Upon launch, autonomous vehicles could deliver the convenience of an Uber at one tenth of the price.[1] As a result, autonomous taxi platforms could generate trillions of dollars in revenue by the late 2020s. Discounting and valuing the expected cash flows, ARK estimates that the leading autonomous taxi platforms should be valued at more than $2 trillion today.

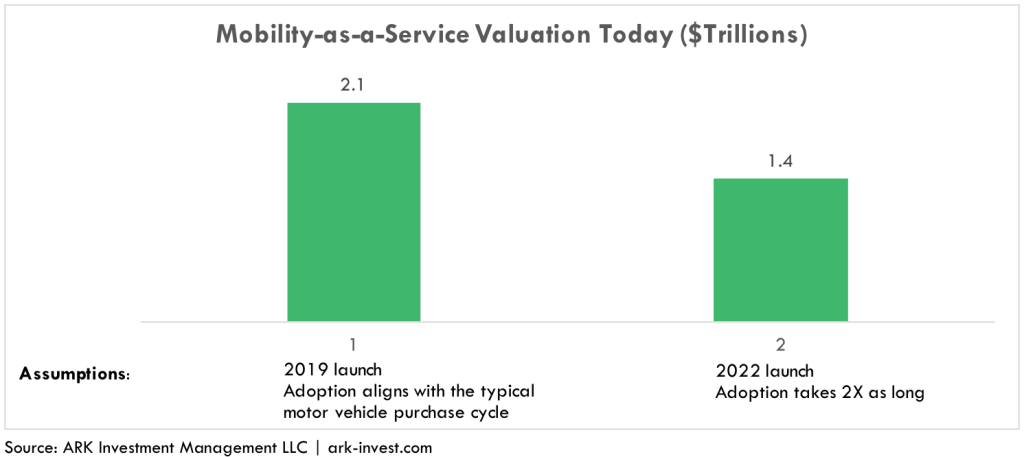

But what if autonomous taxi platforms take longer to evolve than we are anticipating? How sensitive is that $2 trillion valuation to the launch date of fully autonomous vehicles?

As it turns out…not too sensitive!

Autonomous cars should create significant investment opportunities whether or not they hit the roads within the next 2-3 years. While autonomous taxis could debut as early as 2019, regulation could delay their launch, as could technology-related corner cases.[2] Even if autonomous ridesharing takes three more years than expected to debut, ARK estimates that autonomous taxi platforms, also known as autonomous mobility-as-a-service (MaaS) platforms, should be valued at more than $1 trillion today, as shown below.

A handful of data points to the likelihood of an autonomous taxi launch date in 2019. Tesla [TSLA]claims that every vehicle equipped with Autopilot 2 hardware will become fully autonomous in the next two years through a series of over-the-air software updates. Baidu [BIDU] plans on launching a commercial autonomous car by 2018. GM [GM] plans to test thousands of autonomous cars with Lyft in 2018. nuTonomy, a Boston based startup testing in Singapore, plans to launch autonomous ridesharing services by 2018, and the average improvement rate of Google’s autonomous cars in California suggests a tolerable failure rate for commercial taxi services in 2019.

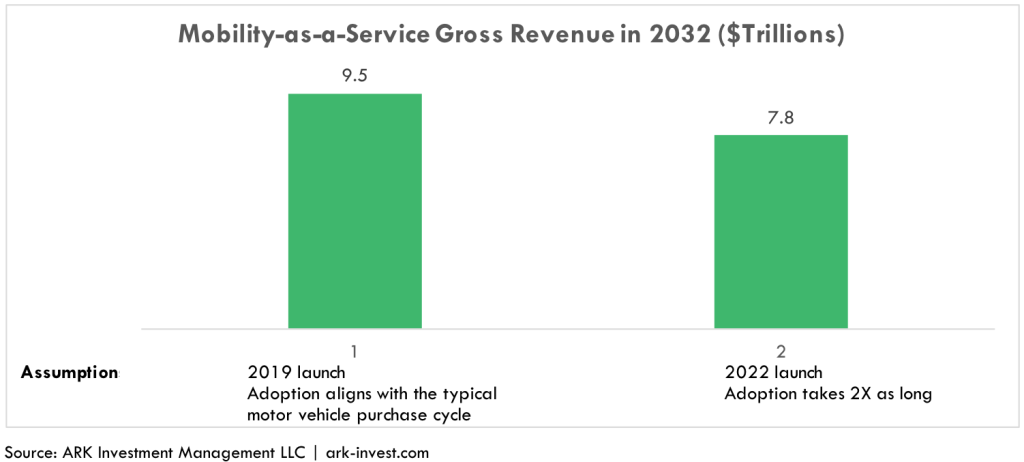

That said, improvements in technology could be slower than expected if corner cases become more difficult to solve and regulators delay launches. ARK estimates that if autonomous cars were to commercialize in 2022 instead of 2019, and adoption were to take twice as long as our base case estimates, the autonomous MaaS market potential would total roughly $8 trillion in gross sales instead of $10 trillion by the early 2030s, still providing one of the largest commercial opportunities in history. Operators such as Google’s [GOOG] Waymo, Tesla, or GM’s Cruise Automation stand to collect 20% of those sales, or $1.6-2.0 trillion, in the form of platform fees.

In conclusion, even with a delay in commercialization, MaaS represents an unprecedented opportunity for technology and auto manufacturers that transition to a ridesharing service model successfully. ARK expects autonomous MaaS, or autonomous taxi platforms, to submit to natural geographic monopolies given the data-intensive collection and testing necessary to launch a taxi service. While Tesla, GM, Baidu, Waymo and nuTonomy seem to have technology and timeline leads, competitors are likely to try and catch up.

Sources

Cover image: Uploaded to https://pxhere.com/en/photo/266700 is licensed under CC BY 2.0