Prime Time for Companion Diagnostics

We think the drug approval process remains convoluted, costly, and time-consuming, but it is about to change. The increased adoption of Companion Diagnostics (CDx)—tests that identify the most suitable patients for a particular treatment—holds much promise. ARK expects that CDx will improve patient outcomes demonstrably, reduce research and development spending per tested drug, and increase drug approval rates. Though likely to transform the economics of oncology therapeutics most visibly and immediately, Companion Diagnostics will impact many disease treatments and could usher in the long-promised age of precision medicine.

Increasing Opportunities to Save Costs

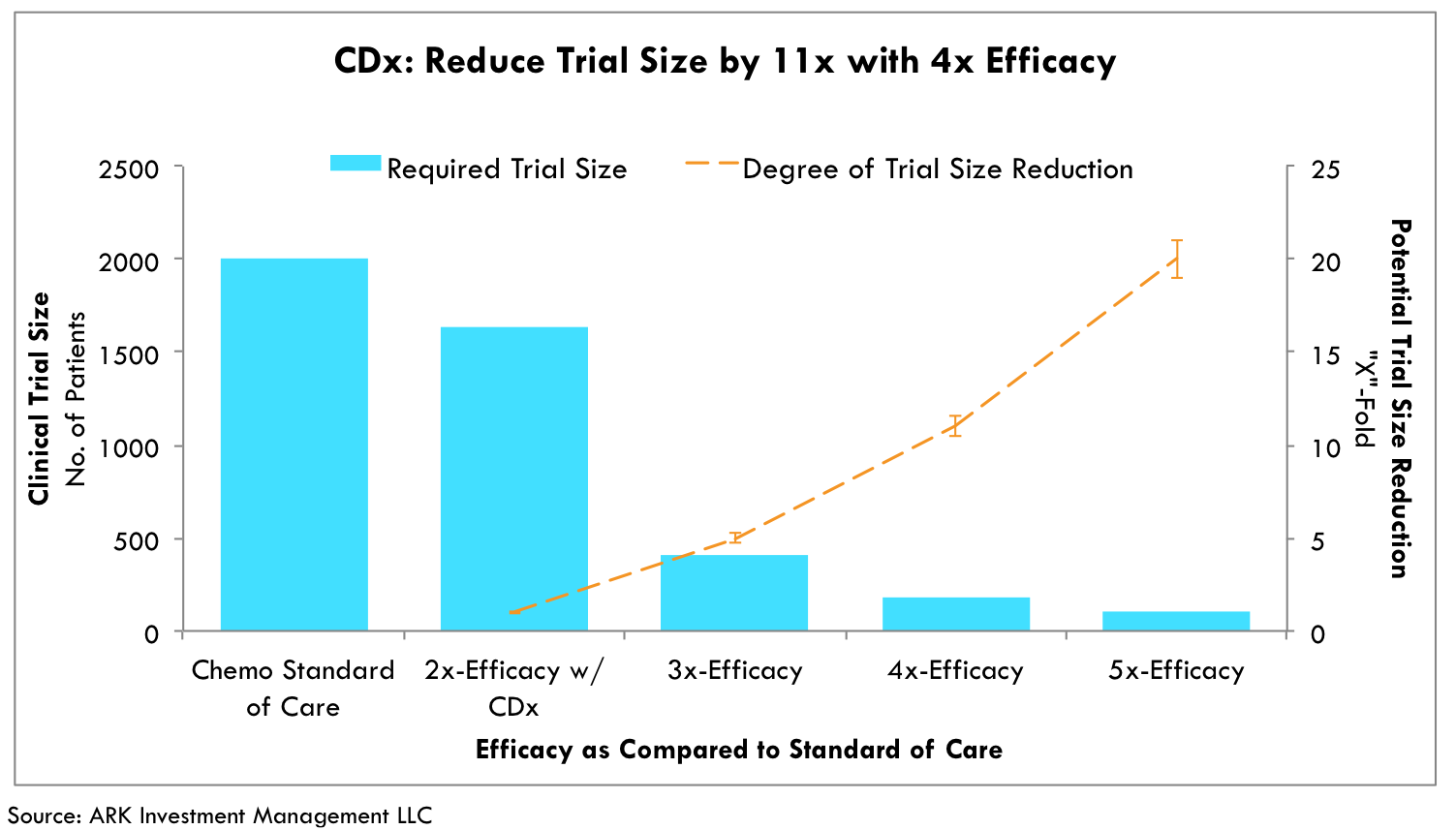

According to ARK’s research, CDx-guided drug development can reduce clinical trial costs by as much as 60%.[1] These cost-savings are contingent on the ability of CDx-guided drug candidates to show greater efficacy during clinical trials with smaller populations. Historically, targeting the patients most likely to respond to investigational therapies has been quite difficult. Only a subset of any patient pool typically responds to the therapies. Consequently, large expensive trials have been necessary to surface the effectiveness of various therapies. By contrast, companion diagnostics identify the subset of patients with the greatest likelihood to respond to therapies before they are administered, narrowing trial sizes considerably. As illustrated in Figure 1, the increased precision can reduce trial sizes by as much as ten-fold.[2][3][4]

Fig. 1 Logarithmic relationship between increased efficacy with CDx and trial size reduction. Estimates based on two-tailed T-Tests, 90% study power, 5% alpha, and 16% chemo efficacy rate. [3][4]

