While the pace of digitization in China has astonished investors during the past decade, not all sectors have enjoyed its benefits. China’s e-commerce penetration is among the highest in the world, its digital payment duopoly has reshaped consumer and business transactions, and offline-to-online platforms like food-delivery have altered consumption patterns. China’s healthcare has proven a notable exception to this progress, a phenomenon that we believe is about to change.

We believe technology is beginning to address China’s overburdened healthcare system with AI-assisted clinical support systems and self-service clinics, among other solutions. As a motivated government accelerates the pace of policy reform, companies like PingAn Health, Alibaba Health, and JD Health appear to be in the right positions to eliminate much of the friction associated with traditional healthcare.

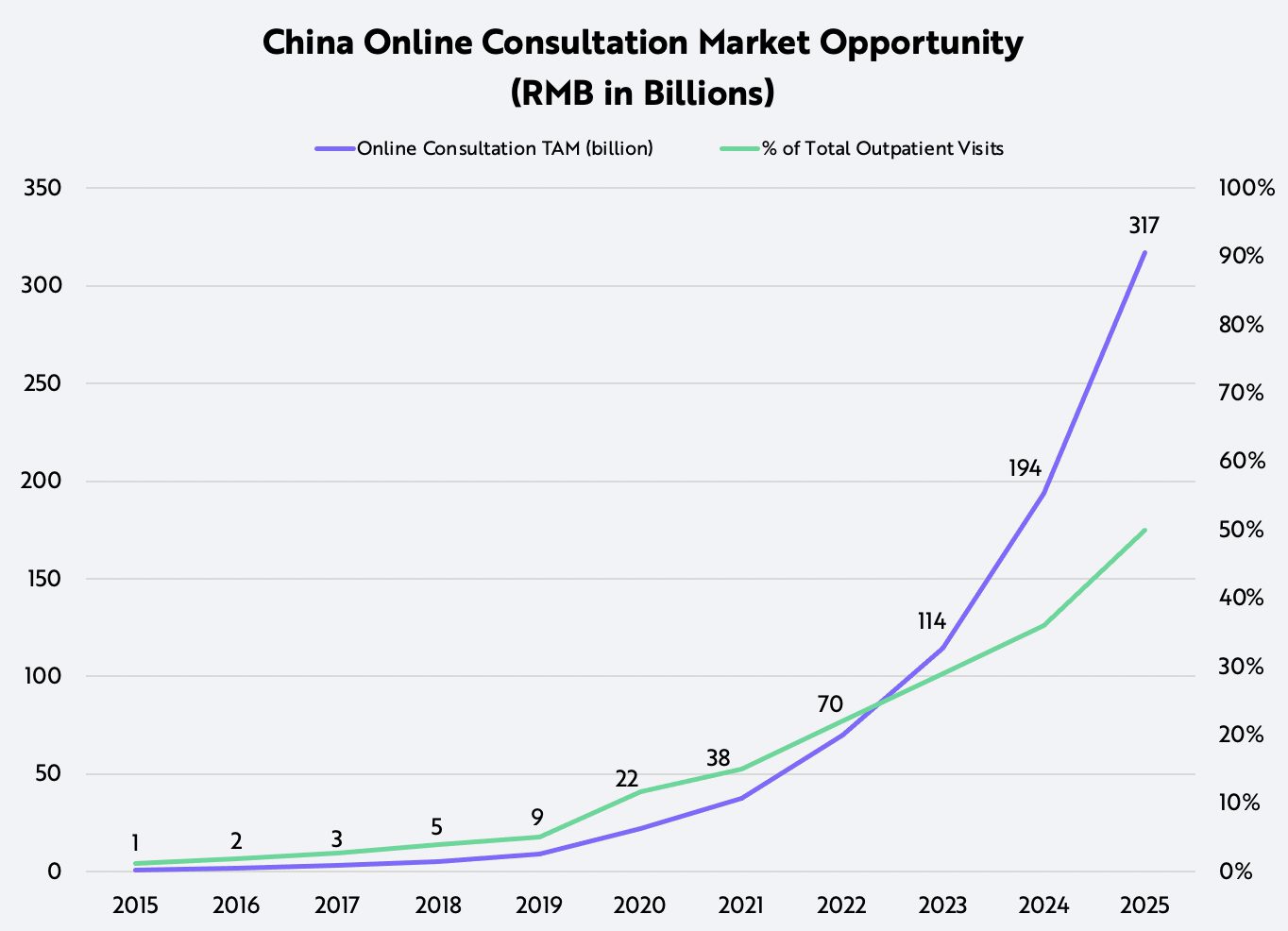

According to our research, online medical consultations in China are likely to increase meaningfully from 6% of revenue in 2019 to 50% by 2025. In yuan and dollar terms, they will surge more than 30-fold from Renminbi (RMB) 9 billion ($1.5 billion) to RMB 320 billion ($50 billion).[1]

