According to ARK’s research models, China will become one of the largest markets for autonomous mobility-as-a-service, reaching $2.5 trillion by 2030. At the same time, automobile sales in China could fall below expectations as a result of autonomous taxi services. Automakers with large exposure to China should launch autonomous cars in partnerships with local players as soon as possible to capitalize on this rapidly emerging trend, especially as the Chinese government is likely to favor local players, granting them natural geographic monopolies.

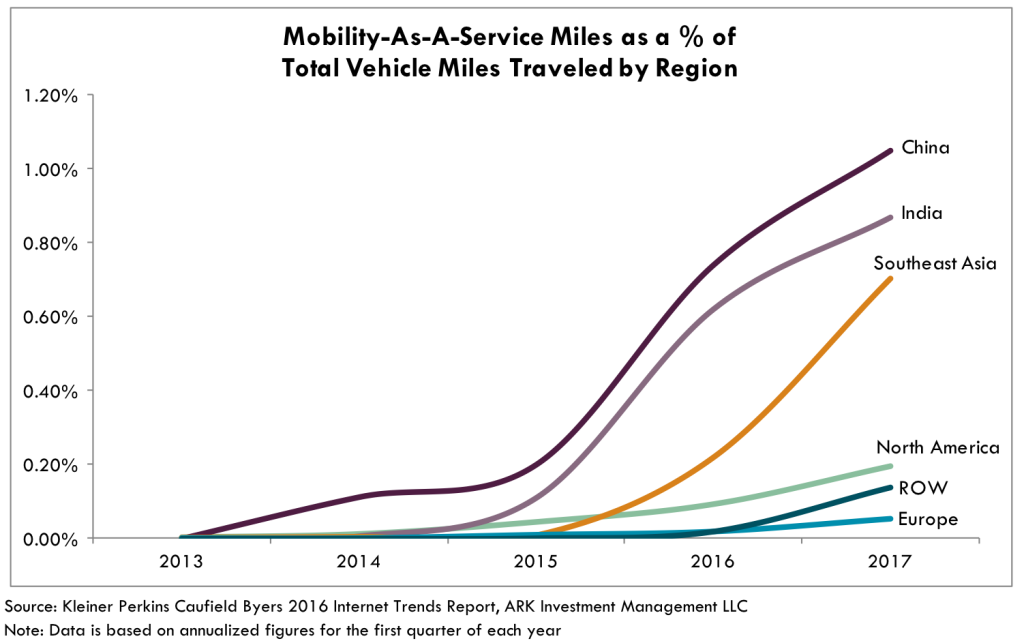

Mobile app-based ridesharing services have flourished in China relative to those in most countries. India is not far behind, as shown below.[1]

The rapid adoption of shared mobility services in China is easy to explain. Among the reasons are the following:

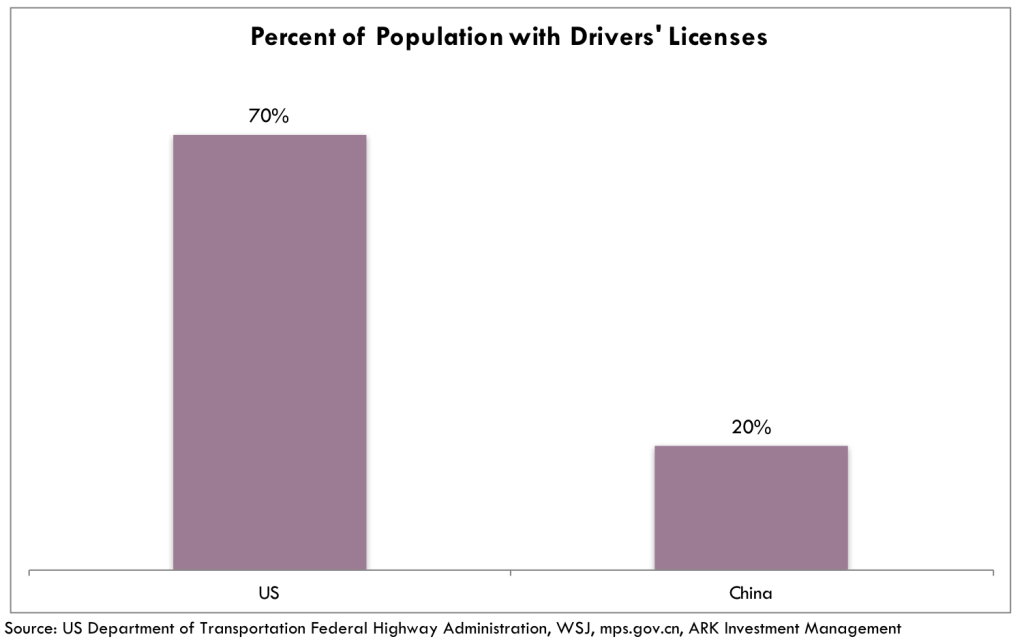

- The non-driving population, or the percentage of the population without a driver’s license, is much larger in China than in developed countries like the US, as shown below.