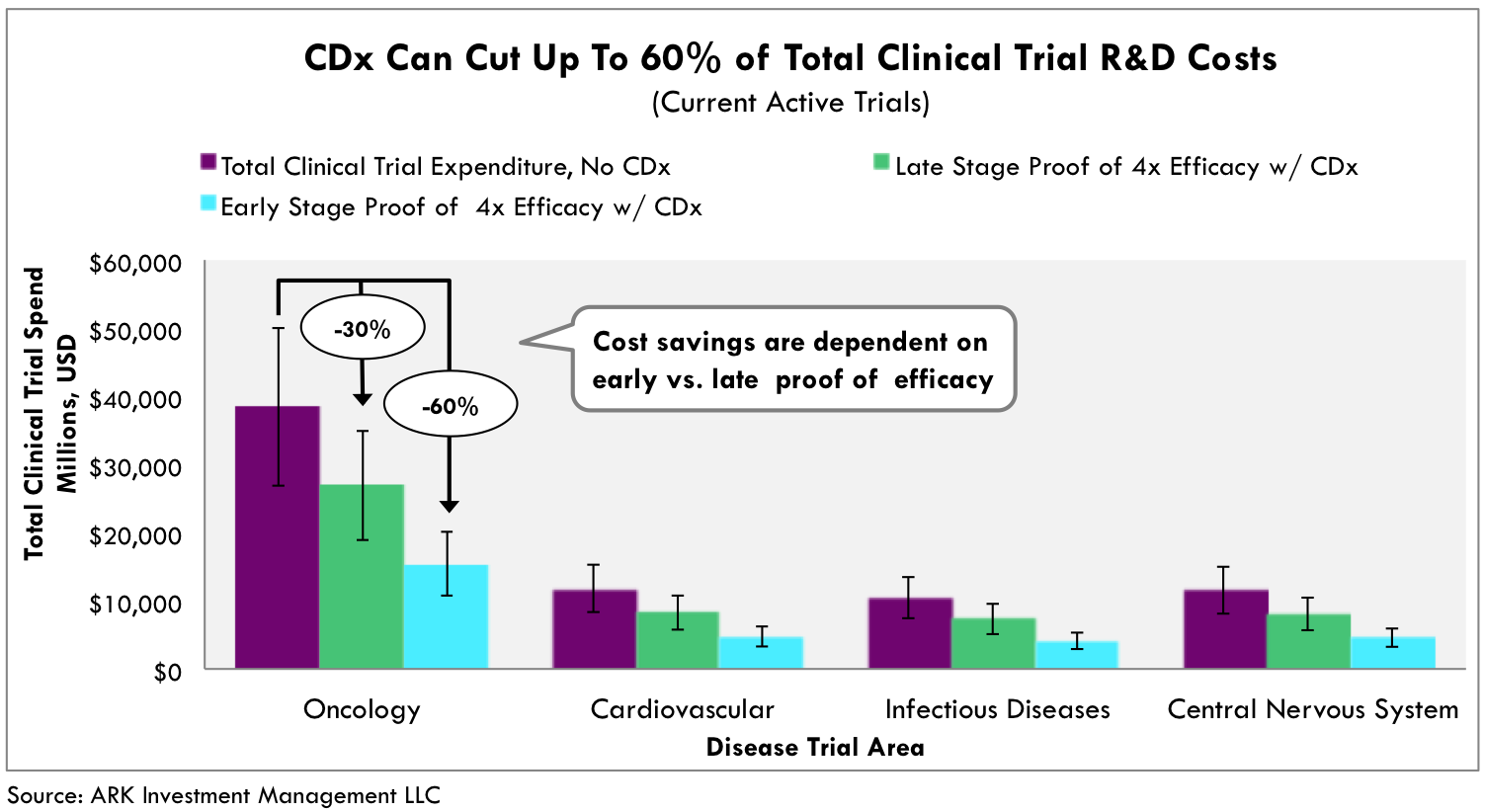

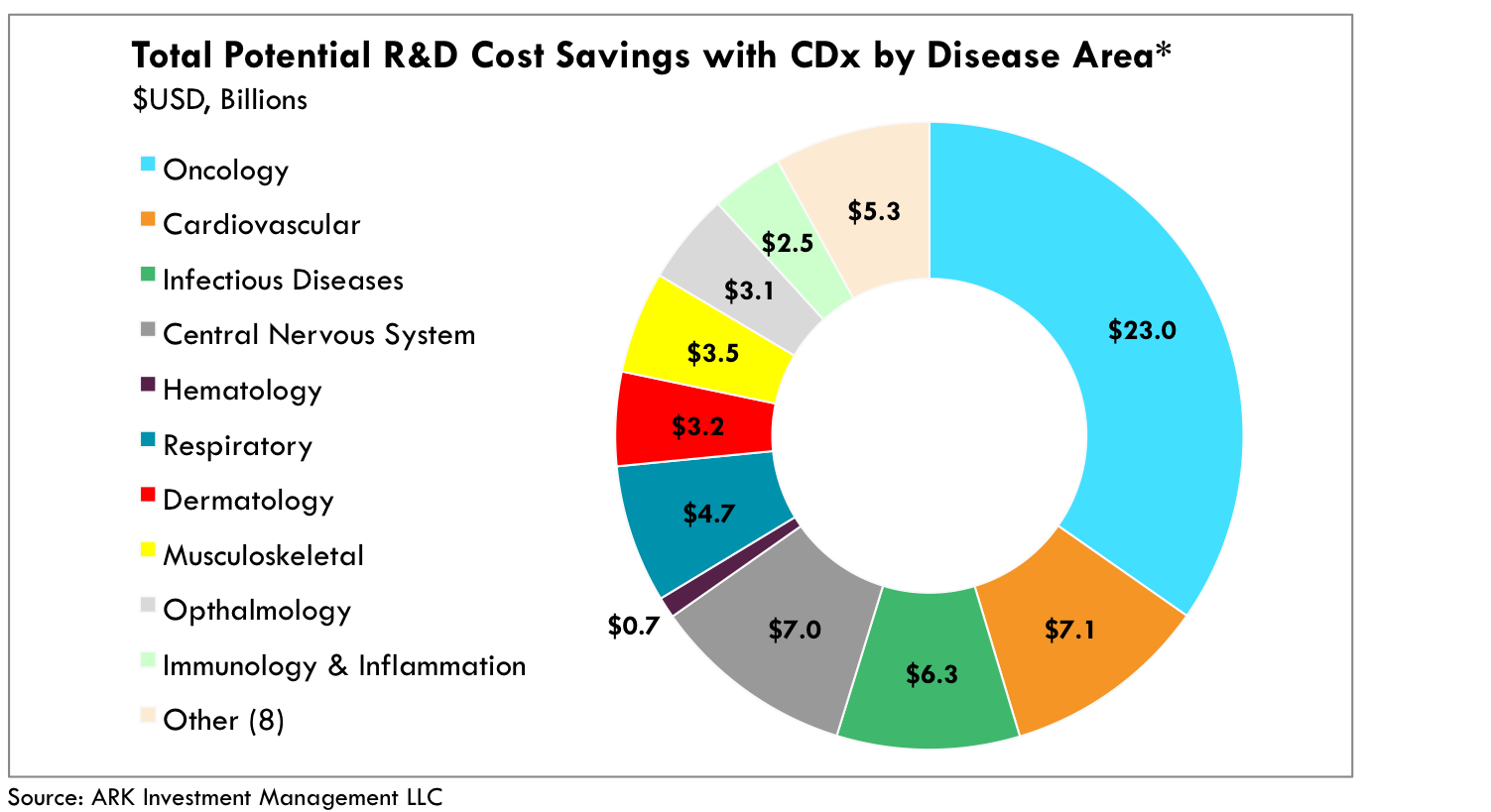

This advance could lead to enormous cost savings. If current active trials in oncology alone were to maximize the cost savings that ARK believes are possible with Companion Diagnostics, then the savings in research and development costs would exceed $20 billion, as shown in Figure 2.

Fig. 2 CDx guided drug development exhibits 30-60% cost reductions. Based on 10x reduction in required trial size based on proven 4x efficacy rates against standard of care and average cost per patient per disease area. Total estimated number of patient in clinical trials as of YE 2015. Validated against historically approved co-developed therapeutics [3][4]

Although oncology and central nervous system (CNS) disorders are the most amenable to CDx assays, rapid scientific advancement and increasingly precise and efficient diagnostic tools should lower CDx barriers in other diseases as well. CDx-guided trials could generate roughly $50 billion in R&D cost savings across all disease areas.[5] As shown in Figure 3, today the net income of the entire pharmaceutical and biotechnology industry is roughly $100 billion, suggesting potential R&D cost-savings equivalent to more than half of current pharmaceutical/biotech earnings.[6]

Fig 3. CDx guided drugs could generate $50 billion in R&D cost-savings across all disease areas. Based on 10x reductions from historical trial sizes, a proven 4x efficacy rate against standard of care [3][4] and average cost per patient per disease area. Total estimated number of patients in clinical trials as of YE 2015. Cost-savings are contingent on advanced biomarker discovery and diagnostic toolsets.