The Chinese Healthcare System Faces Structural Problems Today

As is the case in many countries, China’s healthcare sector has lacked an effective triage system and healthcare infrastructure. As a result, Chinese physicians have struggled to serve an overwhelming number of patients.

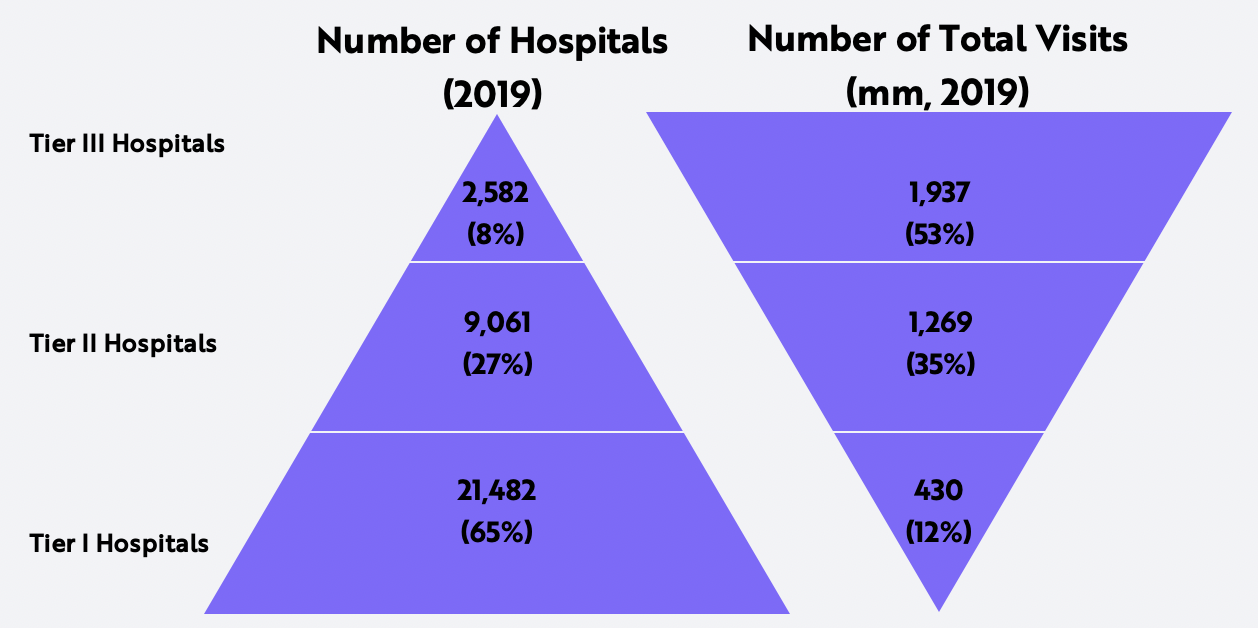

Lack of triage system. We believe the lack of triage[2] in China today has led to the misallocation of resources. Top Tier III hospitals account for less than 10% of ~30,000 hospitals in China but account for more than 50% of total hospital visits, as shown below. Patients could wait for hours, if not days, to receive care from the country’s most seasoned and reputable physicians.

Source: ARK Investment Management LLC based on data from PingAn Group Investor Presentation, Oct 2020.

