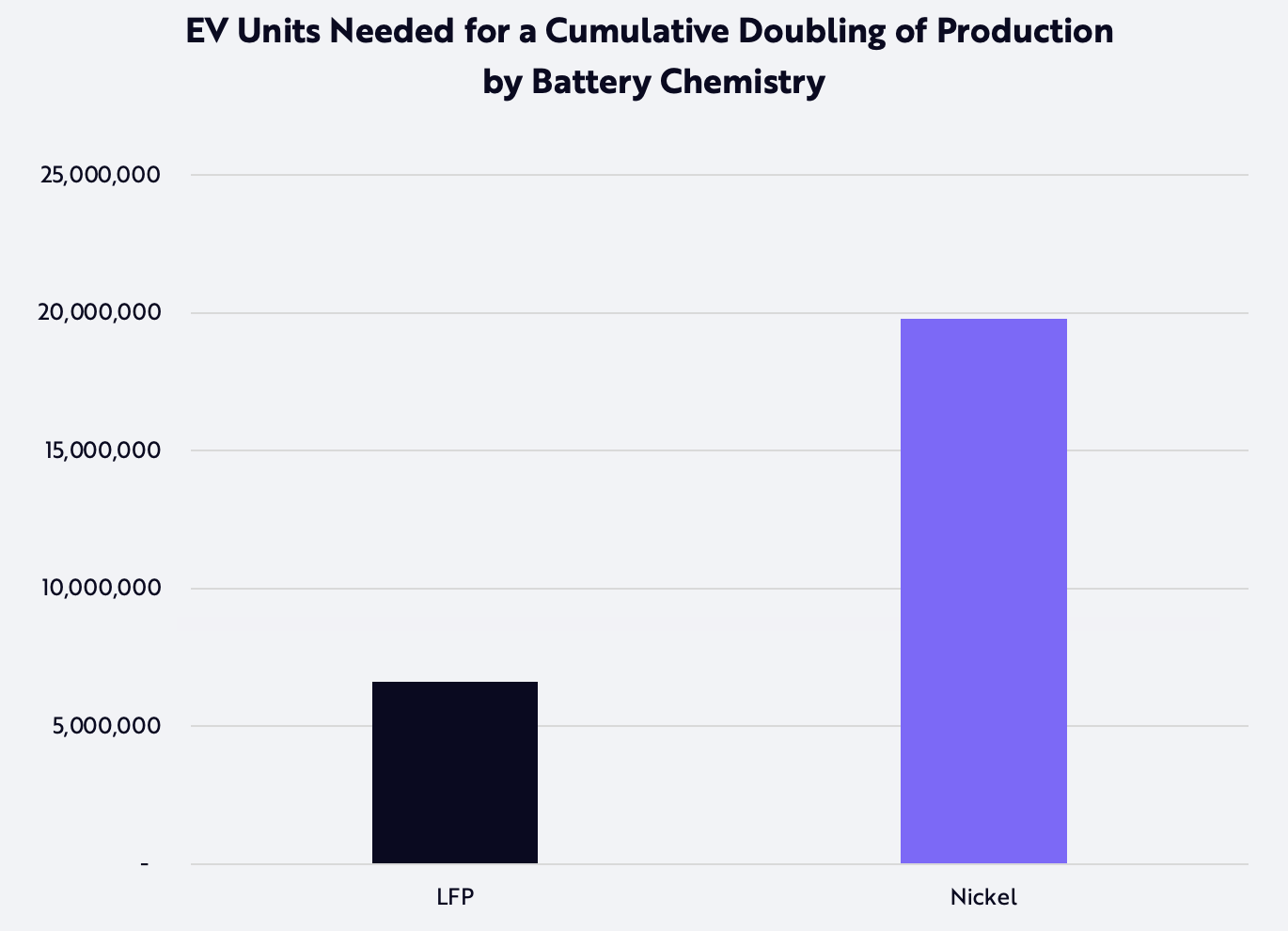

Last year, the number of EV sales hit 4.8 million, suggesting that the time necessary for a cumulative doubling if all vehicle production shifted to LFP batteries would be 1.4 years, as opposed to more than 4 years if the shift were to NMC batteries, as shown below.

Source: ARK Investment Management LLC, 2022

Forecasts are inherently limited and cannot be relied upon.

Behind the slow share gain in LFP-based EVs is the tradeoff between energy density and cost. All else equal, an EV with LFP batteries costs less but offers lower range than the same EV with NMC batteries. Range anxiety has been one of the most important factors in EV consumer purchasing behavior, which is why NMC-based EV manufacturers have focused on and developed more energy dense cells.

For two reasons, NMC batteries are losing share to LFP batteries: nickel and cobalt have become bottlenecks for NMC battery production, and EV drivetrain efficiencies have improved enough so that less energy dense LFP batteries can meet consumers’ range needs. ARK’s research also suggests that shorter range neighborhood EVs will gain share, reducing the need for energy dense NMC batteries that much more.

According to our research, companies with superior drivetrain efficiency should be able to save thousands of dollars by switching to LFP batteries. Those savings will be passed on in several ways: lower EV prices for the consumer, higher research and development to increase competitiveness, and/or higher profits. The transition to LFP batteries probably won’t prevent future material bottlenecks, as lithium itself could become a constraint but, if history is any guide, battery chemistry will evolve further in the quest for the lowest cost way to meet end market demand.