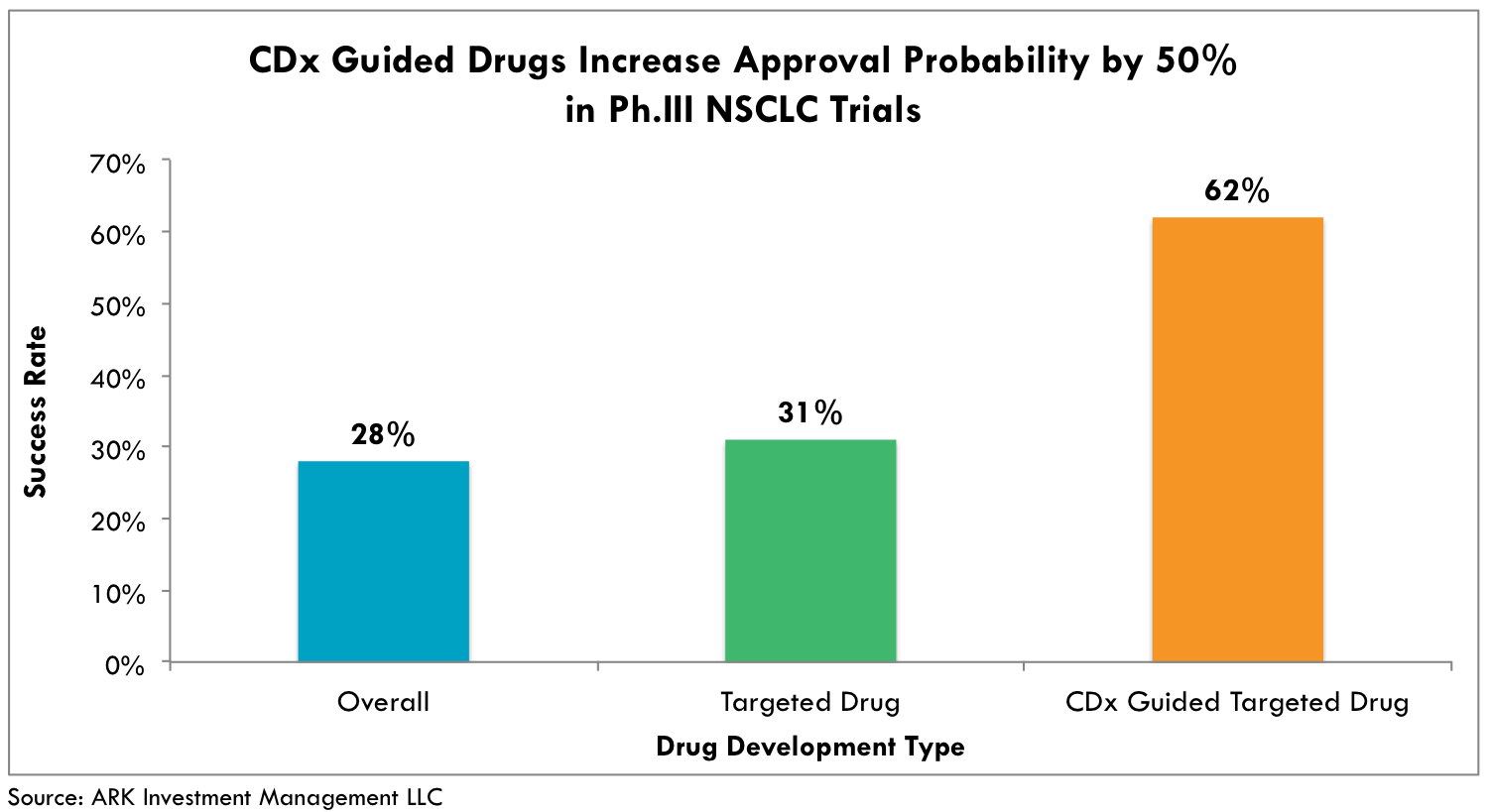

Increasing the Odds of Regulatory ApprovalThese R&D cost savings actually understate the benefits: companion diagnostics not only help to reduce trial sizes but they also improve success rates. Studies show that only ~11% of drugs entering traditional Phase 1 clinical trials reach FDA approval and commercial viability. Drugs co-developed with CDx are much more successful. For example, approval rates doubled in Phase 3 trials based on the meta-analysis of 676 clinical trials in non-small-cell lung cancer (NSCLC), as shown below in Figure 4.

Fig. 4 Success rate for NSCLC drugs in phase 3 trials. Based on analysis of 676 clinical trials, a success rate of 28% for all types of drugs was beaten by receptor target drugs and CDx-guided drugs with increased success rates of 31% and 62%, respectively.