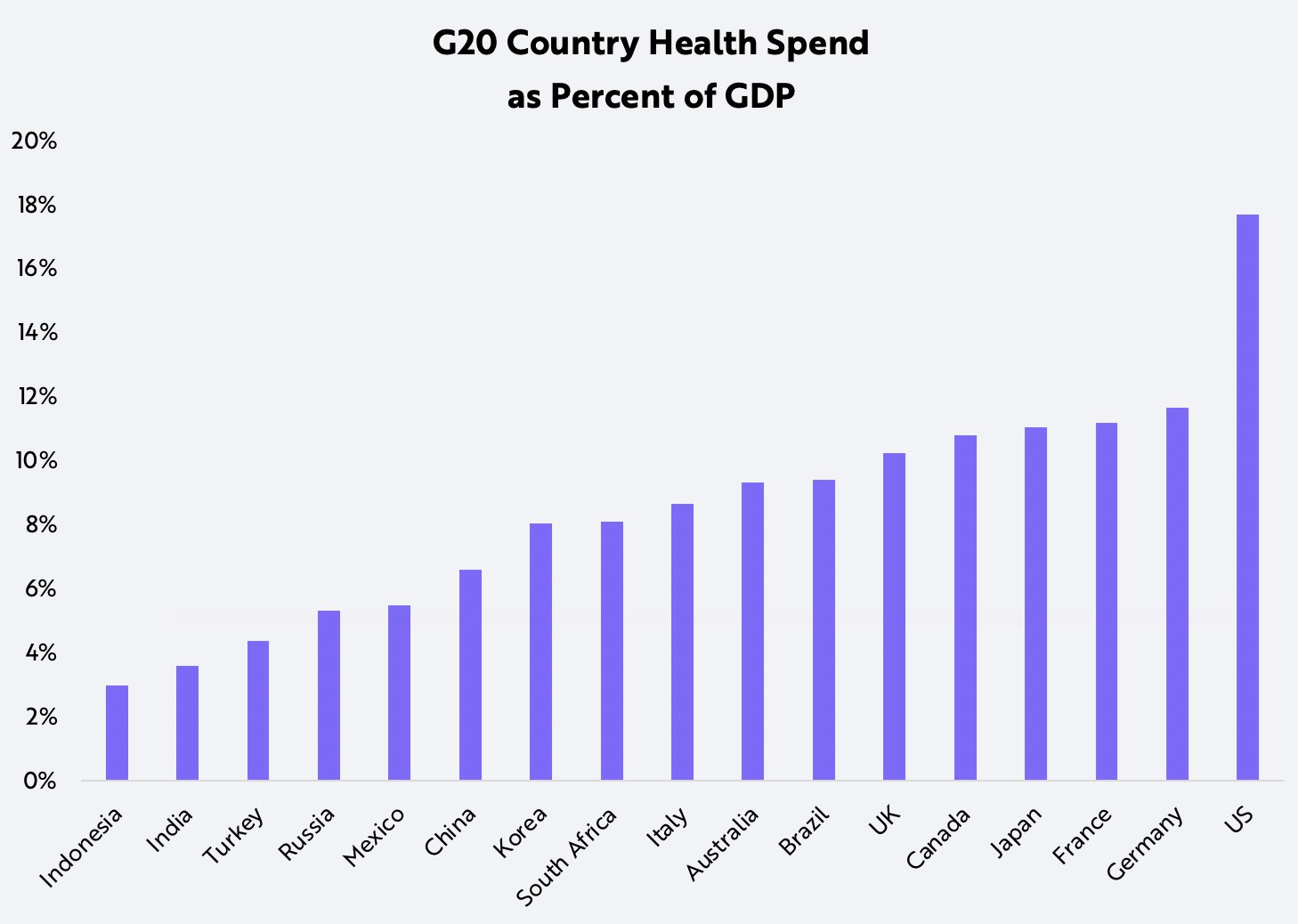

Underfunding. Nationally, China’s healthcare system is “universal”: its national insurance plan covers 95% of the population. In practice, coverage varies based on regional interpretations of national laws. Patients without proper employment in urban areas, for example, may not receive as comprehensive of healthcare. Today, as a percent of GDP, China’s healthcare spending is ~6.6%, lagging that of developed nations as shown below.

Source: ARK Investment Management LLC based on data from https://data.oecd.org/healthres/health-spending.htm

Overwhelmed Physicians. Chinese physicians earn less than USD $14,000 per year on average. At just over 1.5x GDP per capita, their wages fall well short of the 4x in the US and Canada, thanks to low fee-for-service reimbursement rates. As a result, doctors tend to overtreat patients or prioritize those willing to pay “under-the-table”. In response, according to a 2017 survey, during the past year 66% of the doctors in China have experienced verbal or physical workplace violence.

Digital Innovation Could Be the Cure

ARK believes that digital transformation will alleviate the troublesome issues that China’s healthcare system is facing.