- Relative to vehicle prices, average incomes are much lower in China than in developed markets, so pay-as-you-go app-based taxi services are much more attractive than “pre-paid” transportation models.

- China’s environmental regulations make license plates difficult and expensive to obtain.Once obtained, license numbers dictate which days cars are allowed on the road, forcing some auto owners to buy two cars.

Given high rates of urbanization and increasingly dense city traffic, Chinese consumers could become eager adopters of inexpensive shared autonomous taxi services. Much as mobile phones leapfrogged landline telephones and infrastructure, ridesharing and autonomous taxi services could subsume personal car ownership in developing countries.

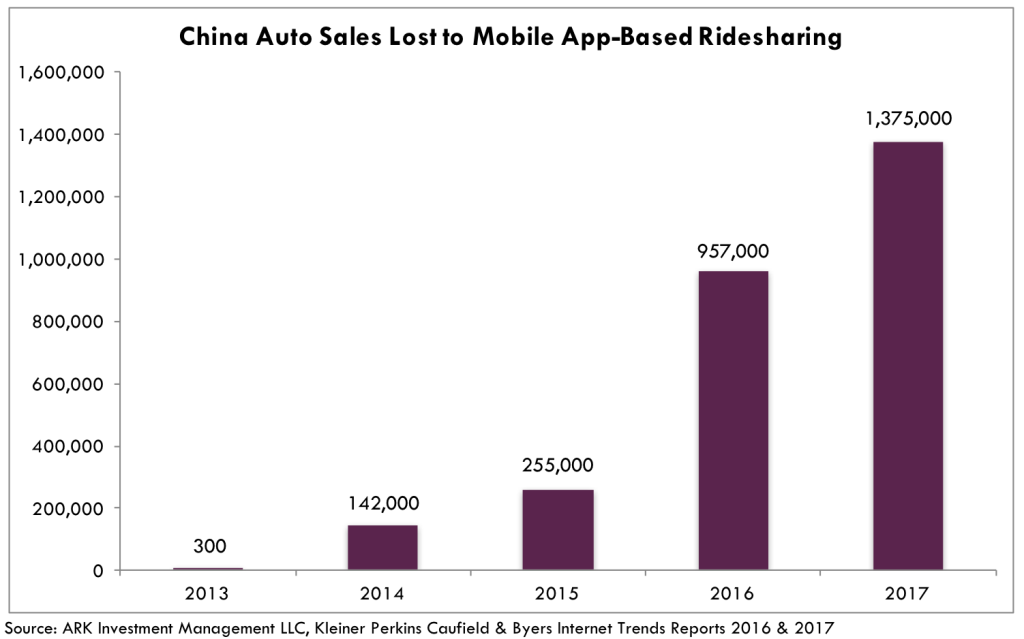

If this happens, shared mobility services will depress auto sales overtime as each vehicle will serve the needs of many customers. Even at relatively high price-points, mobile app-based ridesharing services already have taken a bite out of auto sales as customers forgo personal cars and opt for Didi’s service. According to ARK’s research, Chinese auto sales were roughly one million units lower in 2016 than they would have been in the absence of ridesharing services, as shown below. Even so, auto sales had a record year in China hitting 28 million units thanks to tax incentives which now are unwinding. For comparison, auto sales in the U.S. were 17.55 million units.