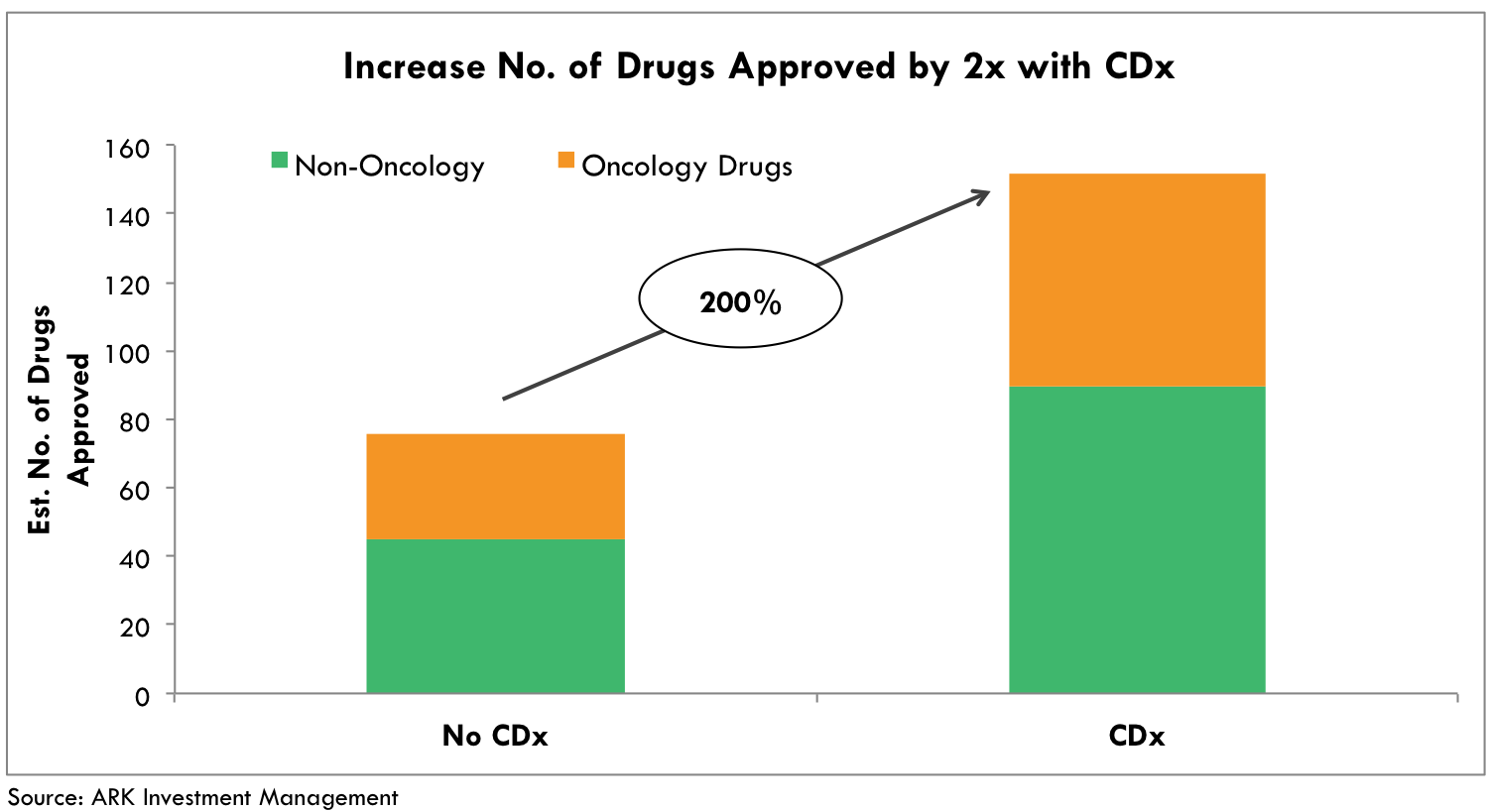

CDx-guided drug development not only increases the efficacy of therapies, but also results in more desirable safety profiles, not to mention more drug approvals. Diagnostic tests allow drug developers to select prime candidates for a given therapy, eliminating noise in the data by weeding out patients with high-risk profiles for side effects. Meanwhile, patients avoid wasting time and enduring side effects from treatments that are unlikely to be effective. Today, if the increased approval odds were to hold and all ongoing oncology drug trials were co-developed with CDx assays, the FDA would approve an estimated 62 novel drug therapies instead of 31 (Fig 5).[7] This class of drugs would be more efficacious and would deliver more desirable safety profiles.