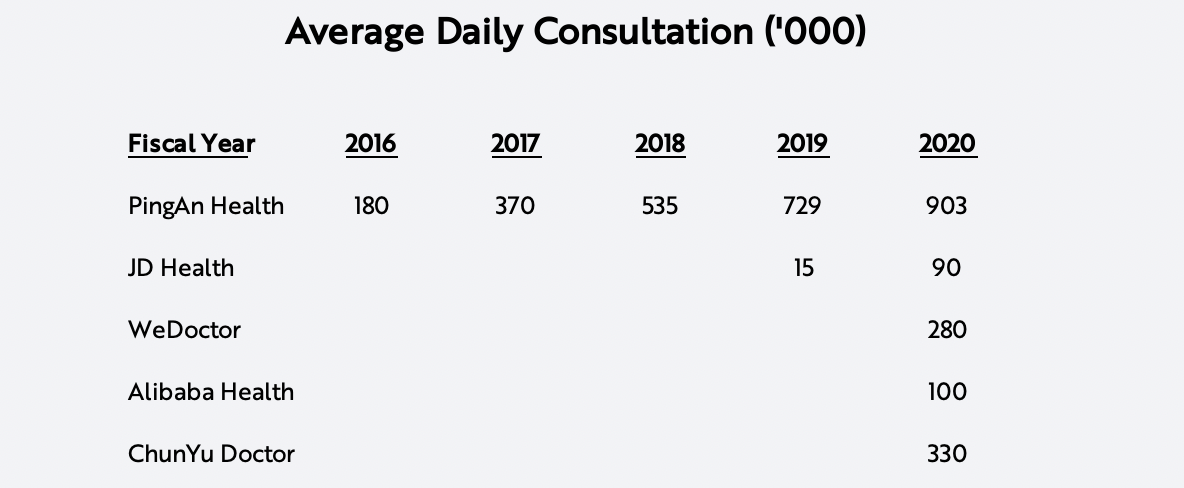

Online Consultation. Properly executed, not only could online consultations provide patients with much better experiences but they also could lower the physical load on doctors and facilitate the coordination of better care. Today, most online consultations are text- or voice message-based which, for the most part, unlike telemedicine, are free. WeDoctor, for example, launched in 2010 and ChunYu Doctor in 2011. In 2020, Covid-19 catalyzed the adoption of these digital services, as shown below.

Source: ARK Investment Management LLC based on data from PingAn Health & Technology Annual Report, Yicai, Reuters Sina, and Zhihu