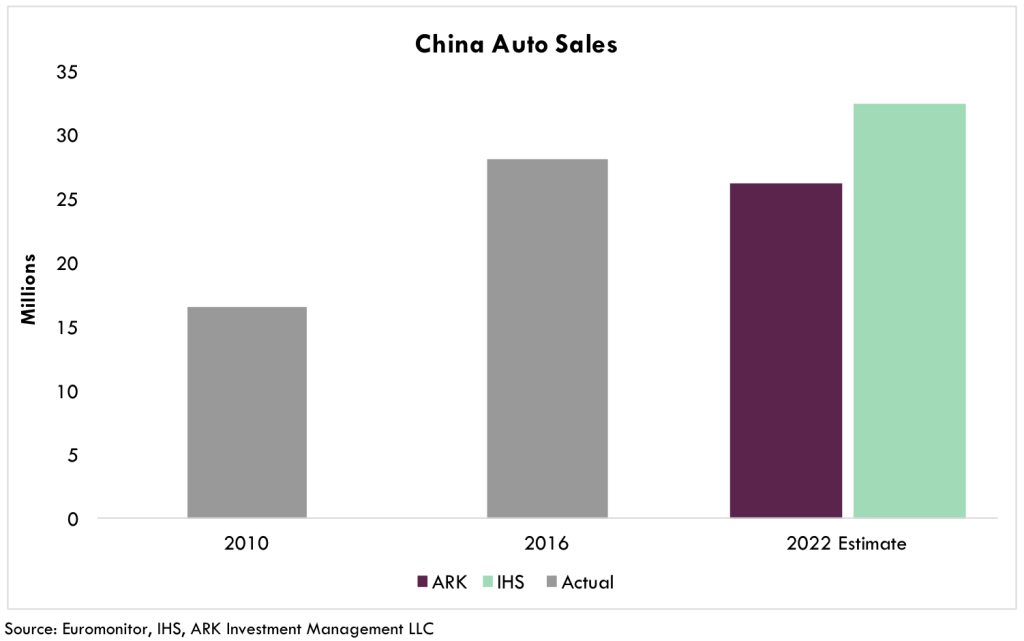

During the next five years, traditional ridesharing services, and ultimately shared autonomous taxi networks, should depress Chinese auto sales by roughly 6 million units by 2022, as shown below. Combined with a used car market increasingly saturated by non-autonomous vehicles, this shortfall could leave many auto manufacturers in distress. In the absence of an aggressive plan to capitalize on shared autonomous travel, the viability of many traditional auto manufacturers will be called into question over time.

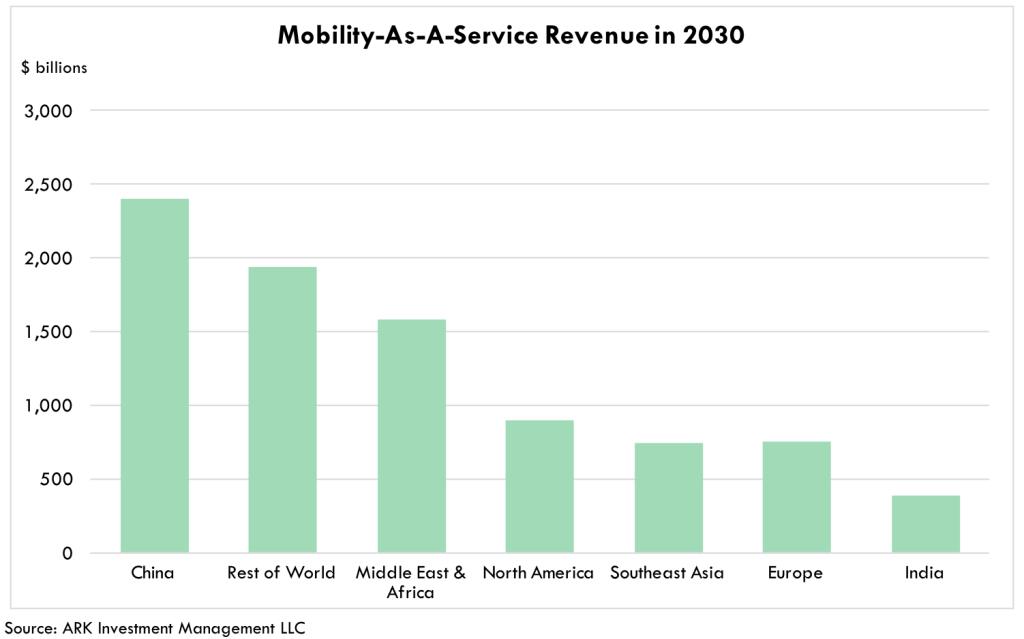

For companies able to “cross the chasm” and create autonomous platforms, the return to investment will be unprecedented in the history of the auto sector. As shown below, according to our models Chinese mobility-as-a-service will deliver $2.5 trillion dollars in revenue by 2030. For perspective, global original equipment manufacturer (OEM) revenues are $2 trillion today.

ARK also anticipates that the autonomous taxi market will evolve into regional monopolies, primarily because of the extensive data libraries necessary to run autonomous services. Consequently, technology players and/or automakers first to market with autonomous taxi platforms could enjoy a “winner takes most” opportunity in China. With its expertise in deep learning, as well as partnerships with BAIC Motor and NVIDIA [NVDA], Baidu [BIDU] could be in a much better position than most analysts now anticipate. Other contenders include Chongqing Changan, the first OEM in China to complete a 1,200-mile autonomous road trip; Volvo/Geely, which plans to launch a China autonomous test driving pilot in 2017; and GM [GM] through its joint venture with SAIC Motor as well as its interest in Lyft, something that it shares with powerhouse ridesharing service Didi. The Chinese government likely will support a local winner, making it difficult for foreign firms without Chinese partners. Recently, Tencent purchased 5% of Tesla’s [TSLA] stock, signaling that other companies may be in the race.

Not only is mobility-as-a-service potentially a massive opportunity for automakers and technology firms in China, but it also will change the Chinese transportation system dramatically. Autonomous taxis will make transportation affordable for 80% of the Chinese population eligible but without a license. Autonomous services will be convenient, diminish socioeconomic barriers, and save hundreds of thousands of Chinese lives every year.[2]