Fig. 5 Twice the number of oncology therapies with CDx. Based on historical precedent with 50% increase in approval probability odds and total active oncology trials as of year-end 2015.

The Final Piece of the Puzzle

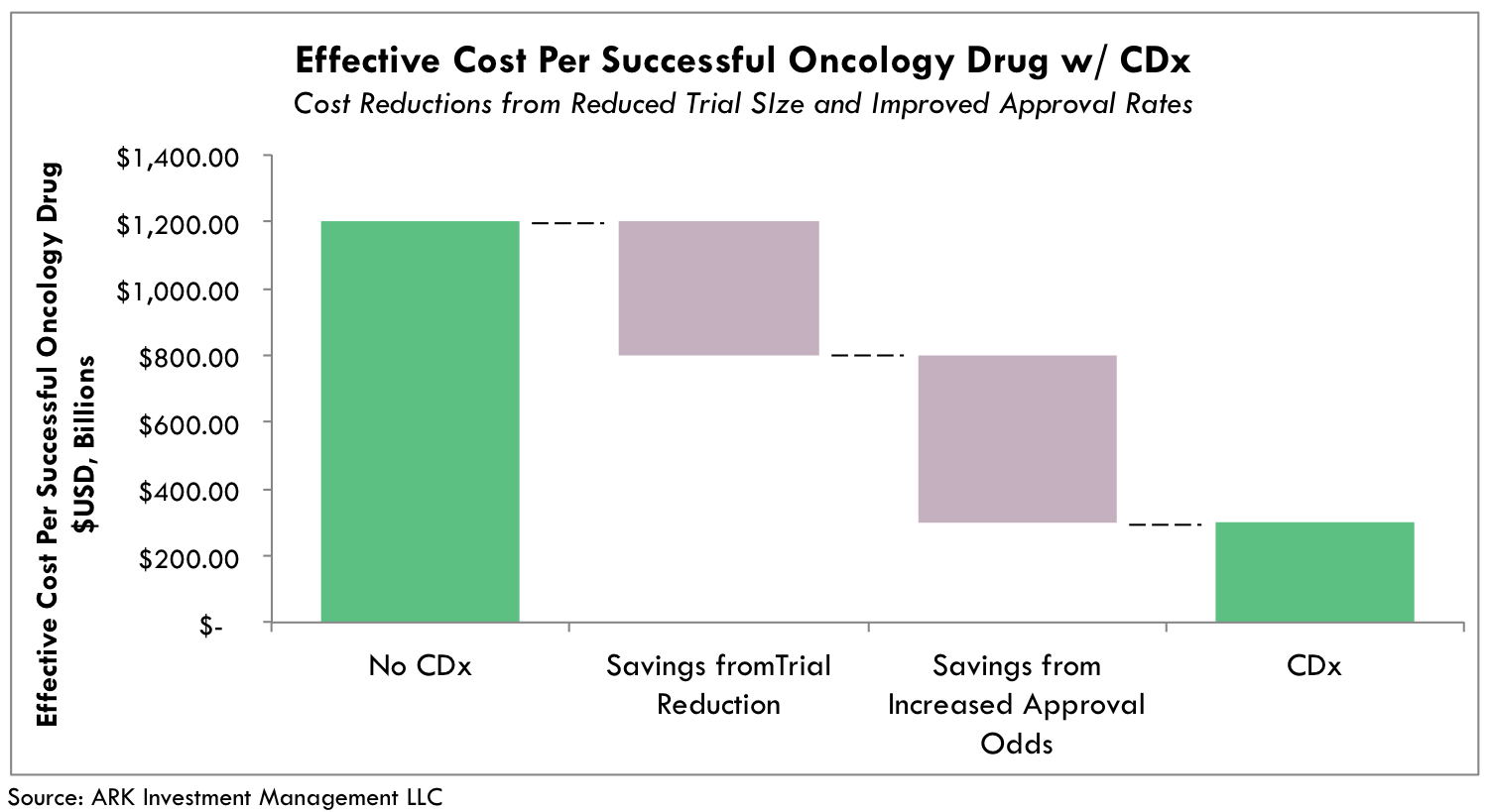

As described above, CDx-guided drug trials streamline the drug development process, lowering clinical trial R&D expenses by 60% and doubling the probability of approval. Historically, R&D costs per commercialized cancer drug mounted to ~$1.2 billion.[8] By contrast, CDx-paired drug candidates have the potential to reduce the effective cost per commercialized cancer drug by 60-75%, to between $300 and $400 million, as shown in Figure 6. Both trial size reductions and increased drug approval odds contribute equally to the realized cost-savings. It is important to note these R&D cost-saving estimates are theoretical, as not all drug candidates are candidates for co-development with CDx assays. That said, our research does not incorporate several other benefits. For instance, smaller, targeted clinical trial sizes enable faster enrollment periods and accelerate the time to market. Additionally, if a CDx assay ends a line of inquiry earlier than in traditional development efforts, the costs and time savings can be significant.

Fig. 6 Effective Cost Per Approved Oncology Drug Including Failure Rates. Accounting for capital losses associated with failed drugs drives a larger difference between total effective cost with and without CDx assays. Estimates are based on active oncology trials as of year-end 2015. In addition to increased approval rates, CDx assay estimates are based on the midpoint of CDx cost-savings associated with whether 4x efficacy and resulting reductions in trial sizes are recognized in Phase 2 or 3 trials.

The cost savings are especially important because CDx filters out patients unlikely to respond to a treatment and effectively shrinks the addressable patient population for a particular therapy. ARK believes that delivering better drugs at a lower development cost to patients most likely to respond will prove to be a profitable strategy for the biotech industry as it delivers on the promise for personalized medicine.