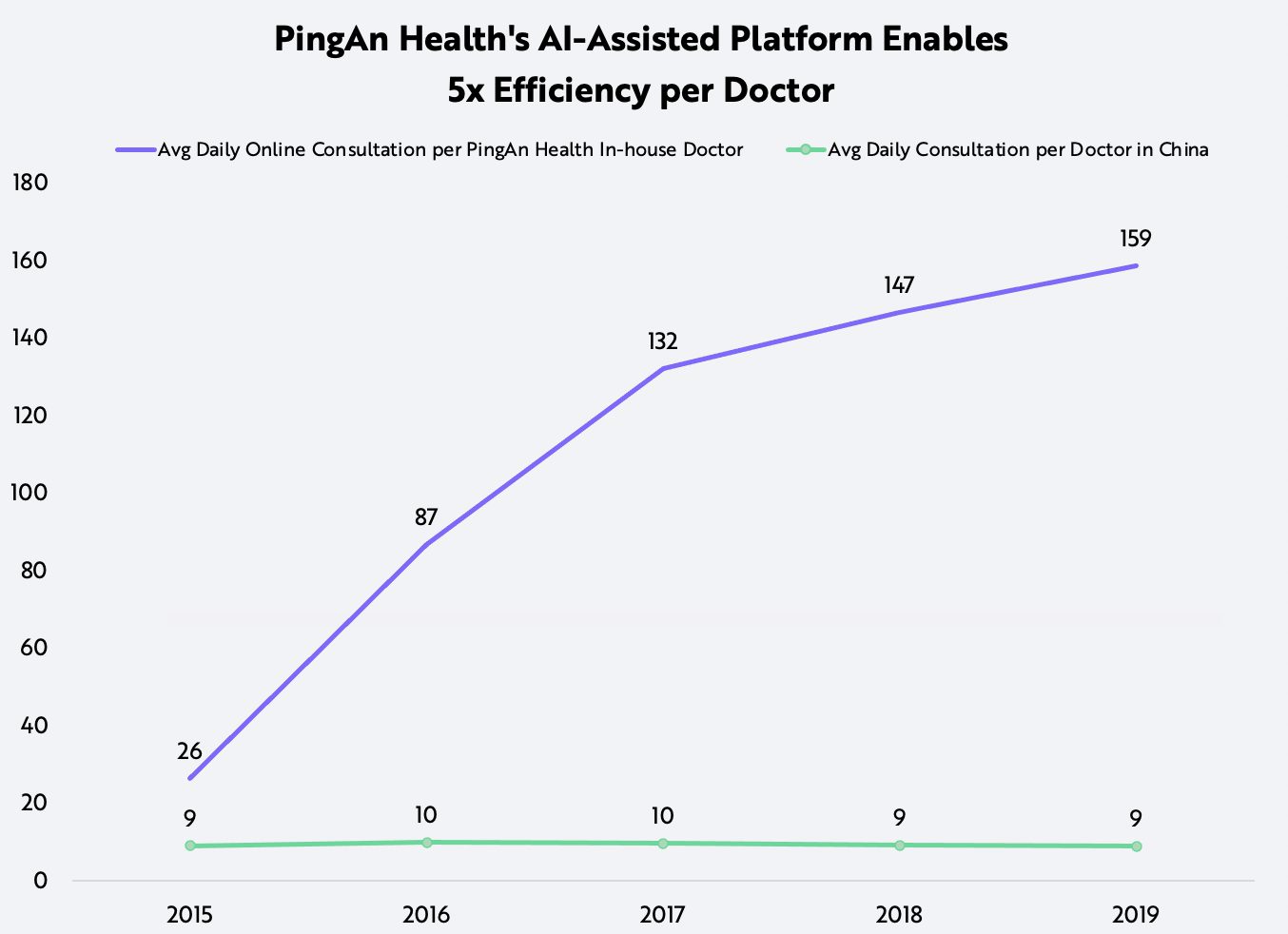

AI-Assisted Clinical Support Systems. A digitized care experience could include automating the collection of patient data, algorithm-assisted routing of patients to the right doctors, and AI-assisted diagnoses and recommendations to support doctors. According to ARK estimates, PingAn’s AI-assisted platform enables its in-house doctors to consult with 159 patients per day, more than the 9 patients that traditional offline doctors can consult, as shown below.

Source: ARK Investment Management LLC based on data from PingAn Health public filings

Digital Healthcare Apps. As digital adoption increases, healthcare apps could become the entry point for healthcare delivery in China. In addition to providing online consultations and basic medical information, these apps can offer offline appointments, facilitate payments, and manage chronic conditions. According to the results of a recent Bain & Company survey, Chinese patients expect to consume many more digital health care services during the next five years.

Home Delivery of Prescription Drugs. Leveraging their strength in e-commerce and logistics, both Alibaba Health and JD Health[3] have reduced the time to deliver prescription drugs to 30-minutes in select tier one cities, which should obviate the need for patients to visit hospitals and refill prescriptions. Today, 85% of refills still take place in hospitals.

Platforms for Specialized Care. Digital health leaders are incubating other ideas to leverage their digital networks. In regions with limited access to health care, for example, PingAn Good Doctor is installing One Minute Clinics, self-service kiosks without physicians.[4] Another area of focus is the remote monitoring of patients with chronic diseases.

Favorable Policy Tailwinds Could Accelerate Healthcare Digitization

Since 2015, China has introduced a series of policy changes to steer more healthcare solutions online. Published in November, the latest draft rules permit online prescription sales for the first time and have set the reimbursement rates for online consultations on par with hospital rates.

The Online Consultation Opportunities Are Sizable

In 2019, China’s bricks and mortar healthcare system facilitated roughly 8 billion on-site visits, or more than five per person, while online consultations accounted for only 6% of all health care visits. Although the lack of electronic health records makes the analysis difficult, a majority of care seekers are believed to have either mild symptoms or chronic conditions, suggesting that they could move online as their first line of health care defense. As a result, according to our estimates, by 2025 online consultations could account for roughly half of all visits, pointing to a total available market (TAM) of RMB ~320 billion or $50 billion,[5] as shown below.

Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC

Conclusion

Our analysis suggests that China’s healthcare system is hitting an inflection point for several reasons: users are seeking – perhaps demanding – better healthcare delivery experiences, digital health platforms are innovating and evolving rapidly, and policy reforms are turning health care pain points into catalysts. To capture a meaningful share of the opportunity, however, digital health enablers will have to exceed the expectations not only of patients but also hospitals, medical professionals, and municipal/national authorities. While only one segment of the value chain, online consultations will be crucial to the successful digitization of China’s healthcare system.