Securing the Bitcoin Network - White Paper

Bitcoin has the potential to be disruptive in a way not seen since the development of the Internet. While the Internet decentralized the dissemination of information, Bitcoin and its underlying “blockchain” are decentralizing the securitization of information. Due to its decentralized design, however, there is no single entity guaranteeing Bitcoin’s long-term reliability. This white paper investigates how the Bitcoin network will be sustained, especially as its incentive structure changes in coming years, and the effect these changes will have on stakeholders. For those readers who are not already familiar with Bitcoin, ARK Invest has prepared an introductory white paper entitled “Bitcoin: A Disruptive Currency,” which provides an overview of bitcoin and the Bitcoin network.[1]

Bitcoin and its underlying blockchain solve a problem humanity has grappled with for centuries: without a reliable third party, how can one trust information sent by a stranger via an insecure channel? Thus far, the financial services sector has been unable to solve this problem, and therefore relied upon expensive middlemen. The Bitcoin blockchain, instead, encrypts information with mathematical functions that are computationally impossible to decipher, unless one is the sender or receiver of the information. Thus, bitcoin does not require a central repository or single administrator to process transactions.

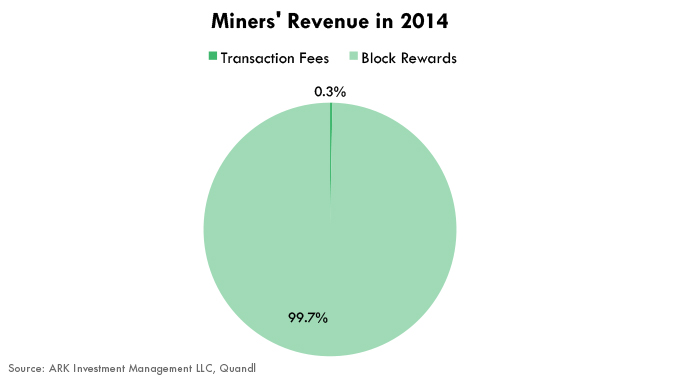

A decentralized network of computers, called miners, provides the processing power that encrypts information and secures the blockchain. The blockchain secures bitcoin. Together, they form a digital ledger that is transparent to the world and records every transaction ever made. Currently, newly minted bitcoins, issued via block rewards, incentivize miners to provide the processing power that sustains the system. While the protocol allows for transaction fees, at this time these fees are a small fraction of miners’ revenue, as shown below.[2]

Over the coming decades, however, as block rewards decline, resulting in a lower rate of bitcoin supply inflation, the fee structure will change. In his original white paper, Bitcoin: A Peer-to-Peer Electronic Cash System, Satoshi Nakamoto suggested, “Once a predetermined number [3] of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.”[4] Herein lies a major problem: part of the currency’s attraction as a medium of exchange is its low transaction fee structure. However, as the currency’s monetary expansion diminishes in importance as an incentive to miners, transaction fees will have to take up the slack to maintain the ecosystem. In effect, what was once a hidden subsidy will become a direct cost on Bitcoin transactions.

At first glance this incentive problem might appear to be Bitcoin’s fatal flaw. To keep the bitcoin network of miners at its status quo without block rewards, transaction fees that currently make up 0.3% of miners’ revenue would have to make up 100%, suggesting a 330 fold increase in fees. Starting from the current average of 0.01%,[5] the transaction fee would soar to 3.3%. At that level, bitcoin transactions would be more expensive than credit cards. However, that logic misses two variables, which ARK Invest believes will change the equation: mining margins and processing power.