Full Speed Ahead, CDx

ARK believes companion diagnostics can improve R&D productivity by decreasing trial sizes, attrition rates, and time to market while delivering more effective therapies at a price premium in narrower patient populations. Perhaps fearing the end of blockbuster revenues, pharmaceutical and biotech companies have approached CDx cautiously during the past decade. While the most progressive companies have developed biomarker programs for 100% of their drug candidates and CDx for 30% or more, the average company has developed far fewer: 30%-50% and less than 10%, respectively.

Historically, scientific and clinical headwinds have placed limits on the pace of development. In certain disease areas, researchers have yet to understand molecular dynamics enough to select biomarkers at early stages of development. In others, the clinical need for CDx does not seem imperative…yet. Finally, some companies have behaved “conservatively” despite the scientific advances.

In oncology, the emergence of targeted therapies has underscored the benefits of CDx assays. Next generation sequencing (NGS) tools offered by the likes of Illumina [ILMN] and Nanostring [NSTG] have transformed tumor profiling from single gene tests to more holistic panel assays, paving the road towards precision oncology. In fact, Foundation Medicine [FMI] and Invitae [NVTA] are just two of the many players benefitting from low-cost NGS technology, enabling multi-gene variant cancer diagnostics.

Other diagnostic and pharmaceutical companies, including AstraZeneca [AZN], Nanostring [NSTG], Myriad Genetics [MYGN], Genomic Health Diagnostics [GHDX] and AbbVie [ABBV], have expressed their commitment to companion diagnostics drug delivery developments. The uptick in CDx-based drug development has just begun, and with it the long-waited era of precision medicine.